03:16

Despite the coronavirus pandemic hitting global demand, China's exports in July saw a surprising surge past expectations.

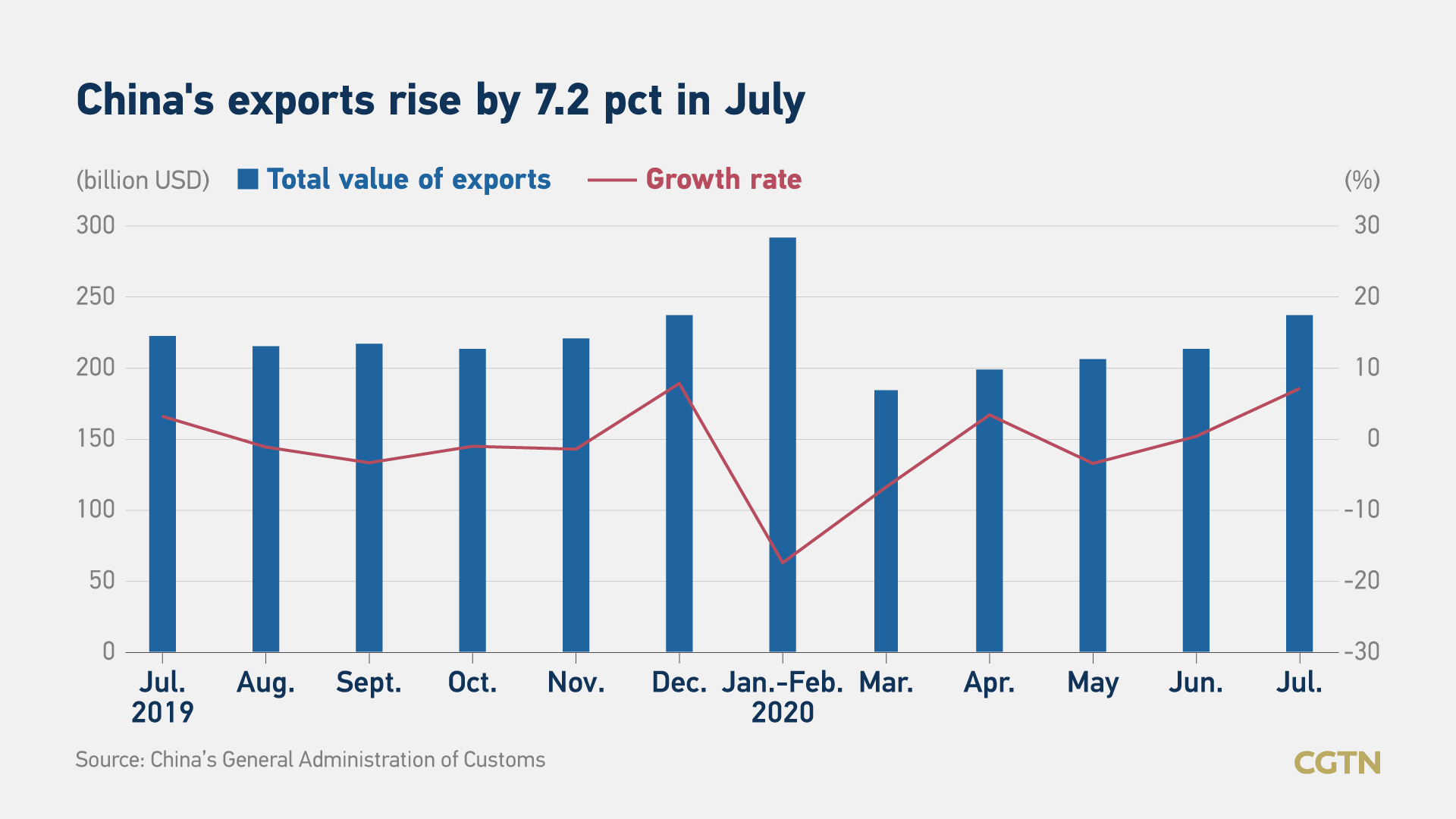

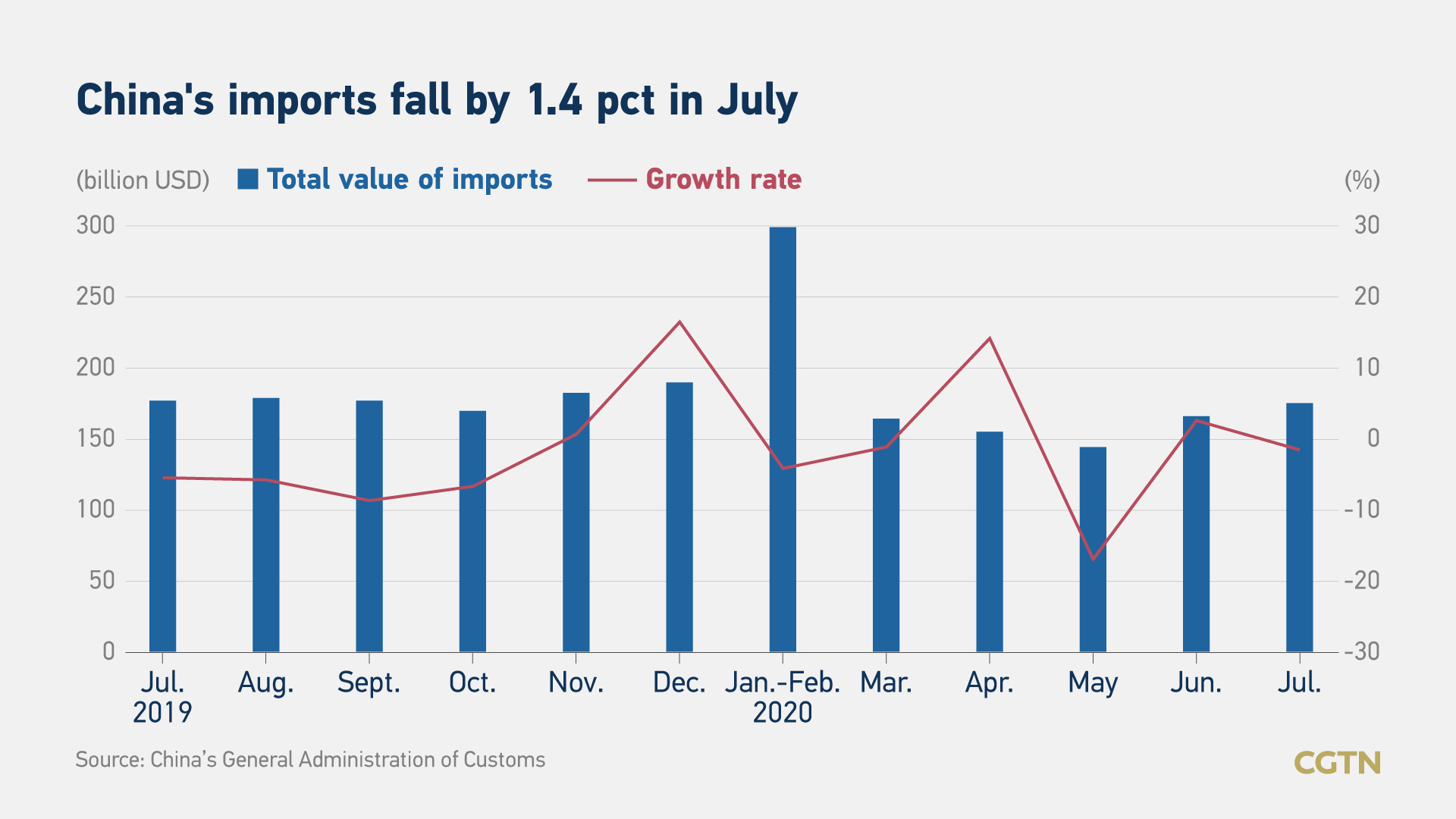

In U.S. dollar terms, exports rose by 7.2 percent to 237.6 billion U.S. dollars, strongly beating expectations, and imports saw a slight decline of 1.4 percent year on year to 175.3 billion U.S. dollars, according to the General Administration of Customs (GAC) on Friday.

Exports in July were expected to have contracted by 0.2 percent from a year earlier with imports likely to rise by 1.0 percent, according to a Reuters poll, compared with a gain of 2.7 percent of imports in June.

In the first seven months of 2020, China's goods trade contracted by 4.8 percent year on year to 2.4 trillion U.S. dollars, official data showed.

During the same period, exports declined by 4.1 percent year on year to 1.3 trillion U.S. dollars, while imports dropped by 5.7 percent to 1.1 trillion dollars, data showed.

In yuan terms, China's goods trade in the first seven months of 2020 contracted by 1.7 percent year on year to 17.16 trillion yuan, narrowing by 1.5 percentage points from the first half of the year. Exports declined by 0.9 percent year on year to 9.4 trillion yuan, while imports dropped by 2.6 percent to 7.76 trillion yuan.

The private sector further played a major role in promoting the steady growth of foreign trade. In the first seven months of this year, the private sector contributed 7.83 trillion yuan, accounting for 45.6 percent of the total trade, up by 3.8 percentage points from the same period last year, with exports accounting for 54.5 percent of the total exports.

The proportion of general trade that represents a longer production chain and higher added-value as the key indicator of a country's foreign trade competence, increased to 60.3 percent in the first seven months this year, 0.7 percentage points higher than a year ago.

