When Ant Group's dual listing in both Shanghai and Hong Kong hit the pause button, the world's biggest IPO in history by a wide margin met its Waterloo in a real sense.

Over the past decade, Ant has changed the way Chinese people interact with money. The company's Alipay app has served as an indispensable payment tool for some 730 million monthly active users nationwide and a platform for obtaining microloans and purchasing insurance and investment products. All these speak volumes for Ant's consequential role in the world's second-largest economy.

Fledgling Ant

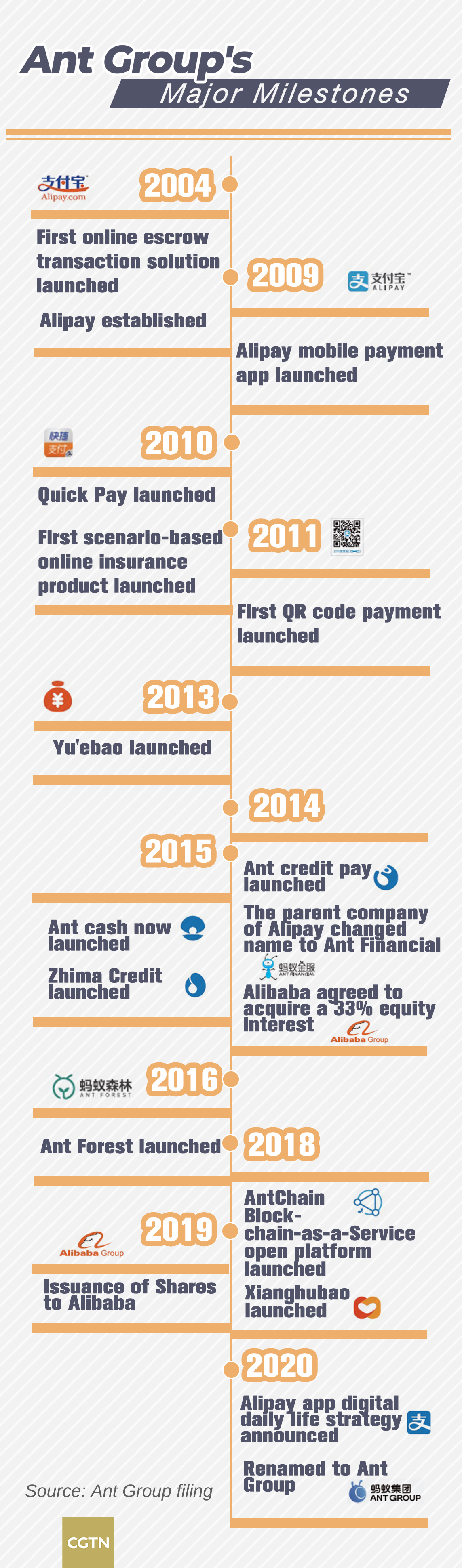

Previously known as Ant Financial, the Hangzhou-based company started out as a fintech arm established by Alibaba Group in 2004 and has operated as an online payments processor called Alipay since then. Alibaba worked in tandem with ICBC, China's biggest commercial bank, to develop this platform in order to facilitate online shopping on Jack Ma's e-commerce platform Taobao.

Alipay is China's equivalent to PayPal to guarantee the security of online transactions. The buyer sends the remittances to the Alipay account, and Alipay informs the seller for shipment. When the buyer receives the product and confirms the delivery, Alipay will remit the payment to the seller at once. The mode works well in China. Alipay overtook PayPal as the world's largest mobile payment platform in 2013.

But regulators did not put Alipay on the supervision list of banks in that they hammered away at bolstering competition and innovation in the industry. Aside from this, it is a far cry from traditional banks long been criticized for their high threshold for issuing loans, lack of investment options, and low efficacy in providing banking services.

A noteworthy event etched in Ant's growth trajectory is Yu'e Bao, the money market fund distributed on the company's payment network. It is managed by Tianhong Asset Management, which is 51 percent controlled by the then Ant Group.

It was originally set up in 2013 by the e-commerce giant Alibaba to help users of its online payment platform Alipay invest with their idle cash. Its innovative technology also allows online shoppers to pay directly by cashing out funds.

Right following the tail of the Chinese New Year in 2014, Yu'e Bao, which had been established for nine months, proclaimed that it had raised some 500 billion yuan, which put Tianhong Asset Management on the map in the turn of a hand.

However, the emergence of Yu'e Bao made the bankers a little bit embarrassed in that 90 percent of its funds were agreement deposits lying in bank accounts, but a great many depositors had begun to move away from banks and settled on Yu'e Bao as their savings' shelter due to relatively high profitability, liquidity, and convenience.

This means that banks need to cooperate with Alibaba on the one hand and launch similar products to fight against it on the other. How to supervise Alipay and Ant Financial had become a hot topic in the financial world.

Lending empire

In the meantime, Ant employed the asset-based securities (ABS) to fund quick consumer loans, or rather, based on the assets owned by Huabei and Bibai, funds were raised through the issuance of bonds in the capital market with the expected returns as a guarantee.

It soon erected an empire connecting the second-largest economy's borrowers and lenders via offering short-term loans credited within minutes. It has resorted to artificial intelligence and all sorts of high-end techniques to propel a variety of services, from payments and loans to insurance and wealth management.

