Editor's note: Ken Moak taught economic theory, public policy and globalization at the university level for 33 years. He co-authored the book "China's Economic Rise and Its Global Impact" in 2015. The article reflects the author's opinions, and not necessarily the views of CGTN.

China's policies of demand-side reforms aimed at reducing income inequality, expanding the social net and land-use or home ownership reform are poised to sustain the country's long-term economic growth and social stability. These policies are economically and socially desirable from a policy perspective because they do not incur crippling debts while cushioning the population from the faltering economy as traditional stimulus policies do.

The Chinese government's spending to keep businesses and consumers afloat in the COVID-19-induced recession, for example, is expected to raise the debt-to-GDP ratio, which could bring future challenges. The same purpose could be achieved via income redistribution from the rich to the poor, but without necessarily increasing the government's financial burdens.

Government stimulus packages are usually a mixture of expansionary fiscal or monetary policies, with the government incurring debts and the central bank increasing money supply to fund economic recovery. Rising governmental debt limits the effectiveness of fiscal policy because the state ends up with fewer resources to address future economic hiccups.

Increasing the money supply triggers domestic inflation because demand exceeds supply, possibly leading to hoarding or economic distortion. Either way, the effectiveness of fiscal and monetary policies in reversing economic woes is questionable.

Statista, an agency tracking the national debts and other economic indicators of various countries, estimated that China's debt-to-GDP ratio came out to be 61.7 percent in 2020, a significant rise from 2017's 46.36 percent, largely because of increased government spending to cushion falling economic fortunes due to China-U.S. trade war and later the COVID-19 pandemic.

Though small compared to the debt-to-GDP ratio of other major economies, averaging at over 100 percent, the rate of increase raised concerns of possible future financial uncertainty. Further, the 61.7 percent ratio was higher than the Maastricht national debt-to-GDP ratio cap of 60 percent, a "red flag" indicating potential financial danger or burden.

Against this backdrop, the central government's demand-side reforms are a step in the right direction because they could boost economic growth without necessarily requiring massive government spending or quantitative easing. Income redistribution, implying the government is taxing the rich and giving the poor greater consumption power, does not require additional spending, at least not significantly.

Though it does not necessarily apply to China because of the understated rural and migrant workers' incomes, economists usually apply the Gini coefficient to measure income inequality. The coefficient's value ranges from 0 to 1, with 1 being absolute income inequality and 0 being absolute equality.

