Innovation is widely recognized as a central driving force for the current global economy, national prosperity, and entrepreneurial success. Advanced enterprises, leveraging innovative ideas and solutions, enjoy an elevated position in global value chains, harvesting most of the returns from every product and service. By contrast, lagging players are constantly struggling to survive, grasping for market shares, and clinging on slim profit margins. Meanwhile, the competition for innovation has laid bare the idea of too-big-to-fail conventional industries. Regardless of their scale, reputation, and revenue, tech-giants face pressure from emerging unicorns championing alternative solutions or even entirely new growth points. Cases of this are numerous, including the once-booming Wang Laboratories and then-promising Yahoo. The former has been buried by competitors, and the latter is just holding on in marginal markets. Nevertheless, those on top now will soon face their turn against emerging threats in the form of innovation-based small and medium enterprises (SMEs) trending in a new direction of change.

As the world moves toward an innovation-oriented economic pattern, East Asian countries, once exemplifying the economic miracle in industrialization, also find themselves successfully taking the lead in this new direction. China, Japan, and the Republic of Korea's (ROK) innovation output, ranging from semiconductors to smartphones, solar panels to electric vehicles, and artificial intelligence (AI) to robotics, occupies large shares of world production capacity and weighs in with significant power in global supply chains. What is even more noteworthy is the unparalleled vibrancy of the innovation-based SMEs in the three countries, which not only perform impressively on the national and regional scale, but also equally with global competitors, if not better.

It's against this backdrop that this report aims to shed light on the most popular innovation-based SMEs in China, Japan, and the ROK. By spotlighting these SMEs, an ongoing movement in these global innovation hubs can be decoded, in order to better understand what innovations await.

The report begins with the top 10 most popular innovation-based SMEs by constructing a four-level index system and analyzing SMEs' performance in Meltwater's database from October 1st, 2019 to September 30th, 2020. The selected SMEs cover a wide range of front line technological areas, having performed well in commercializing those areas. Covered areas included AI, autonomous vehicles, intelligent healthcare, software as a service (SaaS), smart devices, and more.

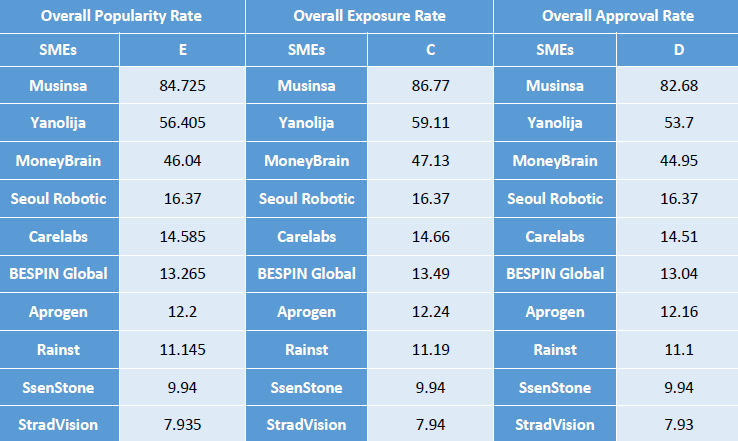

Table 1 SMEs' Overall Popularity Rate Measuring Index System

SME popularity is subject to several equations composed of indexes on four levels, ranging from a meta-index that collects the raw data measuring SME public exposure and information distribution, to compound indexes that process data to depict the overall popularity rates of SMEs ultimately.

1) China

In China, owing to the bigger market size and the venture capital scale, the report only looks at well-recognized SMEs with annual revenue in 2019 below RMB 5 billion, but which were already taking the lead in technological and commercial developments. The report selects 10 most popular Chinese innovative SMEs working on AI, robotics, autonomous vehicles, digital mapping, smart devices, intelligent healthcare, SaaS, and smart education. In addition, the selection of the SMEs also reference companies' contribution to and participation in the ongoing New Infrastructure campaign. The campaign is a large-scale ongoing infrastructure construction policy aimed at leveraging emerging technologies such as AI, internet of things (IoT), and robotics to upgrade existing conventional infrastructure and lay out smart facilities.

