Products display at the World Semiconductor Conference that opens in Nanjing, east China, August 26, 2020. /CFP

Products display at the World Semiconductor Conference that opens in Nanjing, east China, August 26, 2020. /CFP

Too much dependence on a business model that separates chip design, manufacturing and packaging process may hurt China's semiconductor sector in a long run, an industry expert al said at the World Semiconductor Conference that opened in Nanjing, east China's Jiangsu Province on Wednesday.

As the world largest chip importer, China has bought hundreds of billions of dollars worth of chips overseas since 2013. But the industry still relies heavily on foreign high-end chip products, said Wei Shaojun, vice-chairman of the China Semiconductor Industry Association.

If the Chinese industry cannot get rid of the current business model, it will be very hard for it to catch up with its competitors, he added.

Wei Shaojun, vice-chairman of the China Semiconductor Industry Association speaks at World Semiconductor Conference. in Nanjing, east China, August 26, 2020. /CFP

Wei Shaojun, vice-chairman of the China Semiconductor Industry Association speaks at World Semiconductor Conference. in Nanjing, east China, August 26, 2020. /CFP

Wei's words came amid the growing suppression from the U.S. government on China's chip development. Earlier this month, the White House, in the name of national security threat, expanded curbs on China's chip firm Huawei.

The policy banned suppliers from selling chips with U.S. technologies to the Chinese firm without their permission, which, according to some industry analysts, is obviously designed to choke Huawei's access to some cutting-edge chips and disrupt global supply chain.

