01:43

China's economy has sustained a steady recovery as factories stepped up production and retail sales expanded for the first time this year, in spite of the dual pressure of the epidemic and recent flooding, the National Bureau of Statistics (NBS) said Tuesday.

"Strong external demand, a further recovery from the pandemic and pent-up demand from the floods all contributed to the robust activity data in August," Nomura said in an email to CGTN.

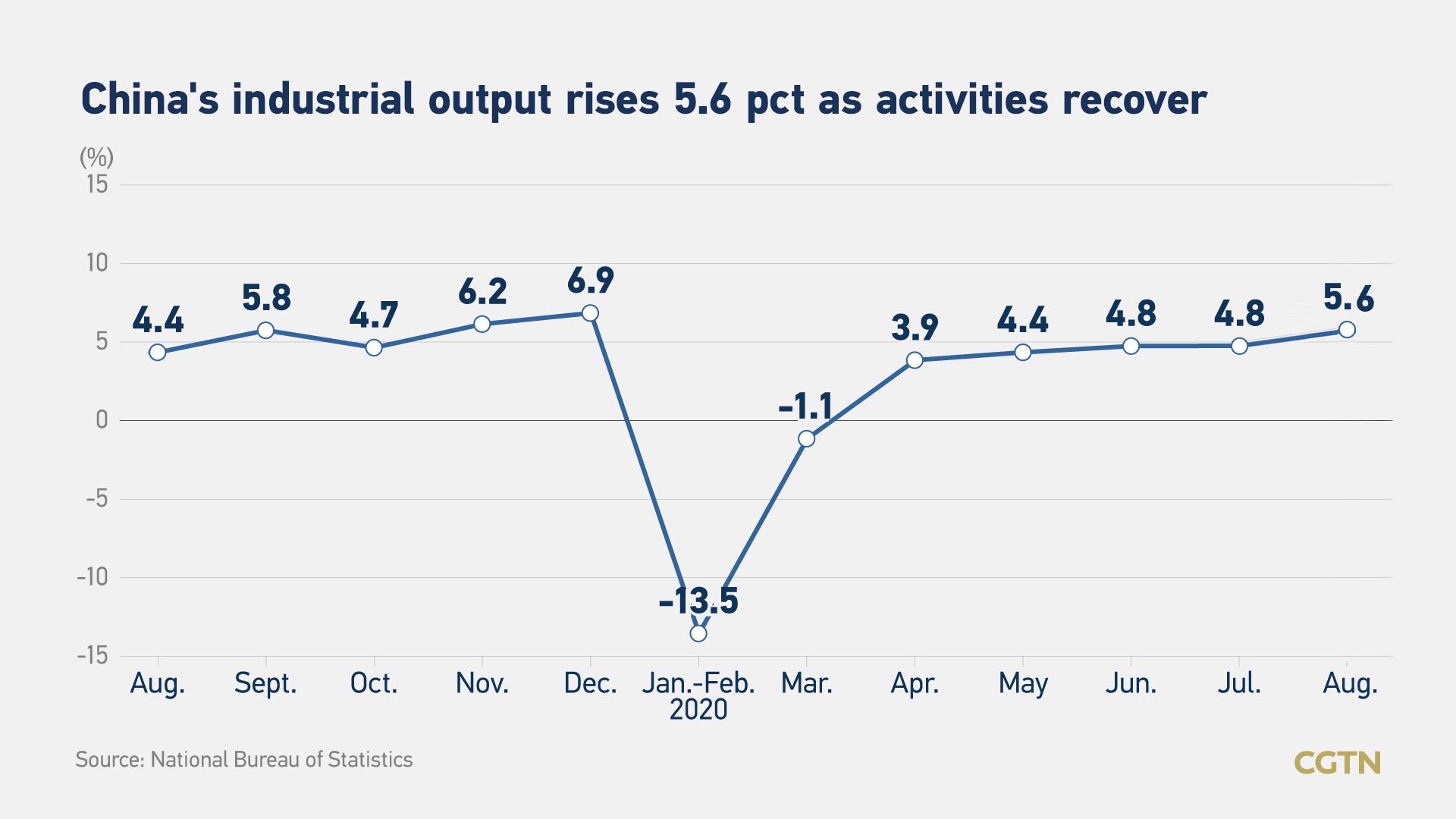

The country's value-added industrial output went up 5.6 percent year on year in August, marking the fastest gain in eight months, NBS data showed. It accelerated from a rise of 4.8 percent registered in July, and higher than the 5.1-percent growth tipped by Reuters' poll.

