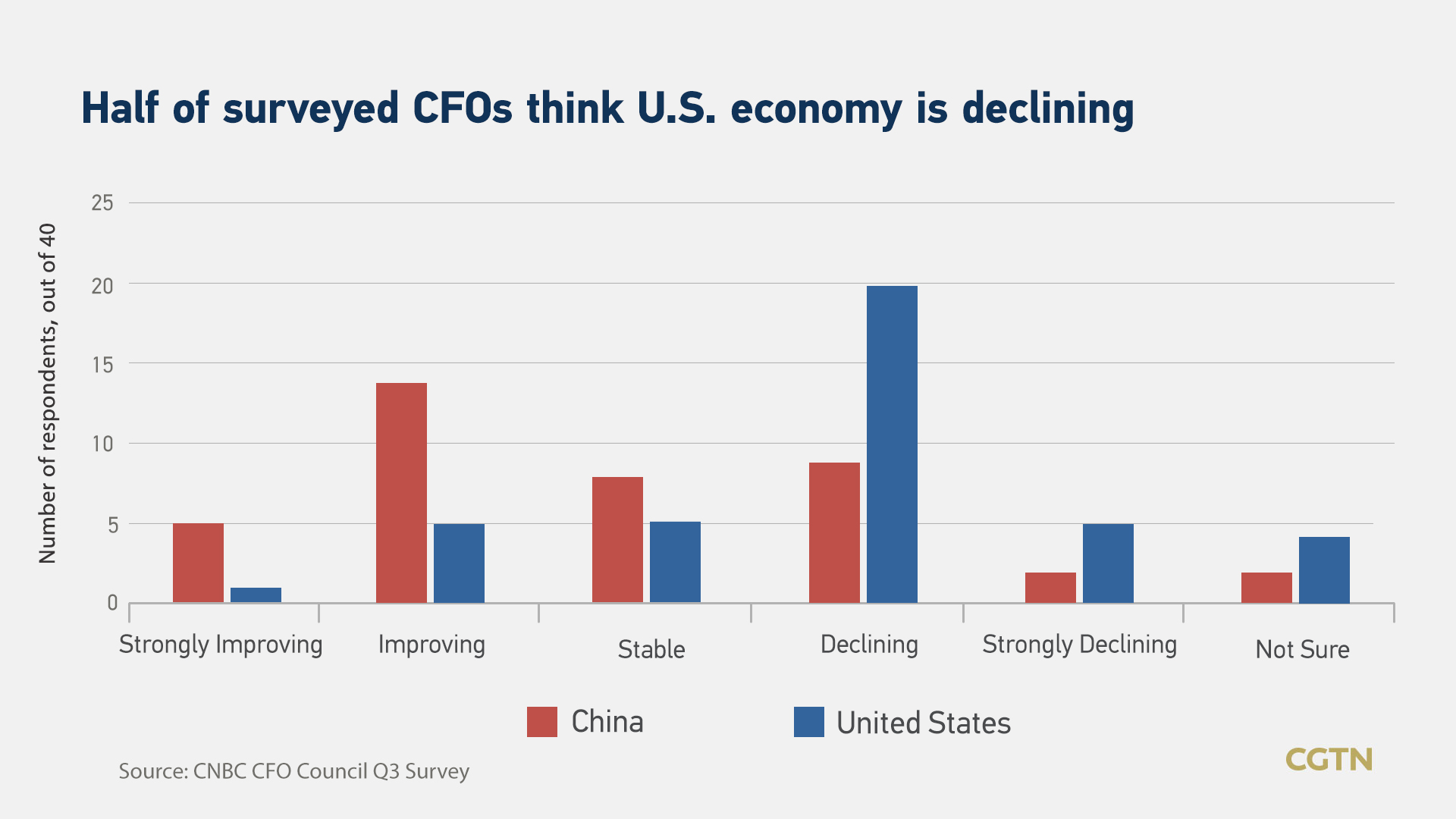

The world's leading chief financial officers have a more positive outlook for China's economy than they do for the economy of the United States, according to the latest Q3 CNBC Global CFO Council Survey.

The CNBC Global CFO Council represents some of the largest public and private companies in the world, collectively managing more than 5 trillion U.S. dollars in market value across a wide variety of sectors. In the survey, CFOs gave an average forecast of "stable" for China's GDP and "modestly declining" to the U.S.

For the third quarter, the council upgraded the rest of Asia and the Eurozone from "modestly declining" to "stable" and Latin America from "strongly declining" to "modestly declining", while remaining the cautious tune to the U.S. economy that is seen as "modestly declining" for the second straight quarter.

It the first time in the survey's history that this elite corps' financial executives were more upbeat on China, CNBC said.

