04:35

From Bill Clinton's campaign slogan "It's the economy, stupid!" to Donald Trump's promise to "take jobs back to America," the state of the economy is always a crucial factor in U.S. presidential elections.

History has shown that economic performance is often closely correlated to election outcomes – a better economy helps an incumbent president's party, while tough conditions can push voters to look for a fresh option.

In 2020, the painful coronavirus recession and the following social cleavage have made the election year even more dramatic.

Before the virus outbreak, Donald Trump was planning to center his campaign on the economic battlefield – one area where he had a clear advantage. But now, both he and Democratic challenger Joe Biden are working out how to navigate an economic downturn.

The COVID-19 pandemic has been a serious drag on economic performance in the U.S., which has about 25 percent of the world's confirmed cases despite making up only five percent of its population.

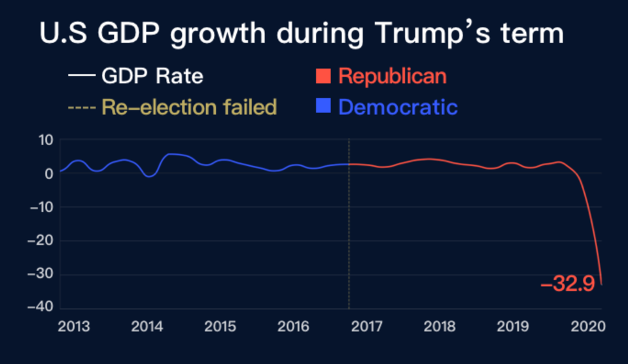

In the first three years of Trump's term, the country's GDP grew – but the pandemic led to the biggest plunge in 70 years, with the economy shrinking by 32.9 percent in the second quarter.

A look back at previous cycles shows that most re-election bids have failed when GDP growth was weak, let alone negative.

Among all the switches from party to party over the past 40 years, half were accompanied by a struggling economy and growing unemployment rates.

Pollsters often ask the question, "are you better off now than you were four years ago?"

When a downturn strikes, many voters will answer "no." Recessions mean pain and struggle, with job losses for individuals and lower revenues for businesses.

In the three years after Trump took office the unemployment rate steadily decreased, but the pandemic pushed joblessness to 14.7 percent in April.

The job market showed a weak improvement in August, with the unemployment rate dropping to 8.4 percent.

However with the pandemic persistence and the support from the federal government running out, the job market recovery is losing speed.

Nonfarm payrolls increased by 1.37 million in August, the lowest increase since May, and nearly a fifth of the gains were from the government's temporary hiring for the 2020 Census.

Around 13 million people who had a job before the pandemic are now unemployed, and any new spikes of coronavirus cases threaten more job losses.

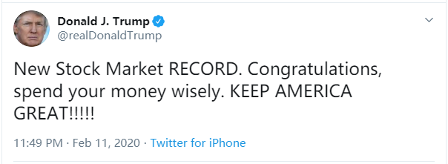

Another key data point is the performance of the stock market, which is a factor in the election because it is linked to many U.S. citizens' wealth or retirement plans.

Trump has often taken the stock market's positive performance as a personal achievement.

Except for a short plunge in March, the U.S. markets have largely stayed strong in 2020. The economy shrank this year, but the S&P still stands above 3,000 points.

This has led to questions about possible market bubbles: Why have the markets remained buoyant even as the economy collapsed?

It's not unreasonable, and there have been recent signs of a correction. U.S. stocks closed low in the first week of September, bringing an end to the year's advances.

The S&P 500 tech sector fell more than four percent for the week.

The Dow plunged 1,862 points, or 6.9 percent, on September 2 in the biggest selloff since March 16. The Nasdaq tumbled 5.3 percent and fell back below the 10,000 level.

Analysts believe that stocks are still supported by a combination of Fed liquidity and the reopening of the economy, but with students returning to school and pandemic fatigue setting in, risks of rising COVID-19 cases could cast another shadow over the markets.

With the economy reshaped by the unexpected pandemic, can Trump stay in the White House for another four years?

Or, will Americans give Biden a shot at saving the nation from this socio-economic crisis?

The world is watching.