2) Japan

The ten most popular Japanese innovation-based SMEs were chosen from those endorsed by Japan External Trade Organization (JETRO), and the country's authoritarian media specialized in the tech market, which yields out a group of well-performing SMEs in the fields of AI, SaaS, Fintech, drone manufacturing, intelligent medicine, industrial robotics, aviation, IoT, mobile payment, autonomous vehicles and others.

3) ROK

In regards to the top 10 ROK innovative SMEs on par with Chinese and Japanese counterparts, the report refers to those unicorns identified by the South Korean Ministry of SMEs and Startups, and DemoDay, a comprehensive database on South Korean enterprises, and ROK's nationally renowned tech media. These identified SMEs distributes in various industries, including AI, Fintech, intelligent healthcare, SaaS, etc. Though Coupang and WeMakePrice, two famous Korean e-commerce brands, perform very well in the past year, the two companies have scaled up enough to elevate themselves out of SMEs' rank.

III. Top 10 Most Popular Chinese Companies

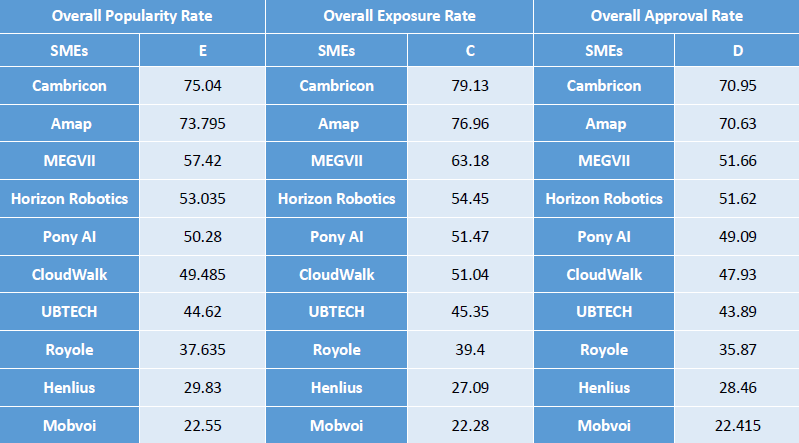

Overall, the top 10 most popular Chinese innovation-based SMEs cover almost all well-recognized tech unicorns, which normally ranks top 5 in their specialized fields. Cambricon (寒武纪) has a popularity rate as high as 75.04. This shining unicorn dedicates itself to providing intelligent cloud servers, intelligent terminals, and core chips for robots' central processing units, occupying a top spot in China's AI industrial landscape. Founded in 2016 by a group of promising scientists, the company was the global pioneer in the mass manufacturing of artificial intelligence chips. Having scaled up quickly, the company emerged as a major competitor in the global AI industry and went public on the Shanghai Stock Exchange's Sci-Tech innovation board. Cambricon's AI industrial competitor, MEGVII (旷视科技), is also popular. With a margin of around 20 points, MEGVII, launched in 2011, is a major AI player, and has already found itself a global leader in IoT for individuals, cities, and supply chains in which they provide customers with full-stack solutions that integrate algorithms, software, and hardware. In between these two competitive AI unicorns is Amap (高德地图), a leading digital mapping service provider in China, and it directly serves people's daily navigation demands with high precision AI navigation and location solutions.

Table 2 Top 10 Most Popular Chinese innovation-based SMEs

In a tie with each other are Horizon Robotics (地平线) and Pony AI (小马智行), two leaders in China's autonomous vehicle industry, rated 53.035 and 50.28, respectively. Both companies have gathered a group of talented experts and industry veterans in AI algorithms and processor architecture, penetrated the autonomous vehicle market with their leading AI technologies for Smart Mobility and IoT applications. Following tightly below is CloudWalk (云从科技), the largest AI solutions supplier in China's financial industry. As its business mainly deals with financial institutions, it might explain why it is a bit behind other top AI players. As the only robotics developer, UBTECH (优必选) is founded in 2012. The company devotes itself to AI and humanoid robotics. Within a few years, it has grown an entire portfolio of robots, including consumer humanoid robots, enterprise service robots, and STEM skill-building robots for kids at home and in the classroom.