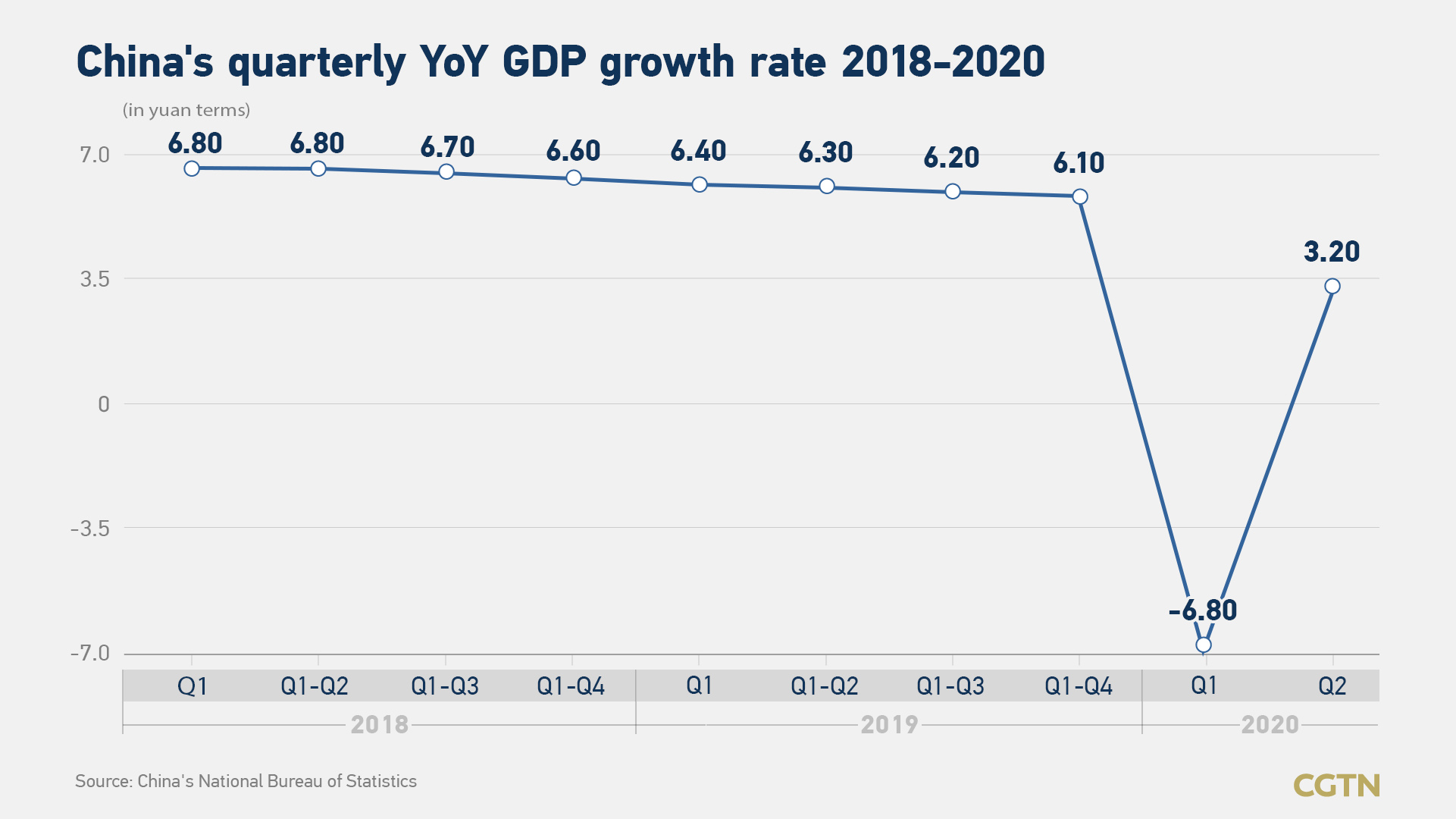

The outlook echoes the fact that China's economy is rebounding with a more controllable epidemic situation domestically thanks to effective epidemic prevention works.

China's economy returned to modest growth of 3.2 percent in the second quarter of 2020, while the U.S. economy decreased at an annualized rate of 32.9 percent in the same quarter, the historic worst single-quarter decline in history.

China's Q2 GDP growth recovers to 3.2% after steep slump, beats forecast

World Bank upgraded China's economy forecast based on the second-quarter GDP rebound, attributing the reversion to its significant policy space in rolling out fiscal and monetary responses.

The International Monetary Fund has forecast China's real GDP to expand 1.0 percent for 2020, the only major economy expected to report growth in 2020, while the U.S. is expected to see real GDP contract 8 percent during the same period.

