01:03

Young Chinese, especially those born after the 1990s, are more willing to save and invest in light of their growing earnings power amid a rise of convenient fintech investment products, experts said Thursday.

A recent survey from Yu'e Bao, the money market fund distributed on Ant Group's payment network Alipay, found that 134 million out of its 700 million users are from the "post-90s" generation.

This number, compared to China's total post-90s population of 174 million, translates to roughly every three out of four using the said app to save money.

The latest data also shows that these young people are also saving and investing their money 10 years ahead of their parents' generation, mostly through digital platforms.

Shi Fanqi, assistant professor at Peking University's School of Economics, said that there are two main reasons why the young Chinese seem keener to invest and at a younger age, compared to their parents.

"There is indeed some difference in thinking and practices. They are saving more, (as) they are earning more, plus they are also marrying later… deferring marriage," Shi said.

"They are more willing to take risks – (for example) more people are investing via fintech or the stock market, which exposes them to larger risks compared to traditional investments."

Shi also said that there are more financial products available these days that are more convenient and accessible through mobile devices and phones.

However, he noted that there's a difference between those young people who are saving versus those who are investing. "When you look at the investment of the post-90s generation, most of them are still going through traditional trading firms."

He said one of the reasons is due to the government's tight regulations relating to riskier investments.

Banks losing younger crowd

Meanwhile, Liu Shichen, research lead at Shanghai-based consulting firm Z-Ben Advisors, said that fintech companies are targeting the younger generation of Chinese users at the expense of banks.

"I think for the younger generation, yes, indeed, banks are losing ground, compared to new platforms like Alipay and WeChat," Liu said.

"For banks, I think they are still the most trustworthy financial institution… banks are still in the financial system, but new apps are popular among the younger generation," he said, referring to both Yu'e Bao and Tencent's WeChat that allows users to also invest via its super app.

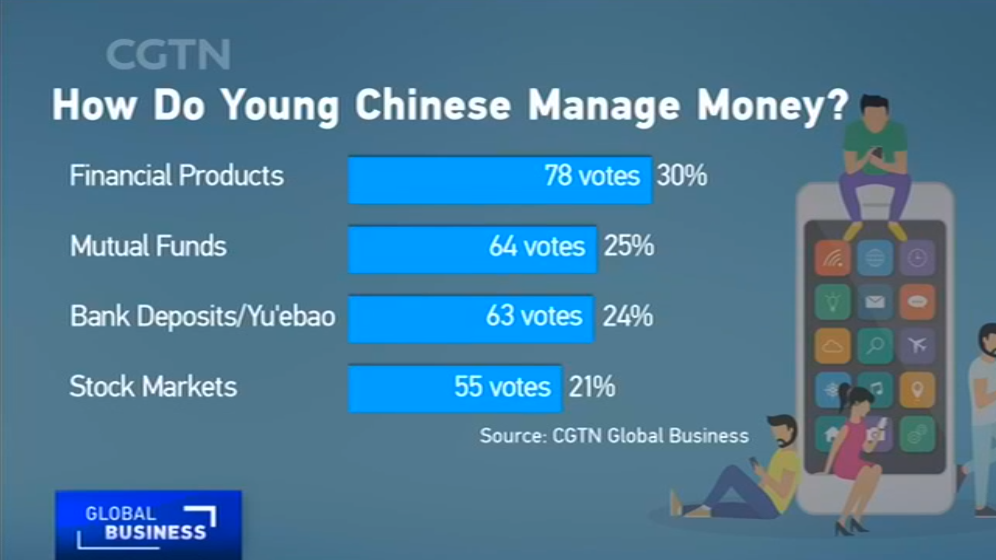

Meanwhile, an online survey by CGTN Global Business showed there appears to be a clear sense of financial management among young people, but not a strong preference for an investment platform.

In a voting poll of 260 Weibo users, about 30 percent were pursuing relatively stable returns by investing in financial products issued by banks or financial firms. Twenty-five percent of them value long-term growth and have bought mutual funds.

Another 24 percent prefer safety with bank deposits or Yu'e Bao despite lower interest rates. And the rest of the votes went to stock markets, meaning over 20 percent of young people are willing to take bigger risks with their money.