A motorist rides past the Hangzhou Hikvision Digital Technology Co. logo displayed at the company's headquarters in Hangzhou, east China, May 28, 2019. /Getty

A motorist rides past the Hangzhou Hikvision Digital Technology Co. logo displayed at the company's headquarters in Hangzhou, east China, May 28, 2019. /Getty

Editor's note: Bradley Blankenship is a Prague-based American journalist, political analyst and freelance reporter. The article reflects the author's opinions, and not necessarily the views of CGTN.

On December 10, the S&P Dow Jones Indices removed some Chinese companies from its index products after an executive order from the administration of U.S. President Donald Trump issued in November. They are now the second major index to do so after FTSE Russell. Given China is the second largest economy in the world, and also the fastest growing major economy, barring "U.S. persons" from investing in Chinese companies is simply ridiculous.

The executive order by the Trump administration targets Chinese companies identified by the Department of Defense (DoD) as being connected to the Chinese military. It disallows investment firms, pension funds and others from buying securities from these companies. However, no serious evidence has been provided to designate these companies as "Chinese military companies," and it's clear that it is targeted against highly competitive Chinese companies.

It raises the question of where things go from here. What other Chinese companies will be targeted out of "national security" concerns? The U.S. apparently has no problem breaking the international rules based system to benefit its own companies, so nothing should be assumed to be off the table.

And also, what action could China retaliate with? After all, there is a laundry list of American companies operating in China with open links to the U.S. military, such as Boeing, Caterpillar, General Motors, Ford, Apple, Amazon, Micron Technology, Qualcomm and many more.

It is not likely that the incoming administration of President-elect Joe Biden will reverse course on this matter. Companies tend to follow these executive orders on their own accord before having to wrestle with the federal government, saving a massive headache and possible legal action. By removing these companies already before the order goes into effect, passive investors will be shut out from investing in these companies before active investors ultimately follow.

Politically, Biden has been cornered by this series of provocations by the Trump administration and would appear as a collaborator with China if he were to lift some executive action. The wave of attacks against Chinese companies has been accompanied by a towering public opinion campaign meant to damage China's public image to the American people.

Furthermore, the U.S. Congress, despite how polarized and deadlocked it always is, continues to agree on anti-China legislation. The Democrat-controlled House of Representatives unanimously passed through a law last week to boot Chinese companies off U.S. stock exchanges if they fail to comply with auditing rules in the United States.

The prospects of this course being reversed are slight, but the Biden administration must think carefully. It would only hurt U.S. persons (defined here as any U.S. citizens, permanent resident aliens, any persons in the United States or any entity incorporated in the United States, including foreign branches) looking to make sound investments.

After all, China is the only major economy projected to see GDP growth in 2020 and, accompanying this, Chinese companies are widely recognized as having long-term growth potential. The fact that these companies' delisting in the U.S. caused pretty much no serious disturbance in the Chinese financial market speaks to this.

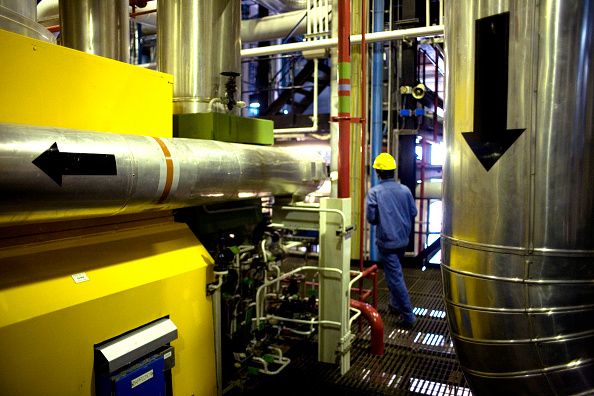

A worker in the main turbine room at the LingAo nuclear power plant in Daya Bay, Guangdong Province, south China. /Getty

A worker in the main turbine room at the LingAo nuclear power plant in Daya Bay, Guangdong Province, south China. /Getty

This course of action also sets a terrible precedent. There is no serious national security risk here and, while the general public might not know that, investors can see that politics is merely getting in the way. Other foreign companies looking to break into the American financial market might think twice before doing so given that if they end up succeeding then the U.S. government will try to take them down.

Former Treasury Secretary Hank Paulson wrote in an op-ed for the Wall Street Journal published on December 9 that U.S. financial leadership "is increasingly being challenged by fierce competition from abroad and by shortsighted and counterproductive policies at home."

The former secretary who was also the head of Goldman Sachs said the administration of Joe Biden must pursue policies that attract foreign capital rather than shoo it away.

Paulson specifically attacked the Trump's administration attack on Chinese companies, saying that the move may help politically, but it will make the U.S. dollar less in-demand for Chinese investors at a time when the U.S. is borrowing heavily to pad its economy during the coronavirus pandemic.

And of course, he wrote, it will make it impossible for U.S. investors to jump on China's growth potential. He noted that Shanghai ranked first among global exchanges for number of IPOs and capital raised through the first three quarters of 2020, showing that America is losing its financial dominance.

Attacking Chinese companies and foreign capital generally is a bad move for the United States. Since the 2008 financial crash, foreign lending to the U.S. has declined, but this year it has fallen off a cliff.

Though the government's inaction on the coronavirus pandemic would have made the U.S. a more unattractive destination for foreign capital, these deliberate actions against Chinese companies will only make the situation worse.

The incoming Biden administration needs to reverse course even if it may not be the politically correct thing to do if the U.S. wants to remain an attractive financial market for foreign investors. If not, the U.S. will surely lose its dominance in the financial sector.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)