Some of the Wall Street's most powerful financial institutions are pressing ahead with deals in China even as tensions escalate between the world's two largest economies, the Financial Times reported last week.

It said the world's biggest asset manager BlackRock was granted approval last month for a partnership with a state-owned bank in China.

A few days later, Vanguard, a rival asset management company, said it would move its regional headquarters to Shanghai, while Citigroup became the first U.S. bank to obtain a fund custody license in China.

Details of JPMorgan Chase's plan to buy out its local partner in a Chinese fund company have also surfaced, the report added.

"Everywhere you look [in China], there's a lot of money, and where else in the world is there an opportunity like this to go and get that sort of money for management?" reported FT, quoting Stewart Aldcroft, Asia chairman of Cititrust, an arm of Citigroup. "There isn't anywhere, frankly."

Since 2018, the China Banking and Insurance Regulatory Commission has approved foreign banks and insurance companies to establish nearly 100 outlets in China, including insurance companies and wealth management companies that are wholly foreign-owned or controlled.

What for?

The world's largest and most promising middle-income group, the most complete industrial system, and the development space reserved for future asset allocation by relatively traditional financial management methods of Chinese households all constitute China's booming economy.

According to Goldman Sachs estimates, only 7 percent of household assets in China are invested in stocks and mutual funds, compared with 32 percent in the United States.

Two-thirds of Chinese households' assets are real estate and nearly one-fifth are cash and deposits, which is why "running Chinese money globally has become the holy grail for foreign firms."

Besides, China's financial industry has been opening up at a faster clip. Since 2018, the China Banking and Insurance Regulatory Commission has introduced 34 measures to open up the banking and insurance industry.

At present, the revision of relevant laws and regulations has been basically completed and the regulatory process continuously improved, with marked improvement in approval efficacy and the level of opening-up.

The new moves come as Beijing takes steps towards the liberalization of its vast but heavily protected capital markets. They show that behind the bluster of U.S.-China tensions in the lead up to November's presidential election, the two countries are edging closer in financial services, FT commented.

