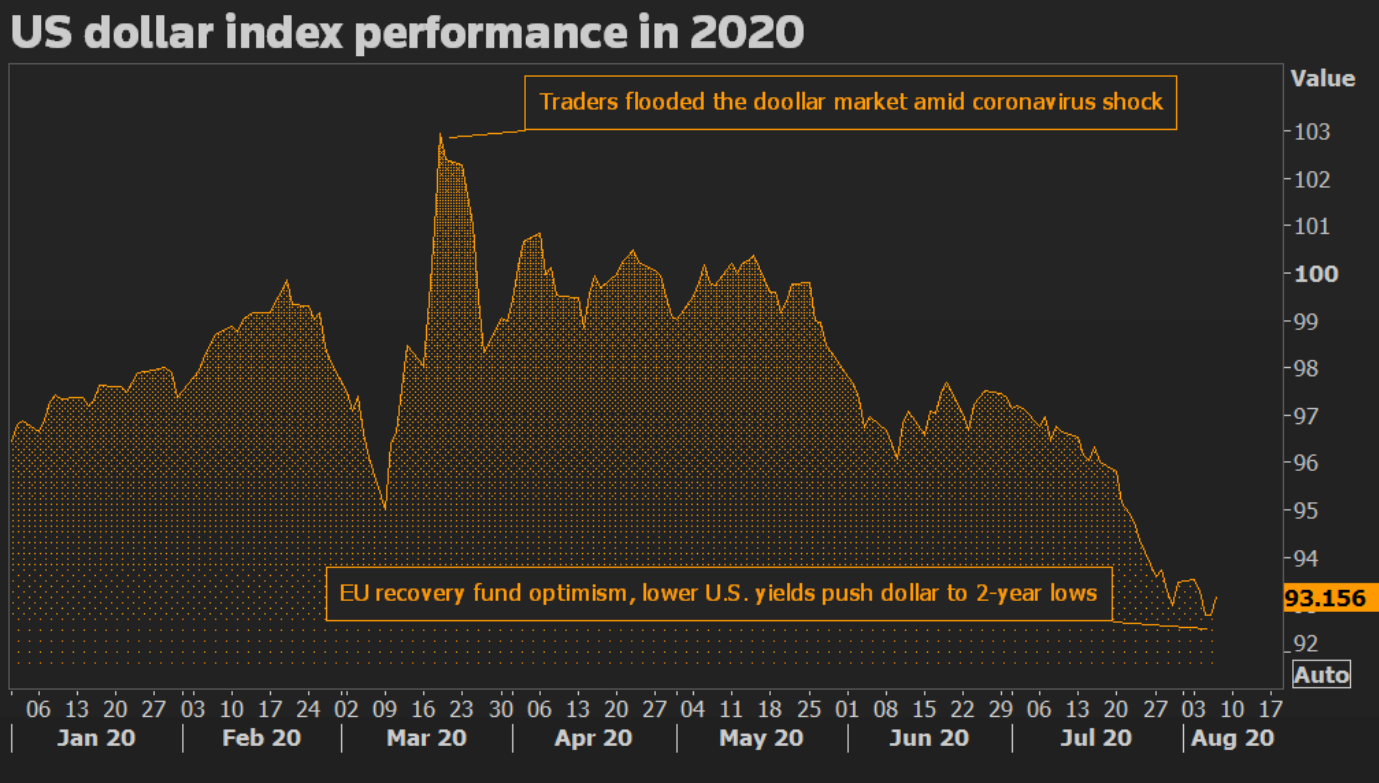

The dollar index remained flat this week since dipping below 93.00 to more than a two-year low last week. The index which measures the dollar against six peer currencies lost nearly nine percent since its peak in March, this is enough to rattle investors in the fairly steady forex market.

Investors have subsequently rushed to gold, supporting its price above the 2,000 U.S. dollars threshold for the first time in history. The value of the safe-haven metal has soared 34 percent this year.