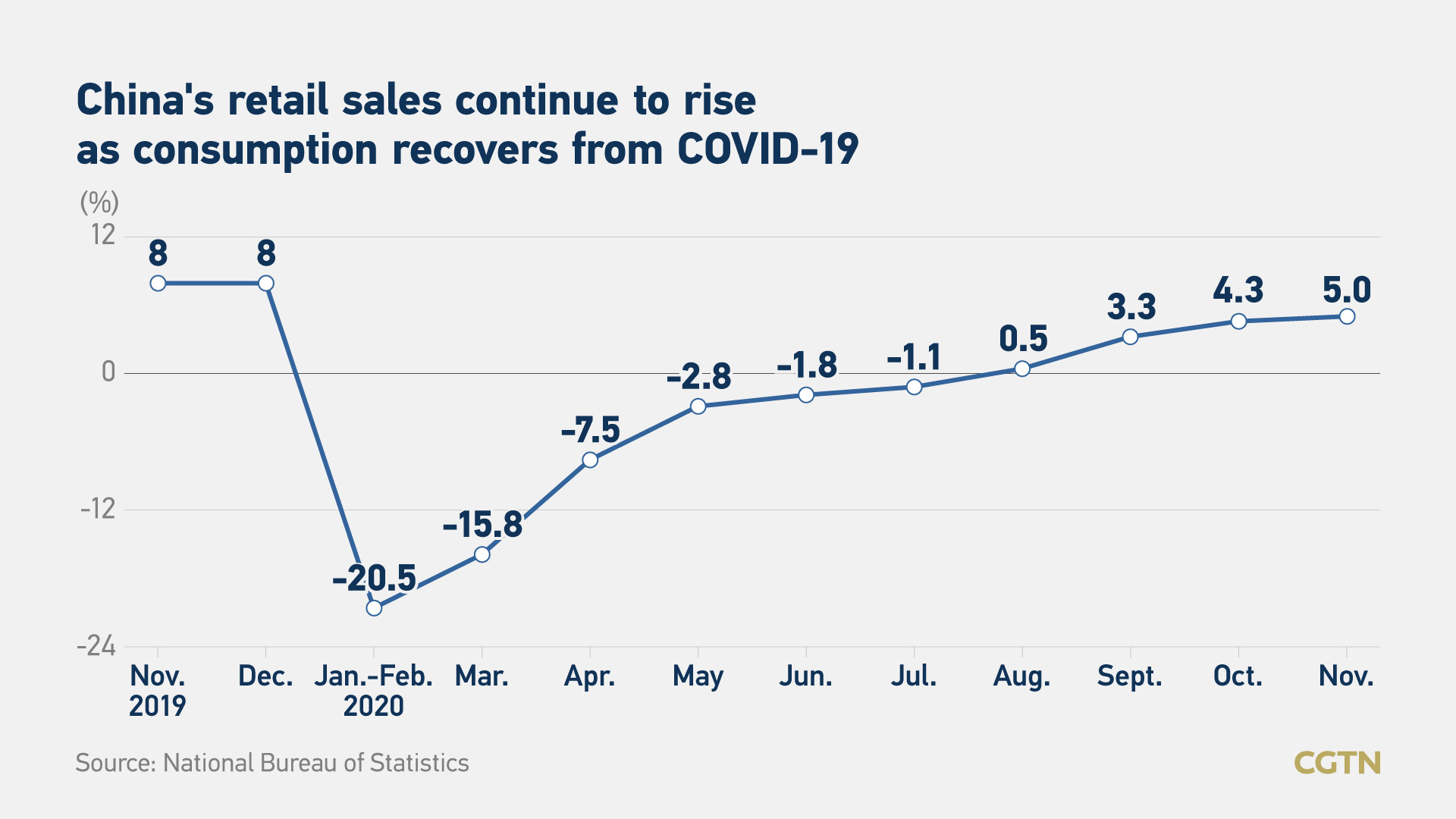

Graphic by CGTN's Chen Yuyang

Graphic by CGTN's Chen Yuyang

According to Statista, China's Gini coefficient was estimated to be 0.46 in 2019, down from 0.49 in 2009, but still well above the United Nation's "danger" figure of 0.40.

To that end, fairer income redistribution would improve China's long-term economic prospects. Expanding the consumer base of the country's 1.4 billion people would increase aggregate demand, improving GDP growth and stability for years to come. The size of the market could attract additional domestic and foreign investments, explaining why China's foreign direct investment increased in 2019.

With regard to land-use and ownership reforms, the government's policy of discouraging speculation could stabilize or even lower housing prices, making home prices more affordable to domestic buyers.

For example, the Canadian province of British Columbia imposed speculative and vacancy taxes on unoccupied homes a couple of years ago to prevent buyers (mostly rich foreign nationals) from speculation and bidding up prices. Since then, foreign buyers, particularly those buying multiple units, were largely absent, resulting in lower home prices.

Furthermore, home ownership reform actually complements the "dual circulation" strategy because one of its policy was to boost income through urbanization. Massive housing construction and infrastructures across the country would create significant multiplier effects, attracting new or additional investment in household goods production and other tertiary industries.

Since urbanization is moving people from farms to cities, rural-city income disparity would be narrowed, thereby reducing income inequality. In addition, government debts incurred in building the new cities and infrastructures would likely be offset by house sales and increase tax revenues from economic growth.

The widening of the social net means more public goods and services are available free or at affordable prices to the population. For example, providing adequate and affordable education and healthcare services promote economic growth. Education improves the quality of the labor force, making workers more productive. Not having to pay costly healthcare services would allow consumers to buy other goods and services, thereby improving economic prospects.

Introducing demand-side reforms could enhance and sustain China's long-term economic and social stability without necessarily incurring crippling government debts. Indeed, the reforms would complement the government's "dual circulation" strategy of assigning domestic demand to drive economic growth.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)