Editor's note: CGTN's First Voice provides instant commentary on breaking stories. The daily column clarifies emerging issues and better defines the news agenda, offering a Chinese perspective on the latest global events.

Ant Group's initial public offering in Shanghai and Hong Kong has been suspended at the last minute. Regulators cited "major issues" in halting the offering that was supposed to be the world's largest. The major issues that Ant reported on the changes in financial technology regulatory environment may result in the company "not meeting the conditions for listing or meeting the information disclosure requirements," Shanghai Stock Exchange (SSE) said in its statement released on Tuesday.

The decision comes after Ant's co-founder Jack Ma was summoned by China's central bank and other three top financial regulators. The State Administration of Foreign Exchange and the China Securities Regulatory Commission (CSRC) were also at the meeting that is seen as a regulatory warning to Ant.

The suspension is law-based and a responsible move for investors. To begin with, according to science and technology innovation board regulations, the SSE has the responsibility to report any major issue to the CSRS, and the CSRS is obliged to handle it in time before Ant's trading debut. If major issues could affect the potential issuers' eligibility for IPO and conditions for meeting information disclosure requirements, regulators have the responsibility to review their previous decision and make adjustments according to the latest situation. Ant has the obligation to report any significant issues to regulators as well.

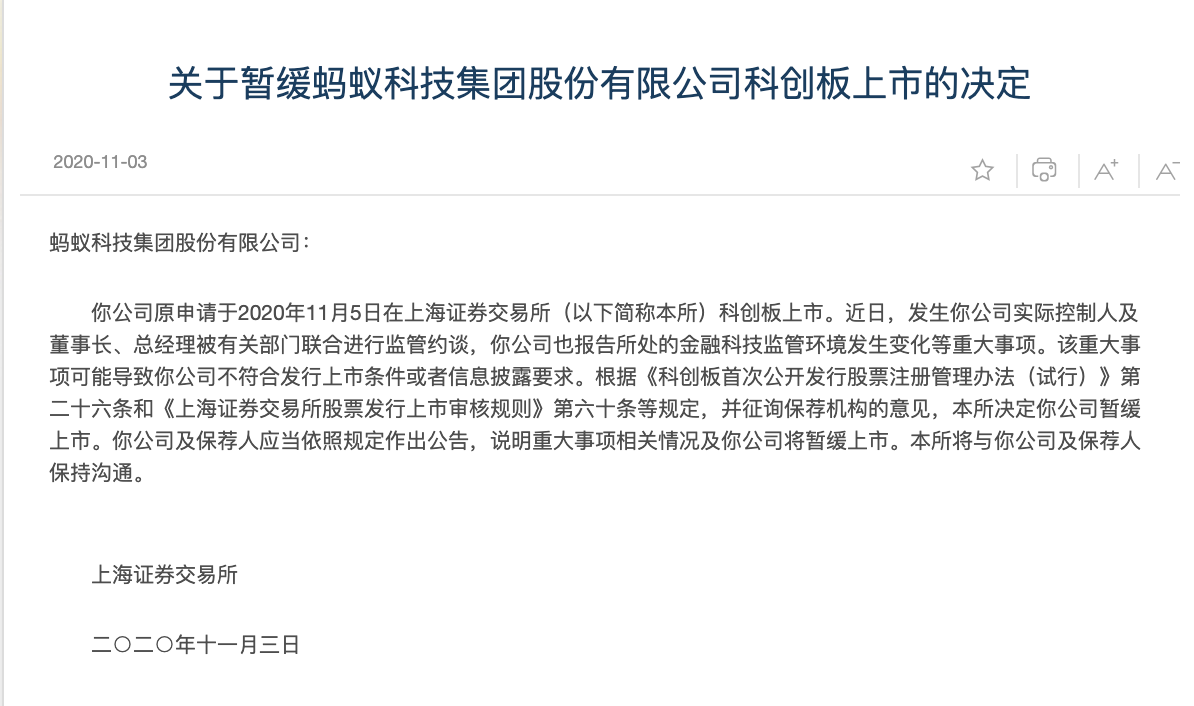

Screenshot of Shanghai Stock Exchange's announcement.

Screenshot of Shanghai Stock Exchange's announcement.

"The SSE's decision to halt Ant's IPO is fulfilling its regulatory responsibilities. The move is law-abiding and responsible," said Zhang Zixue, a professor at Civil Commercial and Economic Law School, China University of Political Science and Law. China's mechanism arrangements in science and technology innovation board grant regulators the right and obligation to adjust their previous IPO decision based on the latest major issues.

The move is also an attempt to safeguard financial stability and the interests of investors. If regulators take no action on the major issues, this would mean additional investment risks. Once Ant adjusts its business models on the basis of the changes in financial technology regulatory environment, the company is highly likely to see huge fluctuations in its valuation and its stock prices. This will not only strike a blow to the interests of investors, but also exert some negative impacts on the stability of the financial market. Ant's sustainable growth has also been put in jeopardy in this process.

"For Ant, the IPO suspension is more beneficial than hastily going public," Liu Junhai, a professor at Renmin University of China, was quoted by yicai.com as saying. Regulatory risks would be tremendously reduced after the suspension. This will help enhance Ant's transparency and credibility, and will also boost investors' confidence in the company in the long run if it makes its stock market debut someday in the future.

In addition, Liu noted that Ant's IPO was suspended, not canceled. This means regulators are still in close communications with the company on the matter. There is still a possibility that regulators will lift the block on Ant's IPO listing after major issues are solved.

The halt doesn't ask for all the hype. It can never be equated to China's toughened measures on private enterprises or a slap on Jack Ma. The decision was made on a solid basis. It showcases Chinese regulators' responsibilities for investors, companies, and the overall financial market.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)