The other three companies Royole (柔宇科技), Henlius (复宏汉霖) and Mobvoi (出门问问) grasp leads in a variety of industries such as smart devices, intelligent healthcare and natural language processing. Royole is a major smart device manufacturer. Henlius has emerged in the past few years as a major intelligent healthcare service provider. Mobvoi focuses on advanced voice interaction and hardware-software integration.

As this report tries to balance the SMEs' overall exposure and overall approval, we can see the 10 SMEs sorted by two indexes, Overall Exposure Rate and Overall Approval Rate that make up the Overall Popularity Rate follow the same sequence yielded by Overall Popularity Rate.

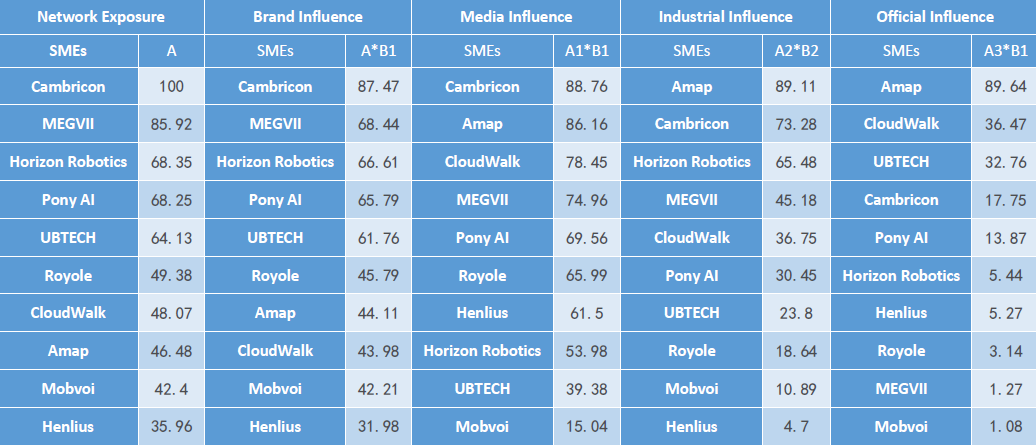

Further breaking the indexes down into second-level indexes, namely Network Exposure, Brand Influences, Media Influences, Industrial Influents and Official Influences, several insights can be drawn. Based on Network Exposure, technologies embedded with a sense of future like AI, autonomous vehicles, and robotics enjoy much more exposure in the networks, enabling Cambricon, MEGVII, Horizon Robotics, and Pony AI and UBTECH to be ordered above others. This outcome is in line with the fact that these technologies championed by these SMEs are hotly discussed online. The Brand Influences share the same sequence with the one yielded by Network Exposure, manifesting a particular synchronization between the advertisers and consumers.

Table 3 Top 10 Most Popular Chinese SMEs Sorted by Second-Level Indexes

As for the Media Influences index, this mainly covers data from conventional news outlets and their WeChat channels, the ranking is a bit different from online exposure, though most of the top seats are still kept by AI unicorns like Cambricon, CloudWalk, and MGEVII. The one that brings a difference in this list is Amap, since it has earned its place for its mature technology and stable daily service.

Looking at the Industrial Influencers based on industrially specialized media including most of the tech-focusing media such as 36kr (36氪), Huxiu (虎嗅), Iyiou (亿欧) and Tmtpost (钛媒体), Amap, Cambricon, and Horizon Robotics are put above others in the list, leaving MEGVII, CloudWalk and Pony AI to catch up. One finding that can be drawn is that the tech media seem to be less interested in intelligent healthcare and natural language processing but shed more light on AI and autonomous vehicles.

As for the Official Influences made up by coverage of official information outlets, SMEs with mature services provided to individuals and institutions are paid more attention. This makes Amap, CloudWalk, and UBTECH stand out, followed by those AI stars and others.

