02:44

Editor's note: The story is part of our continuing World Factory series, which delves into the trajectory of China's economic growth amid a changing geopolitical landscape, the pandemic and a global economic recession. You can read the first one here.

A speeding truck cuts in directly in front. The car slows down. Pressure is gently applied to the brake and slowly eased. There is no momentary jerk. It's a smooth stop.

This is enabled by an embedded automated driving system developed by iMotion Automotive Technology, a hi-tech company headquartered in eastern China's Suzhou Industrial Park – home to thousands of technology firms and high-end manufacturers.

The company is one of the many startups in the "Silicon Valley" of China and one of the country's few providers of autonomous driving solutions. "I started this company because China lagged behind in self-driving development," Song Yang told CGTN.

Over the years, Tesla and Google have been making headlines with their breakthroughs in autonomous driving, but what's receiving less coverage are Chinese companies using artificial intelligence (AI) to put cars on the road.

Song, a former automated driving specialist at Germany's tech giant Bosch, founded iMotion only four years ago. Developing self-driving car systems needs expertise in multiple dimensions ranging from decision-making and control algorithms to road infrastructure and vehicle interconnection. "It's interesting to see a car go from advanced driver assistance to driverless systems, and it requires long-term devotion."

The past few years witnessed China quickly catching up with the U.S. in this field. "We have achieved self-sufficiency when it comes to producing mass-market cars with L1, L2 and L3 automated driving systems despite a smaller market share. China and the U.S. are seeing the fastest development in autonomous driving in the world," said Song.

But when it comes to higher levels of self-driving systems – L4 and L5 – that will render vehicles fully autonomous, both countries are in the initial stage. What hampers these efforts is the looming tech war with the latest battleground in silicon chips.

A self-driving system developed by iMotion attached behind a rearview mirror for a demonstration, in Suzhou, east China's Jiangsu Province, August 25, 2020. /CGTN

A self-driving system developed by iMotion attached behind a rearview mirror for a demonstration, in Suzhou, east China's Jiangsu Province, August 25, 2020. /CGTN

For self-driving cars, chips are essential in enabling its "brain" and "eyes" to work. For the past four years, iMotion has been using chips made by Israeli company Mobileye to empower its sensors, among other key autonomous features.

Mobileye, founded in Jerusalem in 1999, has been developing vision technology for different levels of autonomous driving. In 2017, it was purchased by U.S. tech giant Intel at a prohibitive price of 15.3 billion U.S. dollars. Back then, the acquisition didn't cause jitters among global tech businesses. It wasn't until early 2018, when the trade war between China and the U.S. broke out, that tech companies started to grow concerned.

With a dismal deterioration in bilateral relations, the conflict has spread to high tech, with Washington moving on national security grounds against Beijing. In mid-May this year, the U.S. Department of Commerce extended export restrictions to all semiconductors made or designed with American software and technology, including those applied to automated driving. Those restrictions took full effect on September 14. Apart from Huawei, which received the most press coverage, most Chinese tech companies using such chips have been dealt a heavy blow.

"If we are completely cut off from the chips, both countries will suffer, but we'll lose more," said Song. Most decision-making chips for self-driving largely come from the U.S., Europe and Japan. China is in the early stage of such development despite its incremental investment in related arenas.

The logo of Israeli tech company Mobileye is seen on the building that houses its headquarters in Jerusalem, Israel, May 15, 2018. /Reuters

The logo of Israeli tech company Mobileye is seen on the building that houses its headquarters in Jerusalem, Israel, May 15, 2018. /Reuters

But an entire cutoff is unlikely, as tech companies can't separate from traditional manufacturing, according to Song. Control units, cameras and circuits, among a variety of ingredients, need traditional manufacturing. "The U.S. has been blighted by a hollowing-out of manufacturing in recent decades, and China's position as the world factory can hardly be replaced," Song said.

"There's no denying that a tech decoupling is looming as the U.S. seeks to contain China's hi-tech development, but core chips only constitute a tiny part," said Wang Dan, chief economist of Hang Sheng Bank (China), during a phone interview with CGTN.

