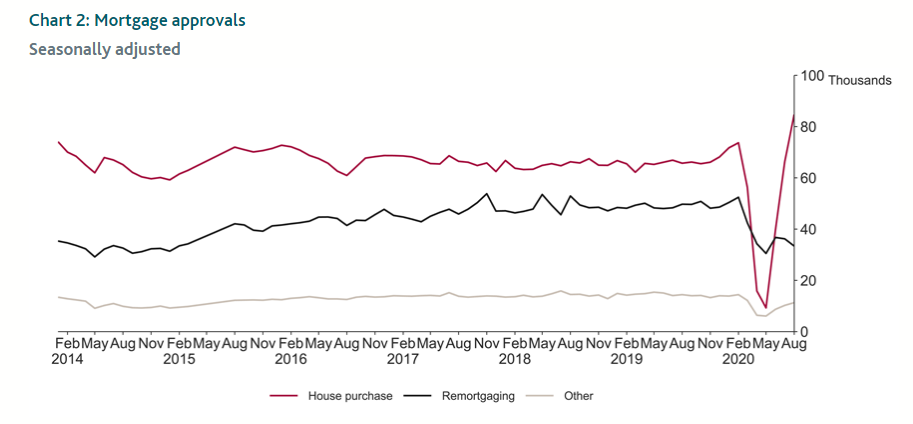

British mortgage approvals for house purchase hit their highest in almost 13 years in August, showing more signs of recovery, data from the Bank of England (BoE) showed.

Mortgage approvals increased to 84,700 in August from 66,300 in July, hitting their highest level since October 2007, but it only partially offsets weakness seen between March and June, said the BoE.

Economists polled by Reuters had expected about 71,000 approvals.

New mortgage rates were 1.72 percent, a decrease of 1 basis point on the month, while the interest rate on the stock of mortgage loans fell 1 basis point to 2.14 percent in August, data showed.

But consumer borrowing – a key driver of economic growth – increased by only around 300 million pounds in August from July compared with a median forecast for a 1.45 billion pound increase in the Reuters poll.

Alistair McQueen, head of savings and retirement at insurer Aviva, said many households were likely to start saving more in anticipation of further economic turmoil caused by the reintroduction of stricter local lockdown measures, Reuters reported.

"This will dent consumer spending, which will curb the UK's economic recovery."

Compared with August last year, consumer borrowing sank by 3.9 percent, the sharpest fall since the BoE began measuring the data in 1994.

(Cover: The Bank of England. /Reuters)

(With input from Reuters)