IV. Top 10 Most Popular Japanese Companies

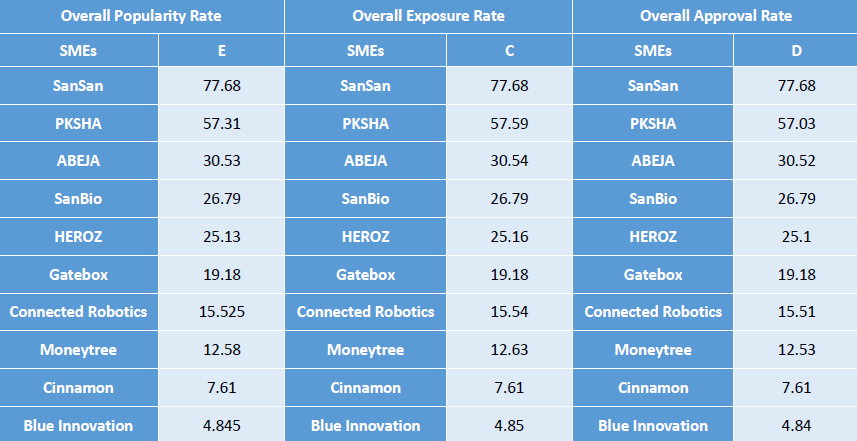

The top 10 most popular Japanese companies also gather almost all leaders of specific front line technological industries. However, unlike their Chinese counterparts, who enjoy relatively equally distributed media attention, Japanese SMEs' popularity pattern yields a huge gap between the two most popular ones and the rest. SanSan and PKSHA, rated 77.68 and 57.31 respectively, enjoy most of media coverage. PKSHA, founded in 2012 and headquartered in Tokyo, engages in the algorithm-based solutions business. It has developed several function-specific algorithm modules for machine learning, depth learning, natural language processing, and image recognition. Its products include PKSHA Vertical Vision, BEDORE, CELLOR and PREDICO. SanSan champions an innovative solution on cloud-based business contact management and emerges as one of the most-funded Japanese tech startups before the initial public offerings (IPO). The two companies also occupy the No.1 place in the Japanese AI and SaaS industries, respectively.

Table 4 Top 10 Most Popular Japanese innovation-based SMEs

Those enjoying moderate popularity (with ratings ranging from 30.54 to 12.63) overtake the middle-level places. These companies, including ABEJA, SanBio, HEROZ, Gatebox, Connected Robotics, and Moneytree, are dedicated to AI, biomedicine, augmented reality (AR), Robotics, and Fintech. Due to their technological solutions, most of these companies are also active players in Japan's AI industries, ranked right after PKSHA. The AI competitors, ABEJA, HEROZ, and Gatebox, are leveraging their AI edges to penetrate into different sectors. ABEJA is a platform that integrates state-of-the-art AI technologies, including IoT, big data, and deep learning. It enables people to utilize various services optimized for each industry, especially for retail, manufacturing, and infrastructure. Its platform supports the entire pipeline of machine learning and deep learning, from development, deployment, and operation. HEROZ, developing its core technologies of machine learning and deep learning through AI development for Japanese Chess, Chess, Backgammon, and Go, applies its technologies beyond the gaming to provide industrial solutions. Gatebox enables the 2D character to be alive in the 3D world, fulfilling ACG-loving young people's demands.

Amid the AI competitors is SanBio, which concentrates on regenerative medicine, a new form of medicine that uses artificially processed and cultured cells or tissues to repair, regenerate, and restore certain tissue or organ functions been lost due to causes such as illness, accidents or aging. The only robotics developer, Connected Robotics, built upon the harsh fact of the country's aging society, develops robots for use in the kitchen to solve the shortage of workers in the Japanese food industry. Below is Japan's major fintech service provider, Moneytree, which began with a personal finance app for individuals but was quickly able to identify a business opportunity and started to offer financial data aggregation tools for consumers, small businesses, and broader financial enterprises.

The remaining two SMEs, Cinnamon and Blue Innovation, rated below ten are working on two interesting issues. The former is dedicated to an AI Document Reader to automate the data extraction from unstructured documents, and the latter is tapping into the potential of drones to enable people, goods, information, and services are free to move in the future sky economic zone.