A slew of Southeast Asian countries have seen the migration of certain American factories amid trade and tech tensions, but they have a difficult time catching up with China in precision manufacturing at an affordable cost. "They have lower labor costs, but most of their products are of coarse quality in addition to a much longer time span," said Chen Lei, an application engineer at iMotion.

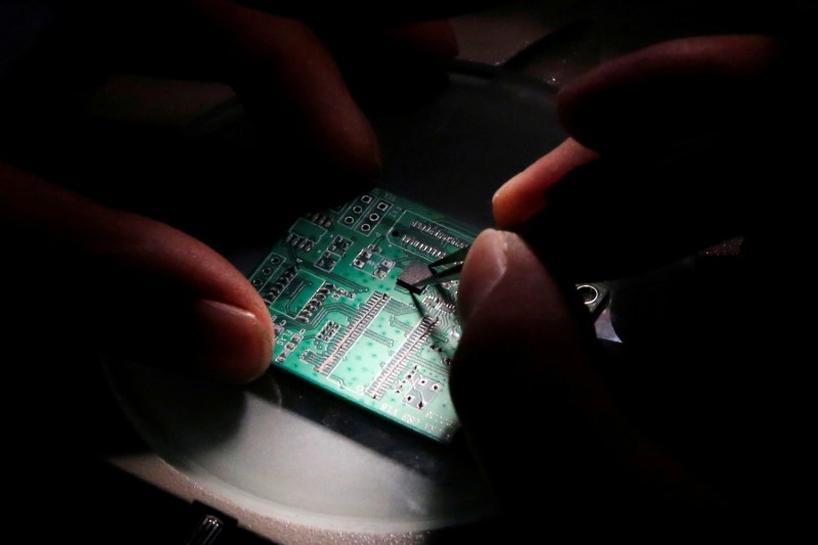

A researcher uses a microscope to place a semiconductor on an interface board during research to design and develop a semiconductor product in Beijing, China, February 29, 2016. /Reuters

A researcher uses a microscope to place a semiconductor on an interface board during research to design and develop a semiconductor product in Beijing, China, February 29, 2016. /Reuters

Besides its strength in high-end manufacturing, China has developed the most complete supply chain in the world, as well as reliable infrastructure over four decades of reform and opening up. The country also has the world's largest automotive market, making it a lucrative destination for chipmakers of autonomous driving systems.

American tech companies that got ahead in achieving truly self-driving vehicles have been making inroads into the Chinese market. Nvidia, a California-based company, is reported to have the world's fastest processors for running artificial intelligence programs that can power self-driving cars. It has teamed up with Baidu to develop an autonomous vehicle platform for China, but the tech export restriction has hampered the endeavor. Mobileye, on the other hand, partnered with Chinese electric vehicle startup NIO to apply its sensor chips to mass-produced cars.

A handful of big Chinese cities have begun issuing commercial testing licenses for self-driving cars in recent months. A dozen Chinese tech companies, ranging from ride-hailing platform Didi Chuxing to startups such as WeRide, have introduced self-driving taxis in autonomous driving zones across Chinese cities.

The biggest opportunity on the horizon, Song said, is the upcoming deployment of 5G networks in China. According to data from the Ministry of Industry and Information Technology, more than 600,000 5G base stations were expected to be built nationwide by the end of 2020. A forecast from the Global System for Mobile Communications shows that China is set to become the world's largest 5G market by 2025, with 460 million 5G users.

"Under 4G network, latency in communications means it would be hard to realize autonomous driving, but under 5G network, it would be much easier," he explained.

The chip war, nonetheless, has put all these prospects in the crosshairs. "Globalization is only going to continue, albeit a bit slowly," Wang said. Cooperation between countries continues to drive the world economy, bringing to life what was seemingly science fiction just a decade ago.

Article written by Wang Xiaonan, Yu Jing

Video director: Wang Zengzheng

Videographer: Zheng Lei

Voiceover: Zeng Ziyi

Cover image designed by Li Jingjie

Supervisor: Zhang Shilei