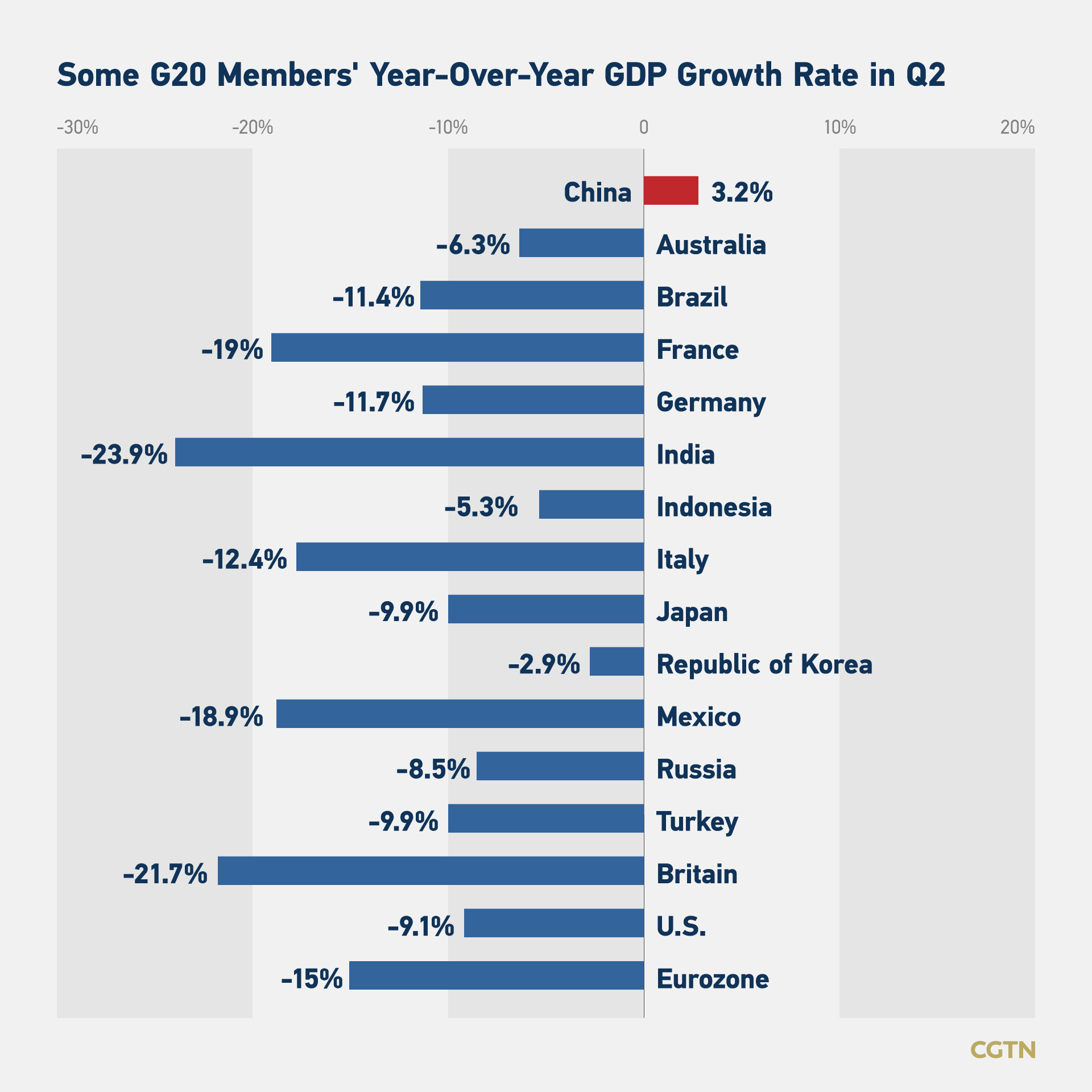

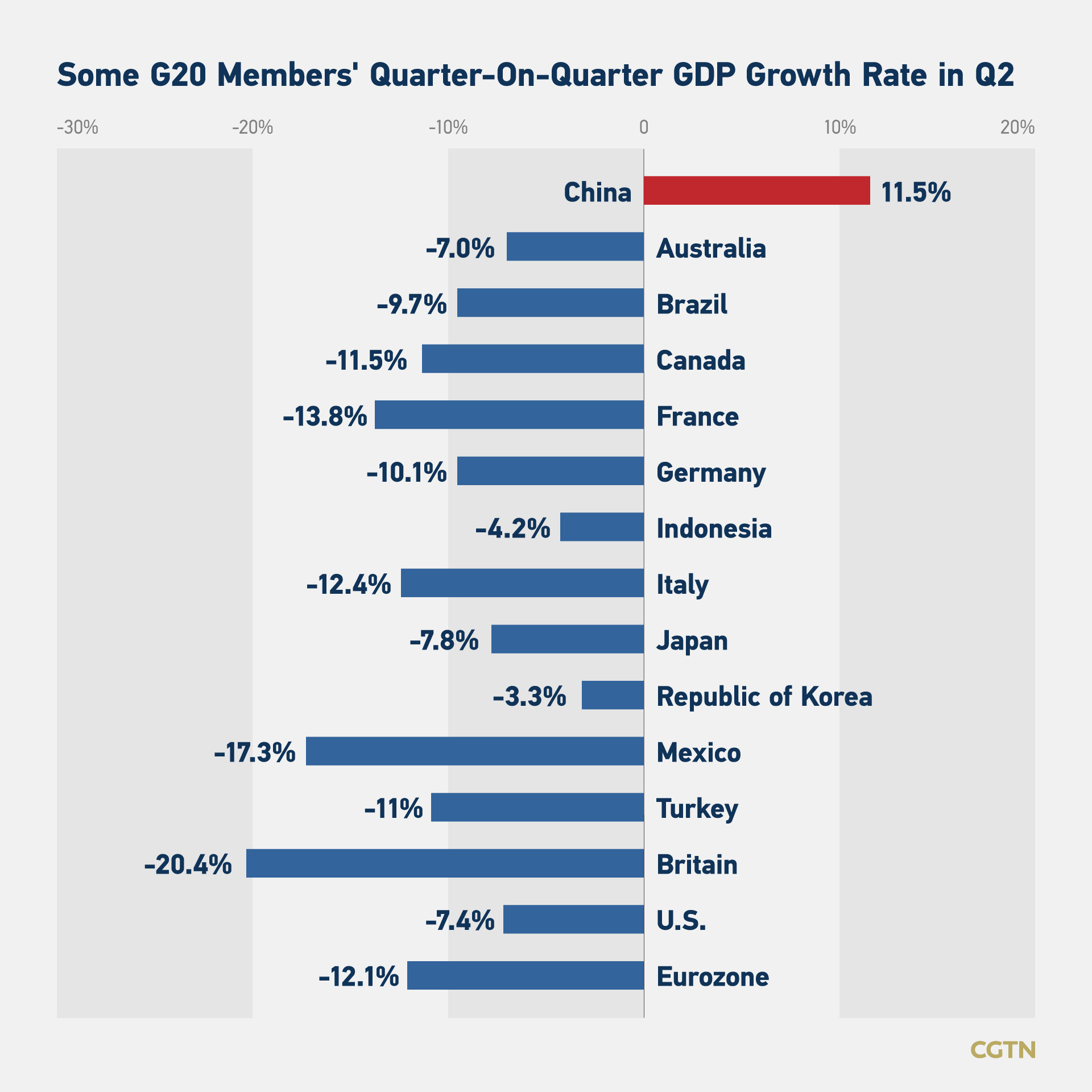

In the post-epidemic era, China's economy was the first to recover, and its resilience has increased investor confidence.

"China's recovery makes it an outlier as the pandemic weighs on the rest of the globe as the rest major economies have shrunken dramatically in the first half of 2020... China was the only country for which the International Monetary Fund projected growth this year in its June forecast – it's expected to eke out a one-percent increase," according to CNN.

Casey Quirk, a consultancy, estimates China will overtake the UK as the world's second-largest funds market by 2023.

(Cover: CFP)