04:12

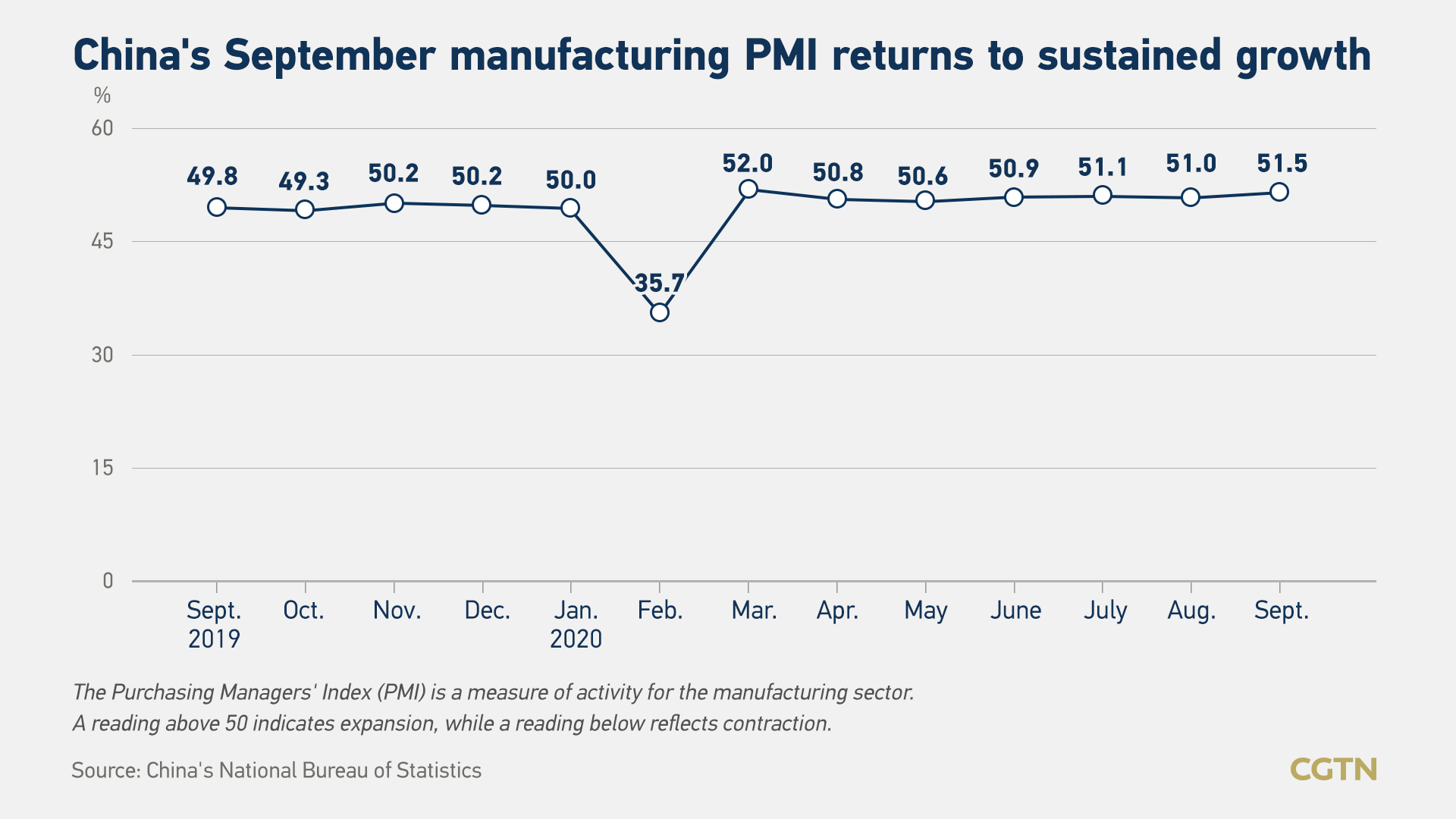

China's manufacturing purchasing managers' index (PMI) increased to 51.5 in September from 51.0 in August, with the new export orders sub-index rising above the 50.0-mark for the first time since the COVID-19 outbreak, official data from the National Bureau of Statistics (NBS) showed on Wednesday.