Wind data showed that in 2017, the ABS issued by the two microloan companies reached to the tune of 269.2 billion yuan, compared with 49 billion yuan from the preceding year. The enlarged credit scale laid the foundation for further profit potential.

After unrelenting efforts and fund injection made into offline payment, transportation, and other fields in real earnest, Ant's user growth and activity were saliently improved, and its open platform strategy began to take effect.

According to the prospectus, the behemoth's mobile payment app Alipay boasted 731 million monthly active users as of end-September this year, with transaction volume to the tune of 118 trillion yuan during the 12 months through to the same month.

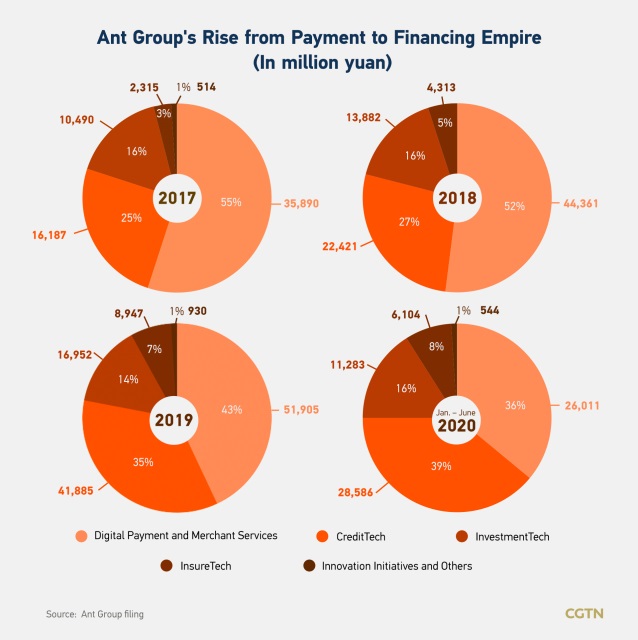

The bulk of Ant Group's revenue is contributed by its "Credittech" business operating an array of loan services targeting individuals and merchants, with the former in particular. Credittech revenue surged 59.5 percent from the year-earlier period in the six months ending June this year to 28.6 billion yuan, occupying 39.4 percent of its total revenue in the interim.

Credittech's products comprise Huabei, a virtual consumer credit card service, Jiebei, an online cash loan targeting individuals, and Mybank, an online lender serving small and medium-sized businesses (SMB). The lending empire said in a statement that the consumer credit balance of its loan businesses stood at 1.7 trillion yuan, and the SMB credit balance settled on 400 billion yuan as of end-June.

Unlike traditional banks, when Ant is engaged in the banking business, it is almost free from regulatory restrictions in areas such as loan-to-deposit ratio, capital adequacy ratio, and non-performing loan ratio. "If there is no opportune threshold, its lending activities may accumulate higher risks to the financial system, not to mention its financial derivatives with a leverage ratio of tens or even 100 times," industry insiders noted.

What's even more alarming is that the average annual interest rate of these consumer loans is about 15 percent, which is a step away from the 15.4 percent bottom line of the highest annual interest rate for private loans stipulated by the Chinese regulators.

Put finance under regulation

Chinese authorities may have realized that an unregulated fintech sector growing exponentially at the expense of the incumbents could have provoked a domestic financial market relying on a state-owned banking system that employs a large portion of the country's population, which is unquestionably detrimental to the real economy.

Vice Finance Minister Zou Jiayi said at the Bund Summit on October 24 that fintech hasn't changed the nature of finance relying on credit and conducting leverage, and fintech firms must not be allowed to dodge regulation.

On November 2, China's financial regulators conducted a rare joint regulatory talk with Jack Ma and top executives of Ant Group. In the evening that day, the China Banking and Insurance Regulatory Commission and the People's Bank of China went on record as saying they had set about seeking public opinions on the interim measures for supervising online small lending.

Although the measures are not only specifically aimed at Ant, the combo boxing paired with the regulatory talk still spells out in sharp detail that the tycoon's lending business has ushered in the first year of stringent supervision.

In accordance with the draft rules, a microloan lender's balance of financing accumulated via issuing standard credit assets such as bonds and asset-backed securities should by no means exceed four times the size of its net assets.

The balance of online microloans issued to individuals shall not exceed the 300,000 yuan threshold (44,836 US dollars) and must not surpass one-third of the average annual income of the borrowers in the last three years, which points to the fact that individuals with no stable income or proof of income may not get online microloans from these lenders.

It also requires online small lenders to provide at least 30 percent of any loans they fund jointly with banks. This will unquestionably push microloan lenders to cut back on their financial leverage, industry insiders said.

After the Shanghai Stock Exchange announced on Tuesday evening the postponement of Ant Group's listing on the Nasdaq-style STAR Market, the fintech giant announced later on the same day the suspension of its listing in Hong Kong.

This may also mean that the company has to conduct self-adjustment and review from the inside out to let the tech be tech and put finance under supervision.

(Cover: A logo of Ant Group is pictured at the company's headquarters, an affiliate of Alibaba, in Hangzhou, Zhejiang province, China October 29, 2020. /Reuters)

Correction: The story has been updated to reflect the latest figure of Ant Group's monthly active users. The earlier version also mistook the time the company spun out of Alibaba as 2004.