On a month-on-month basis, industrial output rose 1.02 percent in August, higher than July's 0.98-percent increase. In the first eight months, industrial output expanded 0.4 percent from one year earlier, compared with a decline of 0.4 percent in the January-July period.

China's retail sales of consumer goods, a major indicator of consumption growth, rose 0.5 percent year on year in August, according to NBS. Growth in retail sales snapped a seven-month downturn and beat analysts' forecast for zero growth.

"Excluding cars, retail sales were still in contraction. Retail sales of electronics surged due to recovered demand from both domestic and global markets," Wang Dan, chief economist with Hang Seng Bank China told CGTN.

08:56

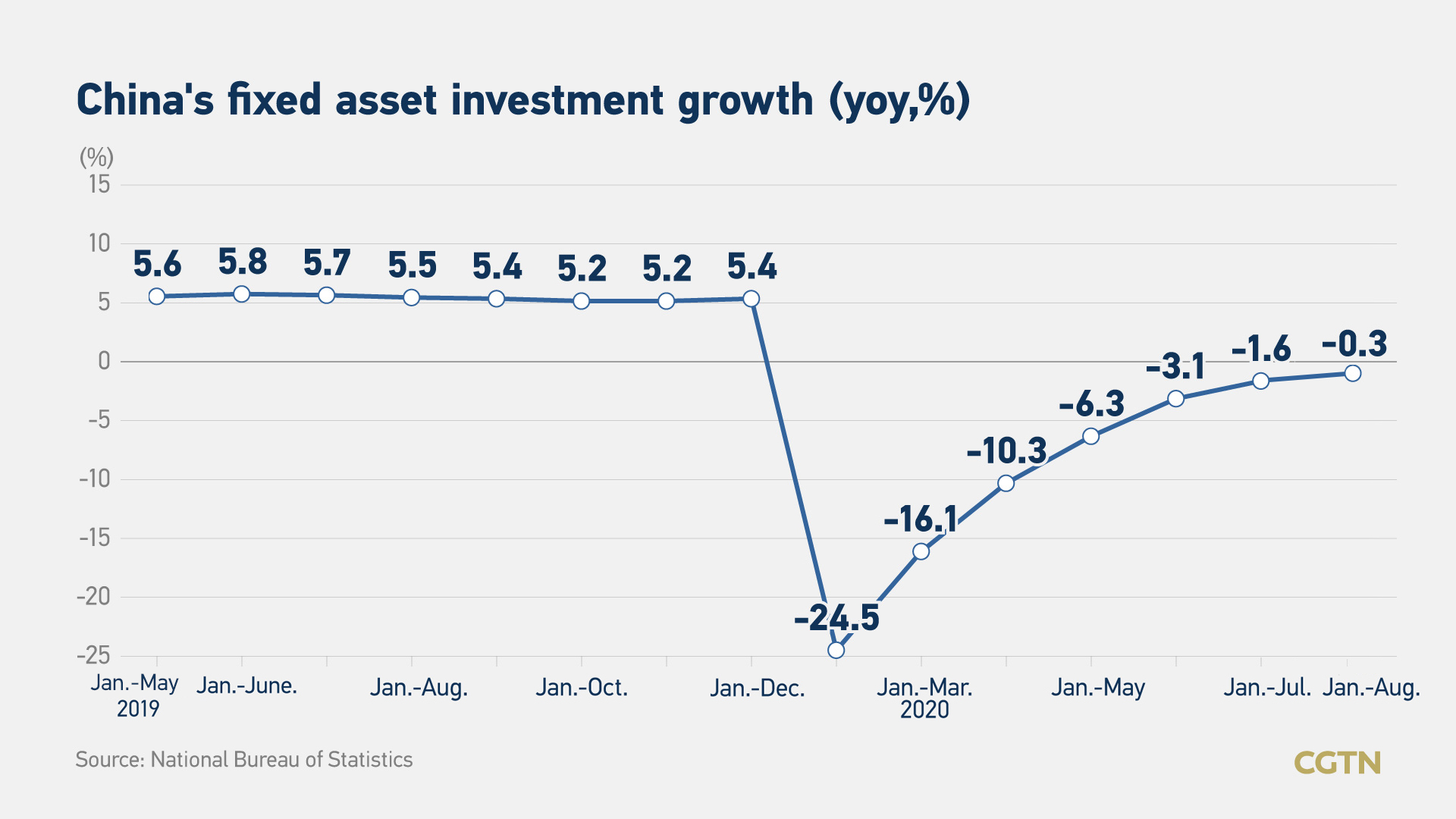

China's fixed-asset investment edged down 0.3 percent year on year during the January-August period, with the decline narrowing from the 1.6-percent drop seen in the first seven months, NBS data showed.