From March to June, China's trade was powered by strong shipments of medical equipment and protective gear, with exports of textiles including masks increasing by 35.8 percent in the first seven months.

Meanwhile, mobile exports increased by 6.5 percent, while clothing and automobiles (including chassis) exports were down 13.8 percent, and 25.9 percent, respectively.

During the first seven months, China's imports and exports to ASEAN, the European Union and Japan increased, while the trade volume with the United States declined.

The total value of China-U.S. trade was 2.03 trillion yuan, declining 3.3 percent from a year earlier, accounting for 11.8 percent of China's total foreign trade. Among them, exports to the U.S. were 1.56 trillion yuan, down 4.1 percent, imports from the U.S. were 475.5 billion yuan, down 0.3 percent, with trade surplus down 5.7 percent, GAC data showed.

"Exports to Japan have also turned positive, leaving only exports to the U.S. is negative among China's top four trading partners," Reuters cited Tang Jianwei, chief researcher of the Bank of Communications. "This showed that the diversification of China's export trading partners has to some extent eased the negative impact of China-U.S. friction on China's exports.

"Now that exports are much better than expected, as long as the resumption of overseas production is accelerating, China's exports should be able to stabilize at a positive growth range...Of course, we must also pay attention to whether the epidemic will bounce back and that trade frictions are still showing signs of escalation," he added.

"China has been able to very, very quickly recover from the crisis. In our business, China is actually up compared to last year's period, so we've seen higher numbers in demand than we used to see pre-crisis," Siemens CEO Joe Kaeser said in an interview with CNBC on Thursday.

During the April-June period, the Europe's largest manufacturer had Chinese orders edging up by six percent from a year earlier. Other than its home country Germany, Siemens recorded order drops in the same period in all regional operations.