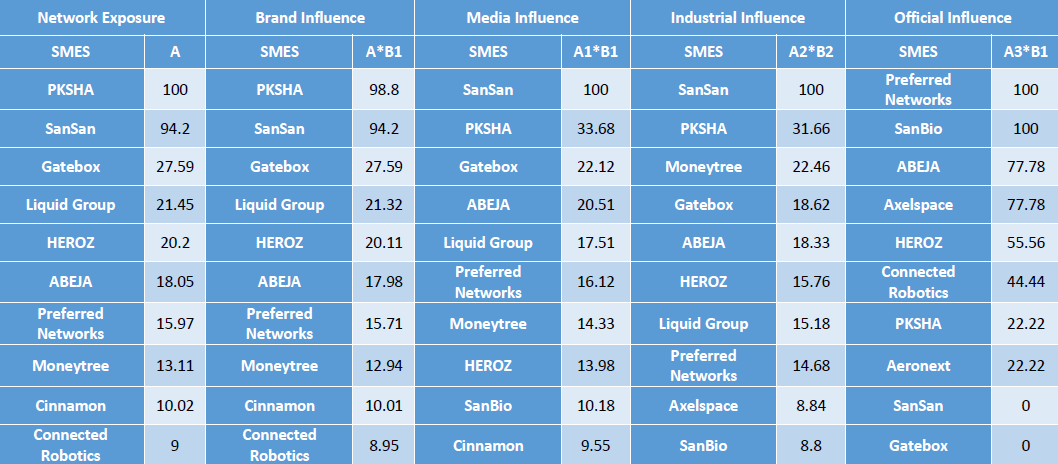

As the Overall Exposure Rate and Overall Approval Rate sort out a sequence that is the same with the Overall Popularity Ranking, the report breaks down further to see Network Exposure, Brand Influences, Media Influences, Industrial Influents, and Official Influences. In short, AI is the most covered area in Japan online as measured by Network Exposure, which enables PKSHA and SanSan to enjoy the most coverage, with 70-point margin between these two as a group and the following Gatebox that is only rated 27.59. The synchronization between advertisers and consumers between the sequences yielded by Brand Influences and Network Exposure can also be found here on Japanese SMEs.

Table 5 Top 10 Most Popular Japanese SMEs Sorted by Second-Level Indexes

As for traditional media exposure measured by Media Influences, the top 3 are the same as those online, but in a different sequence, SanSan, PKSHA, and Gatebox. The reason is probably SanSan, as a representative Japanese company just went public last June. Hence, it has enjoyed relatively more media coverage since then. Gatebox, providing intelligent speakers with holographic projection, attracts attention from SNS terminals and spills over to the conventional media.

Looking at Japan's industrially specialized media, including Gadgetsnews, FabCross, IT Leaders, TechCrunch Japan, etc, Moneytree replaced the place of Gatebox at the ranking of No.3.

In Japan, the official information outlets hold different views from the other three channels, ranking SanBio, ABEJA, and HEROZ, to be the top 3. PKSHA, SanSan, and Gatebox only overtake middle-level places. Japanese official information outlets generally pay less attention to emerging SMEs and are mostly interested in AI and intelligent medicine.

V. Top 10 Most Popular ROK Companies

Among the ROK's top 10 most popular SMEs, there is also a considerable gap between Musinsa, Yanolija, and MoneyBrain, with the rest rated only below 20. Musinsa and Yanolja are featured with consumer services, including fashion magazines, lifestyles, e-commerce, online commercials, travel, and delivery service. The two companies are also ranked top 2 in the specialized internet industry. MoneyBrain taking over the No.1 place in ROK's AI industry, is featured with interactive AI, deep learning, and AI service chatbots.

Table 6 Top 10 Most Popular ROK innovation-based SMEs

Other companies on the above list touch upon a series of advanced technological developments such as intelligent healthcare, SaaS, AI, and Fintech. Seoul Robotics brings the advanced computer vision software for 3D sensors into the robotics, enabling the robotics to see the 3D world and be more intelligent. Both Carelabs and Aprogen are devoted to smart healthcare. The former provides healthcare information technology services, offering clinic information, clinic customer management software, and digital marketing solutions. The latter works on biopharmaceuticals and has accumulated multiple biological drug development technologies. The company championed the first antibody biosimilar in Korea in 2006. Furthermore, the company has expanded its research and development to protein design, high-efficiency cell lines, cell culture optimization, and pharmacological analysis. The latter provides healthcare information technology services, offering clinic information, clinic customer management software, and digital marketing solutions. These two are also the top 2 in ROK's intelligent healthcare industry. Amid the two healthcare SMEs, BESPIN Global takes the lead in ROK's SaaS service, providing terminal-to-terminal solutions and hybrid cloud services.