The fixed-asset investment includes capital spent on infrastructure, property, machinery and other physical assets. On a month-on-month basis, FAI rose 4.18 percent in August. In the first eight months, the FAI amounted to 37.88 trillion yuan (about 5.55 trillion U.S. dollars).

China's investment in property development rose by 4.6 percent year on year in the first eight months of 2020, widening from the 3.4-percent increase in the first seven months, according to NBS.

Property investment "may stay on its slowest speed, given the recent policy fine tuning on property financing," said Robin Xing, chief China economist at Morgan Stanley.

Xing expects that the GDP would return to the pre-COVID-19 potential growth of around six percent in the fourth quarter as the momentum of the dual engines of export and domestic consumption has extended.

"The August data shows China's economic recovery is broadening with the encouraging signs that the private capital expenditure and consumer spending are no longer the weak sport," said Xing.

"Infrastructure building started to gather momentum, driving up demand for steels, construction machinery and trucks," said Wang.

Investment by the state sector went up 3.2 percent during the period, while private-sector investment fell 2.8 percent, with the drop narrowing 2.9 percentage points from that in the first seven months, NBS data showed.

"China sees steady economic recovery, yet the drivers remain to be state-led investment, rather than consumption," said Wang.

Recent indicators, including exports and purchasing managers' index (PMI), have pointed to a sustained recovery in economic activity and manufacturing. China's exports rose by 9.5 percent year on year in August in U.S. dollar terms, marking the strongest gain since March 2019.

Read more: China's exports up 9.5% in August, strongest gain in 17 months

China's manufacturing PMI stood at 51 in August, above the expansion/contraction threshold of 50. However, the pace of expansion slightly missed expectations, with impacts from heavy floods in the south of the country.

Read more: China's August manufacturing PMI sees minor slip affected by floods

China's consumer inflation rose by 2.4 percent from a year earlier in August, contracting by 0.3 percentage points from July, mainly due to easing food price inflation. Meanwhile, China's factory deflation fell by 2 percent in annual terms in August, suggesting the country's industries are continuing to recover from the COVID-19 outbreak.

Read more: China's consumer inflation eases in August, factory deflation improves

"The recovery is nonetheless uneven, with the economic momentum concentrating in major city clusters, particularly Greater Bay Area and Chengdu-Chongqing Economic Circle, while Central China is mostly lagging behind," said Wang.

"We expect regional center cities to continue to attract migrants, investment and financial resources as the new urbanization plan rolls out."

"The stronger-than-expected activity data in August support our recent decision to raise our third-quarter and fourth-quarter growth forecasts to 5.2 percent year on year and 5.7 percent year on year respectively," Nomura said.

The financial services company expected a further, albeit gradual, recovery of the services sector, a steady improvement in retail sales and elevated fixed-asset investment growth.

"However, headwinds remain as pent-up demand will likely lose some steam, medical product exports may have peaked, Beijing is determined to cool property markets, some social distancing measures within China are likely to extend into the second half of the year, and rising U.S.-China tensions could dent China's exports and manufacturing investment," Nomura cautioned.

Beijing will neither add more easing measures nor start tightening in the near term, according to the firm. "We believe it is too early for Beijing to roll back the easing and stimulus measures it introduced in the first half of the year, but it also may be reluctant to roll out fresh stimulus measures in the second half," Nomura explained.

"On fiscal policy, we expect Beijing to carry out what it planned in the first half of the year on the scheduled budget and government bond issuance," it added.

On monetary and credit policies, "we believe the period of quickly accelerating credit growth is over, but it will likely remain at current levels around 13 percent through the second half of the year. We do not expect any RRR cuts or rate cuts before end-2020," Nomura said.

(CGTN's Xia Cheng also contributed to the story.)