South Korean retail investors are stampeding into Chinese stocks in record numbers, ploughing hundreds of millions of dollars into a tech sector rush far removed from punishing taxes and regulations on investment at home.

In July alone, South Korean investors spent 240 million U.S. dollars buying shares in the Chinese mainland, data from the Korea Securities Depository (KSD) showed - their largest investment in mainland markets on record.

That's a seven-fold jump from 32.9 million U.S. dollars in July last year, and accounts for a third of the total 719 million U.S. dollars net investment in China stocks for the January-July period.

While South Korean mom and pop investors have historically been big risk-takers, they have stepped up the hunt for assets overseas as the Korean government imposes stringent mortgage rules and proposals to impose capital gains tax on local stocks.

Among them is the Kim, a 40-year-old Seoul chef, who invested more than 500 million won - nearly half a million dollars - in Chinese stocks. Like others, Kim, who declined to given his forename, is betting on Beijing's push for tech self-sufficiency to counter U.S. trade sanctions and bans.

"It is true that interest in Chinese stocks has increased more than ever, driven by tightened regulations on domestic stocks and a boom in the China market unseen since 2015," said Kim.

The United States remains a top destination for investors like Kim, with Korean investments there a net 2.27 billion U.S. dollars in July, followed by 475 million U.S. dollars in Hong Kong, out of a total 3.19 billion U.S. dollars of overseas stock buying.

But they are also being lured by the promise of China's speedy economic recovery from the coronavirus pandemic and its rising stock market - China's tech-heavy start-up board ChiNext and its STAR Market are up about 40 percent each this year.

Overseas stocks make up about 80 percent of Kim's equity holdings, with 90 percent of that chunk allotted to China and the rest to U.S. equities. Kim plans to park all his equity investments overseas, and is particularly bullish on the Chinese economy and mainland companies with high growth potential.

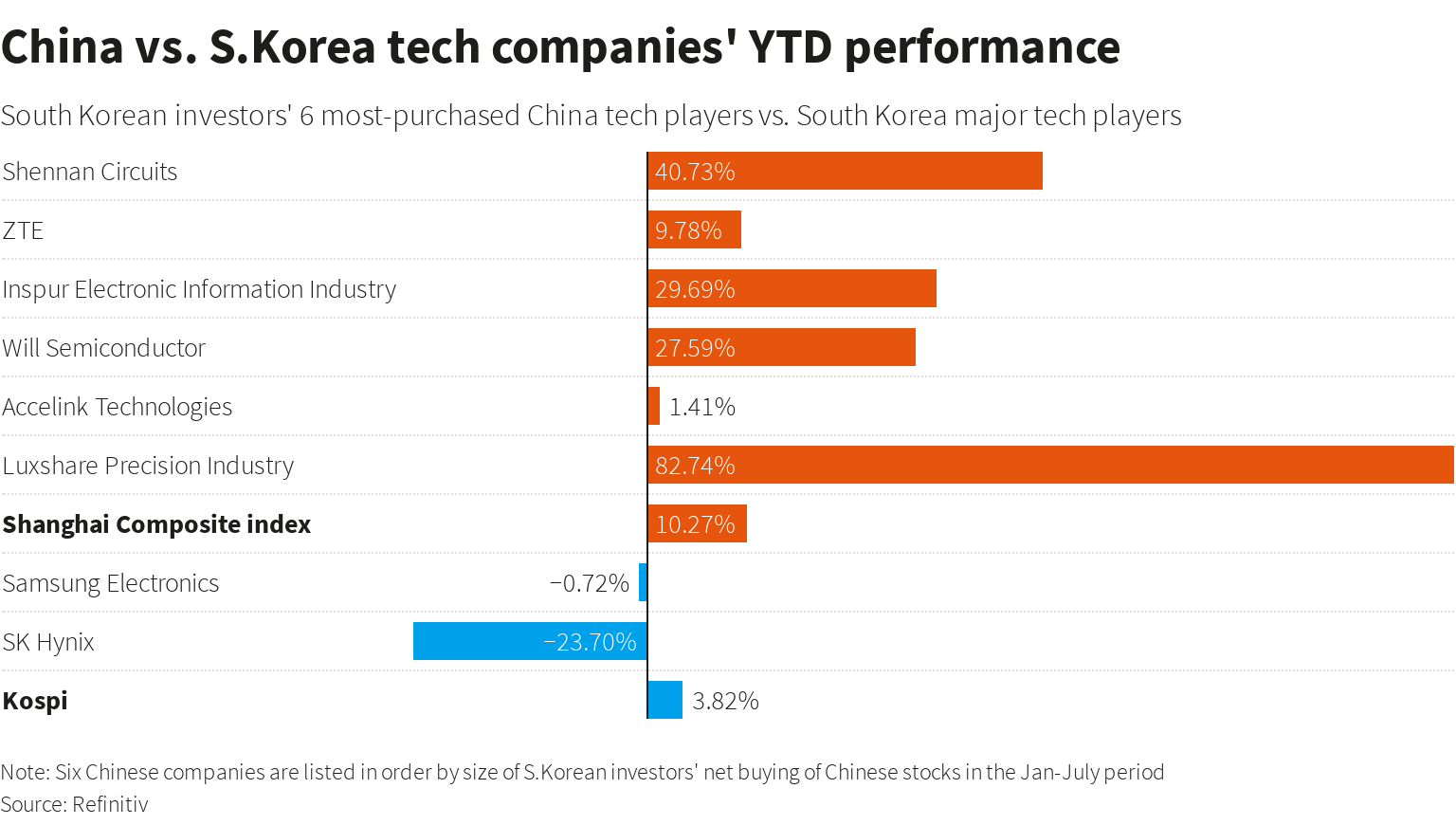

KSD data showed six of the 10 top Chinese companies that Korean investors bought between January and July were tech companies, with Shennan Circuits Co Ltd, a supplier to giant tech firm Huawei, taking the lead with 55.36 million U.S. dollars net.

ZTE Corp was also high on Korean investment list, along with Inspur Electronic Information Technology Co Ltd, Will Semiconductor Co Ltd and Luxshare Precision Industry.

The average year-to-date performance of those six shares shows a spurt of 32 percent, compared with declines of 0.7 percent and 23.7 percent respectively for Korean tech heavyweights Samsung Electronics Co Ltd and SK Hynix Inc.

What's more, the broader Shanghai Composite index is up 10.3 percent, while Seoul's KOSPI benchmark has gained by only 3.8 percent.

(Cover: A street in central Seoul, South Korea, April 22, 2020. /Reuters)

Source(s): Reuters