The other three SMEs are Rainist, SSenStone and StradVision. Rainist provides individual online wealth management platforms. SSenStone has recently expanded to the fintech industry to provide secure payment and authentication services. StradVision claims to democratize self-driving by making the core perception technology approachable, reliable, and viable through their Deep Learning technology.

Breaking down the compound indexes into specific aspects of exposure enables us to closely examine the varied popularity of these ROK's SMEs in different channels. First of all, the ROK's online media sheds much light on those companies working on the internet economy. Hence, Musinsa and Yanolja are the natural winners in this aspect. Musinsa and Yanolja's brand influences are also ranked as high as the top 2. The conventional media favor the internet economy SMEs, and rank Yanolja as the top 1 and Musinsa the second.

Table 7 Top 10 Most Popular ROK SMEs Sorted by Second-Level Indexes

For the industrially specialized media in the ROK that includes the Korea Electric Times, 4irnews, Viva100, etc., the AI-featured MoneyBrain overtakes the top place. However, the 2nd and 3rd are still reserved for Musinsa and Yanolja. This happens to overlap the preference of the official information outlets in the ROK.

VI. Comparison and Conclusion

Comparing the three countries' top 10 most popular innovation-based SMEs, a few findings can be made. While Chinese and Japanese companies are tapping on the potentials of future-oriented technologies like AI, autonomous vehicles, and robotics, ROK SMEs dedicate more attention to harvesting profits from the internet economy, leveraging the technologies to penetrate the consumer markets. However, Chinese AI companies mainly aim at industrial solutions while Japanese ones pay more attention to services. Some Japanese AI companies manifest a great sense of creativity, such as the Gatebox, leveraging the holographic projection to enable the 2D characters to interact with humans in the real 3D world. Sansan, drawing inspirations from traditional but outdated Japanese name-card culture, creates an innovative cloud-based business contacts management system.

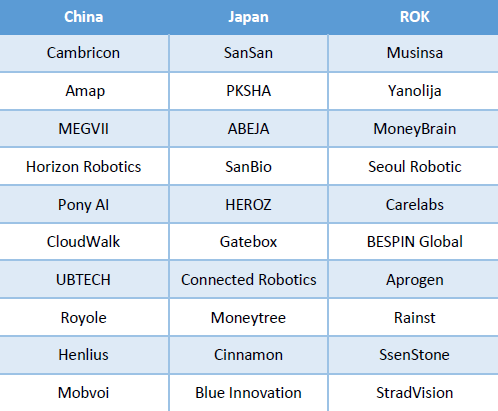

Table 8 Top 10 Most Popular Chinese, Japanese and ROK innovation-based SMEs

That Japanese SMEs' lean towards frontline technological developments also leaves ample space for the internet economy to progress in Japan compared to China and the ROK. Nevertheless, among the top 10 most popular SMEs, all three countries have witnessed the rise of a few fast-growing consumer-tech companies, such as UBTECH and Amap in China, Gatebox and Connected Robotics in Japan, Musinsa and Yanolja in the ROK. The emergence of these SMEs being covered significantly by media manifests a trend that the emerging technologies are embedded gradually into people's daily lives and bring benefits and convenience, which might accordingly raise concerns of digital privacy and cybersecurity.

Breaking down the overall popularity rate into specific media sources, both conventional and online media paid much attention to AI SMEs in China and Japan. Simultaneously, the official information outlets naturally shed more light on more critical and larger-scale technologies. Possessing entirely different preferences, the ROK media across various channels share interests in those several booming internet economy SMEs.

In conclusion, the three countries' innovation landscape of SMEs manifests a certain complementarity in which Chinese SMEs prevail in the core industrial technologies development; Japanese SMEs are championing innovative and applicable ideas for technologies to exert impacts, and ROK SMEs are especially good at penetrating the consumer markets to commercializing the technologies. In this vein, it is recommended to enhance trilateral cooperation among Chinese, Japanese, and ROK's innovation-based SMEs to push forward the digitalization of the three societies in the post-pandemic era and the economic recovery of the region and the world at large.