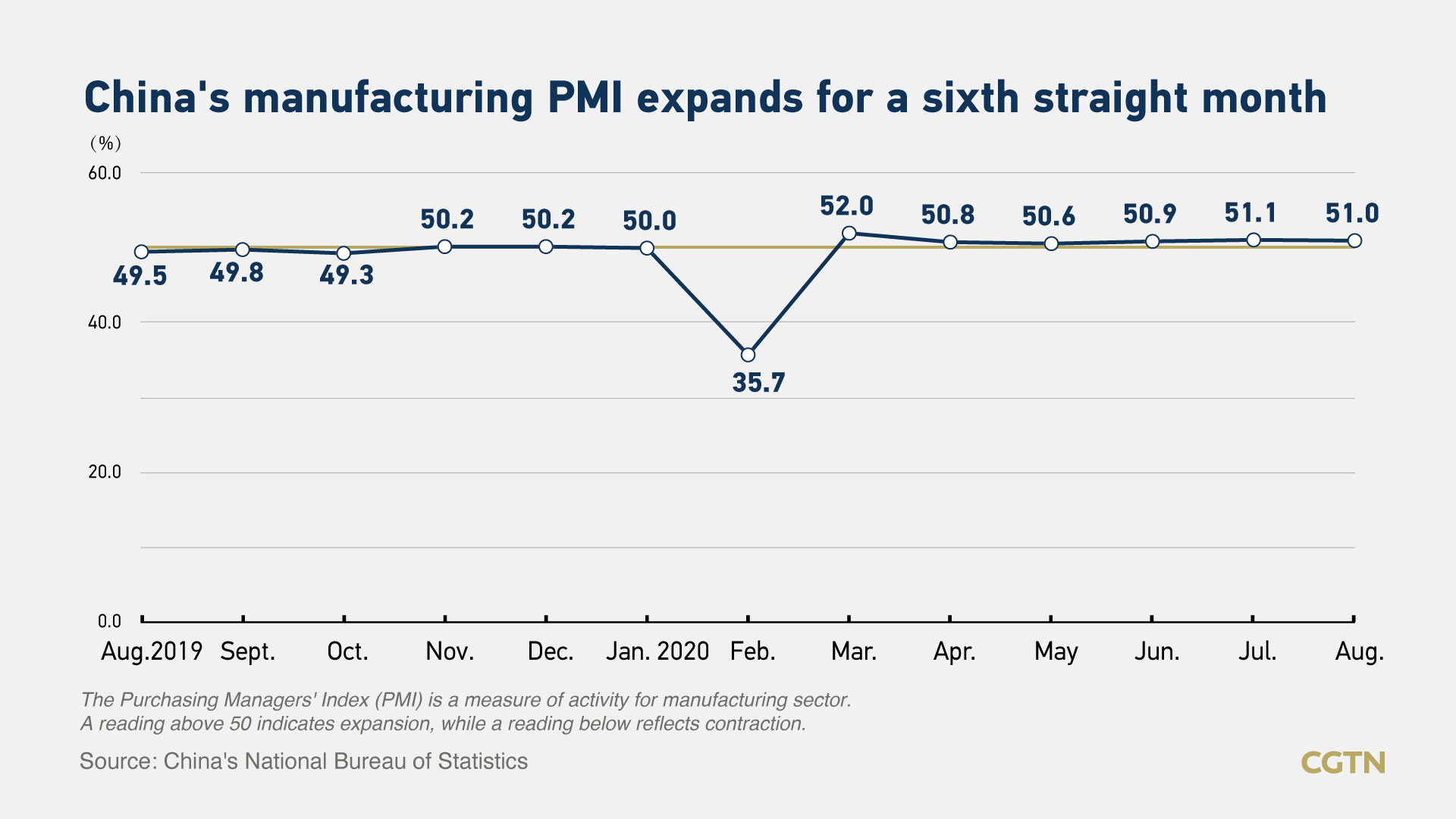

China's manufacturing purchasing managers' index (PMI) decreased to 51 in August from 51.1 in July, with impacts from heavy floods in the south of the country, official data from the National Bureau of Statistics showed on Monday.

PMI readings above 50 indicate expansion. However, the pace of expansion slightly missed expectations, as both Reuters and Bloomberg consensus had forecast August PMI to come in at 51.2.

In contrast, the non-manufacturing PMI rose to 55.2 in August from 54.2 in July, beating expectations by Bloomberg consensus at 54.2 and Nomura at 54.4.

Heavy floods in southwest China's Chongqing Municipality and Sichuan Province resulted in the prolonged procurement cycle of raw materials, and thereby the number of orders and production fell, Zhao Qinghe, a senior statistician with the bureau explained in a statement (in Chinese).

The slight moderation in August manufacturing PMI proves that "pent-up demand may have lost some steam," according to Lu Ting, chief China economist from Nomura.

"It's not too surprising that the manufacturing PMI has started to level off since growth in industry has already returned to its pre-virus level," Julian Evans-Pritchard, senior China economist at Capital Economics, said in a note following the data release.

"While the higher non-manufacturing PMI suggests a faster recovery in the services sector and a buoyant construction sector," said Lu, adding that "the services sector's recovery still faces headwinds and uncertainties from the COVID-19 pandemic."

Lu also pointed out that the moderate drop in manufacturing PMI was driven by weakness in production and raw materials sub-indices, which fell to 53.5 and 47.3 respectively in August from 54.0 and 47.9 in July.

New orders of products like pharmaceuticals and electrical machinery and equipment moved at a faster pace in August than in July, and exports were also improving in general, Zhao added.

New export orders sub-index rose to 49.1 in August from 48.4 in July. Due to the continued growth in the new export orders sub-index, new orders sub-index rose to 52.0 in August from 51.7 in July.

But the reading of 49.1 was still below the expansion/contraction threshold of 50. The reading has been in contractionary territory for eight consecutive months, which suggests "headwinds from weak external demand remain intact," said Lu.

Labor markets saw a continued weakening of sequential momentum, as the employment sub-index stood at 49.4 in August with an uptick from 49.3 in July. However, the reading remained in the sub-50 contractionary territory.

"We expect China's official manufacturing PMI to stay around 51.0 in coming months, while the non-manufacturing PMI could moderate from the 55.2 reading in August," said Lu.

Nomura expects Beijing will neither introduce new stimulus measures nor roll back existing ones.