04:04

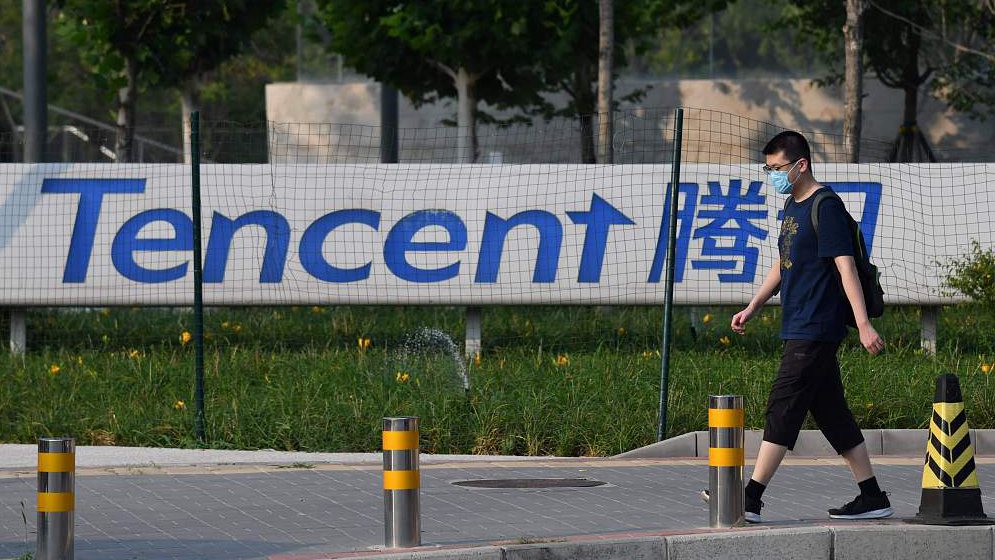

A Tencent statement on Wednesday emphasizing that its international WeChat app is separate from its Chinese version and that U.S. efforts to ban transactions on it won't apply to its domestic Weixin platform, was an effort to soothe market sentiment, according to Chen Jiahe, chief investment officer at Novem Arcae Technologies.

The Chinese gaming and social media giant's biggest challenge will come from players within the tech industry, not from geopolitical fluctuation, Chen said.

After U.S. President Donald Trump's executive order targeting WeChat, more than a dozen major U.S. multinational companies, including Apple, Ford Motor, Walmart, and Walt Disney, raised concerns in a call with White House officials Tuesday about the potential impact.

And during a call with investors on Wednesday, Tencent chief financial officer Shek Hon Lo said that "the executive order is focused on WeChat in the United States and not our other businesses in the United States. We are in the process of seeking further clarification."

Speaking to Global Business, Chen said he believed that the executive order might have a limited impact on Tencent, as the U.S. accounts for less than two percent of Tencent's total revenue.

"Tencent has very little amount of income that comes from outside of China. That means geopolitics has little thing to do with this current status. Only it might hurt its future growth into the international market. The biggest challenge actually comes from players within the tech industry, such as Alibaba Group, ByteDance. That's why we say Tencent has been working so hard on preparing for the confrontation with these companies," Chen elaborated.

Tencent is the world's largest gaming company by revenue. It posted 33 billion yuan in profit for the second quarter through June, and gaming revenues were still the primary driver. The overall games revenue was up nearly 40 percent while mobile games revenue was up over 60 percent in the second quarter.

"These are pretty good numbers," Chen noted but added that it might be slightly hard for Tencent to maintain this kind of performance in the future.

"For the first half of 2020, the economy has been hit by the COVID-19. People spent more time on their online activities, including gaming and mobile gaming. Therefore this super high growth rate might be hard to sustain in the future," he said.

01:38

Tencent is meanwhile eager to create a Chinese e-streaming giant. It announced this week a proposal to merge Douyu and Huya, China's two largest live-streaming sites focused on video games.

Together, Huya and Douyu control over 80 percent of the market. NYSE-listed Huya has a current market capitalization of 5.27 billion U.S. dollars and Nasdaq-traded Douyu is worth 4.44 billion U.S. dollars, giving the duo a combined value of around 10 billion U.S. dollars.

The proposal was non-binding, but Tencent has paved the way for it to go through. After a series of deals with Huya's shareholders, Tencent will hold 51 percent of Huya's shares and 70.4 percent of its voting rights. Tencent is also the largest shareholder of Douyu, with a 38-percent stake and voting power.

Chen expected that the merger would significantly expand Tencent's reach in the gaming eco-system, cementing its lead in China's gaming industry.