Editor's note: Hannan Hussain is a foreign affairs commentator and author. He is a Fulbright recipient at the University of Maryland, U.S. and a former assistant researcher at the Islamabad Policy Research Institute. The article reflects the author's opinions, and not necessarily the views of CGTN.

A new report released by Ericsson this week takes a deep-dive into 5G global penetration, analytics and subscription forecasts, estimating some 220 million global 5G subscriptions to materialize by year-end. As much as 80 percent of this forecasted 5G penetration rests with China, which is estimated to account for 175 million global 5G subscriptions by the turn of 2020.

"This [the increase in anticipated 5G intake] is mainly due to a faster uptake in China than previously expected, driven by a national strategic focus, intense competition and more affordable 5G smartphones from several vendors," states the biannual Ericsson Mobility Report.

Such strategic foresight is critical to globalizing the footprint of next generation network technologies and accelerating access to 5G coverage well beyond the 'one billion' consumer coverage benchmark in the coming months.

Behind China's demonstrated contributions to an extensive 5G subscription base is its close alignment with all three strategies of market delivery effectiveness. The Ericsson report – having analyzed over 300 leading service providers across 121 countries – counts 'quality-led, offering-led and industry-led' strategies as its three distinct strategies to determine whether service providers have established network impact by leading, challenging or following the market.

Recent evidence has shown that China's leading service providers, in-fact, align with most of these aspects. On quality-led delivery for instance, technology giants have introduced cutting-edge consumer products, and translated ICT infrastructure and smart device successes into economic stimulus across major European countries, despite a pandemic casting uncertainties.

On an "offering-led" approach to interconnected network resilience, Chinese service providers have challenged the existing network market by offering new services. This includes a documented leap on non-standalone (NSA) 5G. Think of the NSA as one of two 5G tracks that network service providers leverage to ensure a workable transition from older generation mobile technology (such as 4G) to the latest.

Ericsson notes that 5G's stand-alone (SA) networks "have now been launched in North America and China." Therefore, this consistent evolution from NSA to SA reaches beyond market confines to enable new "offering-led" advances on next-generation technologies to countries that wish to benefit from this trajectory in the future. More importantly, China stays true to its spirit of internationalizing cooperation on improving 5G global standards, effectively extending these service delivery milestones as regional growth imperatives.

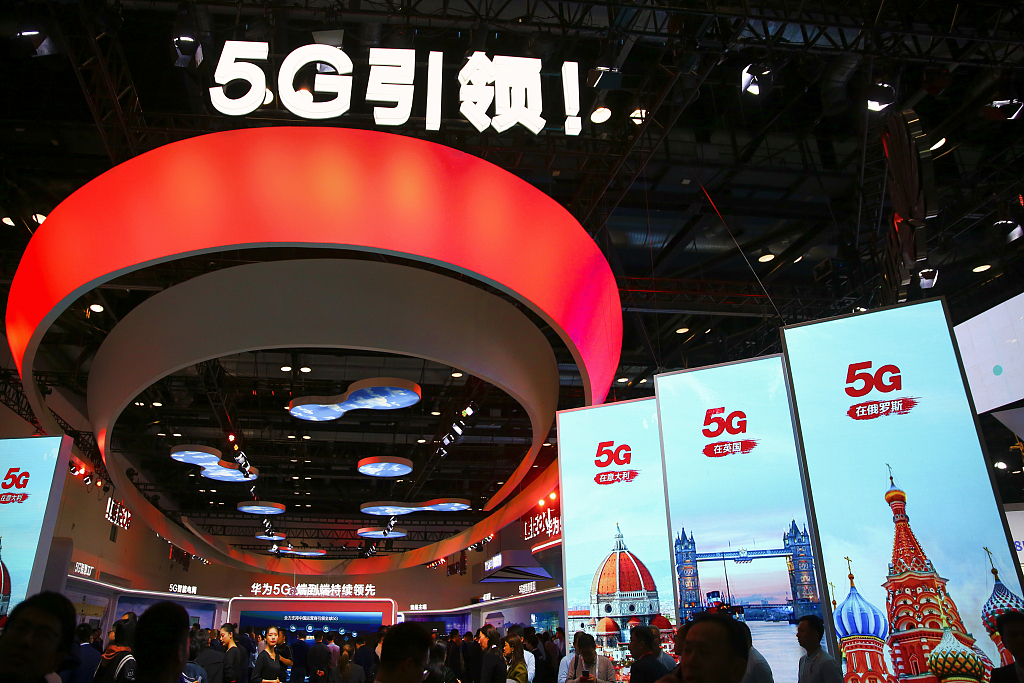

2019 PT Expo China is being held from October 31 to November 3 in China National Convention Center in Beijing, October 31, 2019. /VCG

2019 PT Expo China is being held from October 31 to November 3 in China National Convention Center in Beijing, October 31, 2019. /VCG

Consider the fact that 5G, based on its most recent market forecast, has made regional headway on many levels. It is set to account for "80 percent of North American mobile subscriptions in 2026," and the deployment of 5G commercial services in most of Northeast Asia is a testament to large-scale build-ups in 5G coverage that are pursued in conjunction by Chinese tech giants and their regional partners. Over the next five years, China's 5G subscriptions are also set to clock over a sixfold increase to reach 1.22 billion – an outcome greater than the forecasted aggregate of Latin America, North America and Europe combined.

Interestingly, China is committed to treating its next-generation wireless advances as a building-block of the fourth industrial revolution (Industry 4.0). This belief in global cooperation suggests that the spread of 'quality-led' and 'offering-led' strategies into new regional markets is partly driven by Beijing's multifaceted approach to achieving, maintaining and exporting mutually beneficial technological competitiveness. As McKinsey's China consumer report notes: "Telecom companies in China have maintained their 2020 5G development targets despite the outbreak, suggesting that digital tools for remote work and interactions will likely continue to proliferate rapidly, catalyzed by next-generation communications infrastructure."

Ericsson's third and final category for service providers' market excellence is the "industry-led" strategy. Under this lens, service providers are "followers" instead of leaders in network transformations – seldom or never the first to make inroads into the market. But the point where Chinese providers' approach to broadening national 5G base offers a lesson for several world economies is a simpler one: Chinese providers have deployed new frequency "bands" for scaling 5G coverage within its borders.

This, in turn, signifies vast potential to plug deployment gaps for other countries, which continue to rely on "existing bands" to broaden their 5G coverage. The Ericsson report counts Germany and Spain as two countries that fall within the 'existing' category. Despite marked expansions, both countries could still derive an advantage by studying the factors that propelled China to gain exceptional mileage on estimated global 5G subscription base strength, without having to ever risk its tech-coverage targets in the heat of a pandemic.

Ultimately, the prospect of scaling 5G coverage to 15 percent of the global population by year-end speaks the world's receptivity to high-end digital transformations. The demand for the future, however, is to cultivate locally and globally interconnected operations. The kind of operations that support smart production and scale 5G penetration to 60 percent of the global population by 2026 – exemplified by Chinese service providers' early inroads.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)