The number met the expectation by Bloomberg and beat the Reuters forecast of 51.2. A reading above 50 indicates an expansion in activity on a monthly basis.

Manufacturing boom expands than last month

Thanks to a series of foreign trade measures and the partial recovery of international market demand, manufacturing imports and exports have further improved, with September's new export order index and import index rising above the boom-bust line of 50 for the first time this year, Zhao Qinghe, a senior statistician with the bureau, explained in a statement.

However, he warned that because the pandemic has not yet been fully controlled, there are still uncertain factors regarding imports and exports.

In addition, with the National Day and Mid-Autumn Festival holiday approaching, the new order index of the consumer goods industry was 53.7 percent, 2.9 percentage points higher than last month, indicating an accelerated growth of product orders of enterprises.

Meanwhile, with the continued recovery of supply and demand and the advent of the traditional production peak season, companies have increased their willingness to purchase, Zhao mentioned.

From the perspective of the industry, the production index and new order index of food and beverages, general equipment, special equipment, computer communication and electronic equipment, are all above 55.0 percent, higher than the previous month, he noted.

Services sector helps improve non-manufacturing PMI

The non-manufacturing PMI rose to 55.9 in September from 55.2 in August, according to NBS, beating expectations by Bloomberg at 54.9.

Nomura analysts in a note attributed the improvement in the non-manufacturing PMI to a gradual recovery in the services sector "due mainly to further relaxations of social distancing rules as the most recent cluster of COVID-19 appears to have been well contained".

Growth in China's services sector accelerated in September as the business activity index was 55.2 percent, 0.9 percentage points higher than the previous month and rising for two consecutive months, Zhao said.

He further explained that in terms of market demand and expectations, the new order index and business activity expectation index were 53.5 percent and 62.2 percent, respectively, 2.0 and 0.9 percentage points higher than last month, respectively, indicating that the service industry market demand is picking up and business confidence is further strengthened.

Zhao reminded that although overall manufacturing demand has improved, the recovery is uneven. The survey results showed that more than half of companies in such fields as textiles, clothing and wood processing reflected insufficient market demand.

Nomura also noted that "the employment sub-index remained in sub-50 contractionary territory at 49.6 in September, despite an uptick from 49.4 in August, and has now been in contractionary territory for five consecutive months, suggesting strong labor market headwinds remain."

PMIs forecasted to remain buoyant

Considering "solid exports, pent-up demand from the worst flooding in decades, pent-up demand from COVID-19 and government stimulus measures on consumption", the PMIs are forecasted to remain buoyant over the next couple of months, according to Nomura, further adding that official manufacturing PMI may stay around 51.0 in the near term, while the official non-manufacturing PMI might soften a little as "growth headwinds remain string" amid elevated uncertainties stemming from the pandemic and China-U.S. relations.

Nomura expects Beijing most likely maintain its wait-and-see policy approach through the remainder of this year by neither easing further nor tightening.

Caixin PMI

On Monday, Caixin released its manufacturing PMI for September. Unlike the official PMI, which focuses on large corporations and State-owned enterprises, the Caixin PMI polls mostly small and medium-sized companies. The Caixin manufacturing PMI came in at 53.0 percent in September, down slightly from 53.1 percent in August.

Caixin said output growth eased but remained marked. As overseas markets walk out of the pandemic disruptions, stronger foreign demand boosted export businesses. However, employment seems to lag behind along the recovery path.

A sub-index measuring employment climbed into expansionary territory for the first time this year in September but came in just a hair above 50 percent.

Professor John Gong from the University of International Business and Economics said unsatisfactory employment could have something to do with "structural change" such as "rapid development of the digital economy" and "adoption of robotics."

He said in the long run, empirical experiences tell that new technologies will always create new jobs.

(Zhu Feng contributed to this story)