Business models of the semiconductor sector

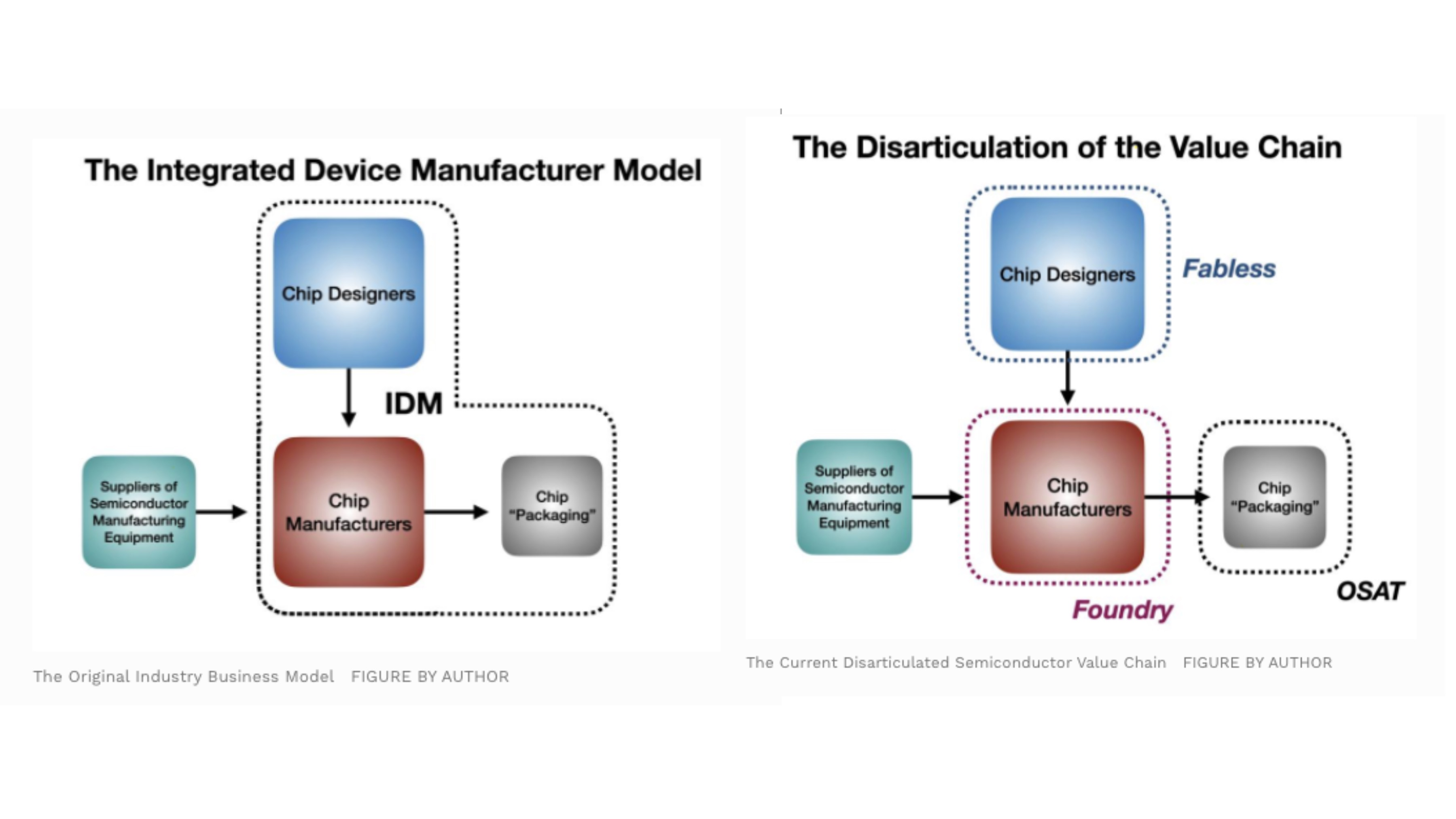

Generally, chip-making of semiconductor business is made up of three technological processes -- designing, manufacturing and assembling, or packaging.

Companies like Intel, Samsung, and TI are the very few players in the global semiconductor arena that have the capability to use this business model. These under-one-roof companies are called Integrated Device Manufacturers (IDMs).

Chip-making is a high-cost and high return business that needs millions of billions dollars of up-front investment. A new model touting to specialize in one specific area is a popular and cost-effective option for many companies who want to share a piece of cake of the lucrative industry.

Companies then began to split the process based on different functions. For example, companies focusing on the manufacturing business are known as foundries, while fabless are those who mainly work on the design part, and outsource their production to foundries.

The two business models in graphic. /CGTN

The two business models in graphic. /CGTN

China has no IDMs, but many of the world's leading fabless companies and foundries. According to an industry report, three of the five main companies worldwide that can design the 5G chips are based in China; and among the world's biggest foundry factories, two are Chinese companies

Bumpy but promising road ahead

Experts warn the lack of investment in products research and development (R&D) is the biggest problem facing China's semiconductor industry. Sometimes policies and capitals cannot keep abreast with R&D as well.

"The reason that U.S. firms can keep leading positions is because they invest heavily in their R&D. Data shows 27 percent of their revenues goes into the research, twice as much as other countries," Wei said.

High investment empowers companies advanced technology, which in turn supports them to make competitive products. Afterwards, these chips help them win the market and bring them profits, Wei concluded. "But China still cannot reach that virtuous cycle."

Beijing has stepped up its effort to forge its own semiconductor supply chain from chip design to manufacturing and packaging as it created a 29 billion U.S. dollars state-backed fund last year.

New policy on tax incentives for domestic semiconductor players has also been introduced in August. Under the new strategy, qualifying projects and enterprises that have operated for certain years will be exempt from corporate income tax.

China is the world largest semiconductor market. /Slide screenshot from the

World Semiconductor Conference

China is the world largest semiconductor market. /Slide screenshot from the

World Semiconductor Conference

"I expect the current tension between the U.S. and China will only invigorate the spending in China on technology including software over the next five years," Mario Morales, program vice president for enabling technologies and semiconductors at IDC told CNBC.

Other industry analyst said the development of China's own chip industry could hurt U.S. companies, as Chinese companies try to build closer ties to other countries like Japan and South Korea and create its own semiconductor "ecosystem."

"If China as a whole is able to acquire the right human resources talent, companies and partnerships, it should still be on track to create a homegrown semiconductor industry over the next decade without access to American tech," said Neil Shah, research director at Counterpoint Research.