A couple of factors have weighted on the greenback, led by a resurgence of COVID-19 infections, ballooning federal debt levels, as well as the U.S. Federal Reserve signaling a shift in favor of inflation.

Analysts say that the U.S.'s response to the disease is fueling concerns about lasting damage to the country's economy which could hold interest rates and growth low for years.

"There is no basis for economic recovery when the epidemic is still out of control," said Liu Ying, research fellow of Chongyang Institute for Financial Studies at Renmin University.

She also put a question mark on the performance of the U.S. stock markets, considering the indices failing to reflect the economy status, as the U.S. GDP collapsed a worst-ever 32.9 percent in second quarter.

"The U.S. stocks turned a blind eye on the epidemic as the disease is yet to cool off. A key support to the market is the monetary policy, as the Fed is offering a flood of credit," she added.

"The logic goes as, if the epidemic drags on the economy, the market will expect more support from the U.S. treasury, as well as loose monetary policy issued by the Fed," Jimmy Zhu, chief strategist at Fullerton Research told CGTN.

"Assets priced in the U.S. currency should benefit from the dollar's drop, notably the U.S. stock and gold price," he added.

Pumping stimulus

The U.S. has been aggressively pumping liquidity to counter the economic shock caused by the pandemic. The government has borrowed three trillion U.S. dollars from February to June, piling on its already expanding fiscal deficits. At the same time, the Federal Reserve has cut rates to near zero, while embarking on buying unlimited amount of treasury and securities to support the financial market.

Traders work on the floor of the New York Stock Exchange on January 29, 2020. /VCG

Traders work on the floor of the New York Stock Exchange on January 29, 2020. /VCG

These have led to a downgrade by the credit rating agency Fitch. It downgraded the outlook for U.S. credit to "negative" from "stable" last week, citing a "growing risk that U.S. policymakers will not consolidate public finances sufficiently to stabilize public debt after the pandemic shock has passed." The agency also flagged up risks to dollar's reserve currency status if its debt spirals.

"Handling of the epidemic, domestic unrest, and retreatment from global agencies are all trimming the credit of the U.S. government," Liu cautioned.

Appeal of the RMB asset

Zhu considered that the economic recovery from the pandemic, along with higher yield on government bond, will both help Chinese asset attracting foreign investors in the second half of the year.

The yield on the benchmark 10-year U.S. government debt sank to 0.52 percent on Friday to a historic low. In comparison, the yield on 10-year Chinese government bond stood at 2.9 percent.

A staff counting the Chinese yuan in Taiyuan, Shanxi Province on August 6, 2020. /VCG

A staff counting the Chinese yuan in Taiyuan, Shanxi Province on August 6, 2020. /VCG

China has kept a steady monetary policy since the pandemic as its central bank believed that too much stimulus could pile on debt and add financial risks. The country has kept its benchmark lending rate steady since May, with the one-year LPR standing at 3.85 percent, while the interest rate on one-year MLF loans to financial institutions staying at 2.95 percent.

"Yuan revealed its role as a stabilizer at this critical moment," Liu commented. Yuan's exchange rate has been linked to a basket of currencies since 2015. Anchored by the official basket, the value of yuan has risen by just 0.2 percent since mid-2016 after adjusted for inflation, making it one of the most stable currencies.

"Chinese capital market is serving as a harbor amid upheaval," Liu commented, while referring that the country's economy expanded 3.2 percent in the second-quarter, and was forecasted as the only major economy to grow this year.

"This will increase the appeal of the RMB-denominated assets, which in turn creates favorable conditions for the internationalization of the currency," she continued.

Liu added that the continuous financial reforms are widening access the country's economy. China in March announced it is bringing forward the planned opening of its capital market by eight months, ending ownership limits for foreign investors in securities, futures, and insurance business.

Then in May, the country decided to scrap quota restrictions on the Qualified Foreign Institutional Investors (QFII) program and its yuan-denominated sibling, RQFII, in a bid to further widen the investment scope for overseas investors.