IMF official confident in China's Q2 growth

Earlier, Mike Henry, CEO of the world's largest miner BHP Group, said although the global economic activity is experiencing an unprecedented drop amid the COVID-19 pandemic, China is experiencing a "pretty solid V-shaped recovery."

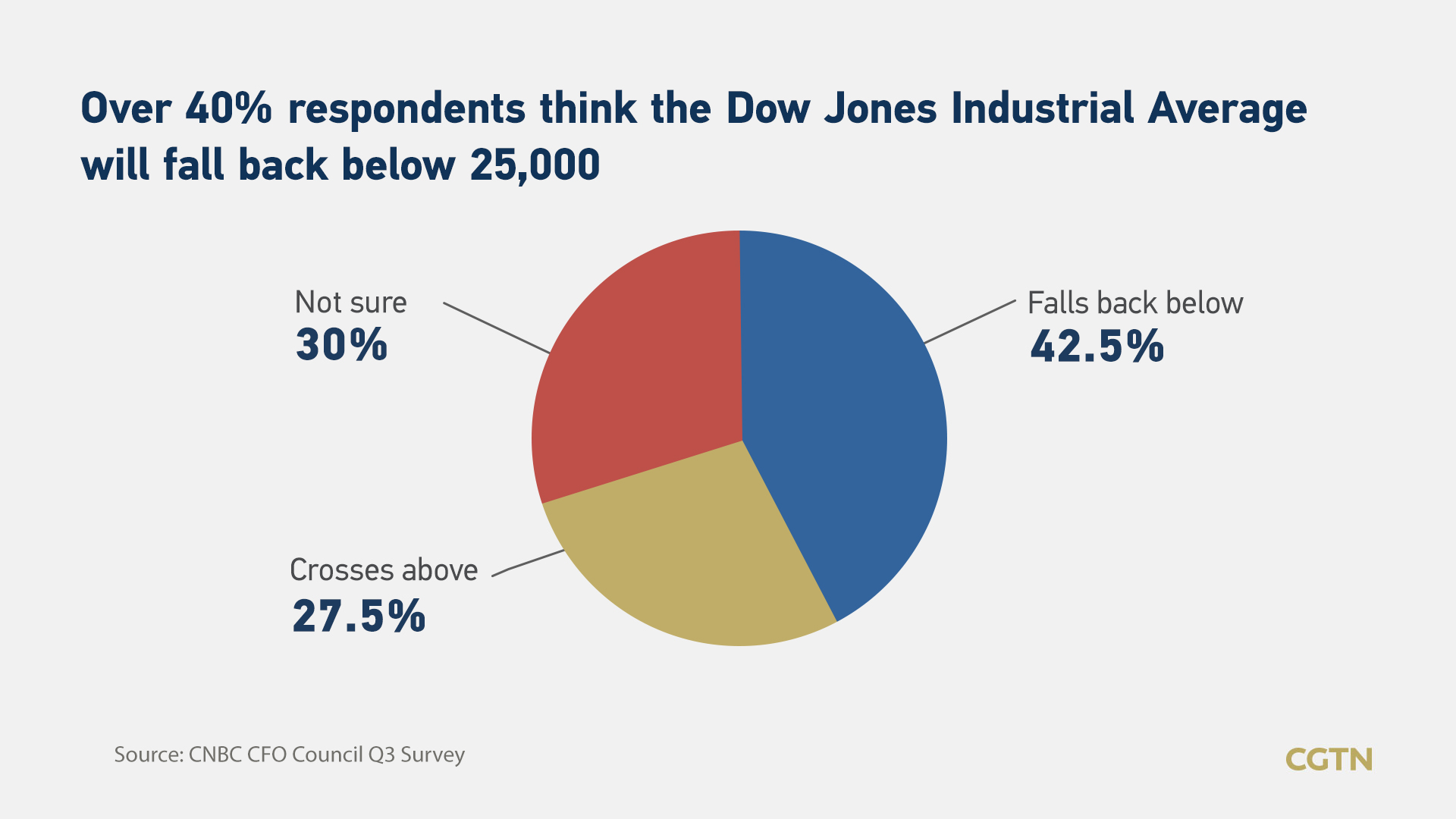

Additionally, CFOs are also cautious about the performance of the U.S. stock market in the CNBC survey. The council is split on where the market is headed next - 42.5 percent surveyed CFOs say the Dow Jones Industrial Average will fall back below 25,000 before it reaches 30,000, while only 27.5 percent of respondents think it will cross above 30,000 before another downturn.

The gloomy outlook for the U.S. economy and the markets reflects the increasing uncertainties for the companies in the worsening COVID-19 situation. According to the latest tally from Johns Hopkins University, the U.S. has registered over 5.9 million infections and more than 182,000 deaths so far – both the highest in the world.

(Cover via CFP)