An employee wearing a face mask works at a SMC factory following the outbreak of COVID-19, in Beijing, China, May 13, 2020. /Reuters

An employee wearing a face mask works at a SMC factory following the outbreak of COVID-19, in Beijing, China, May 13, 2020. /Reuters

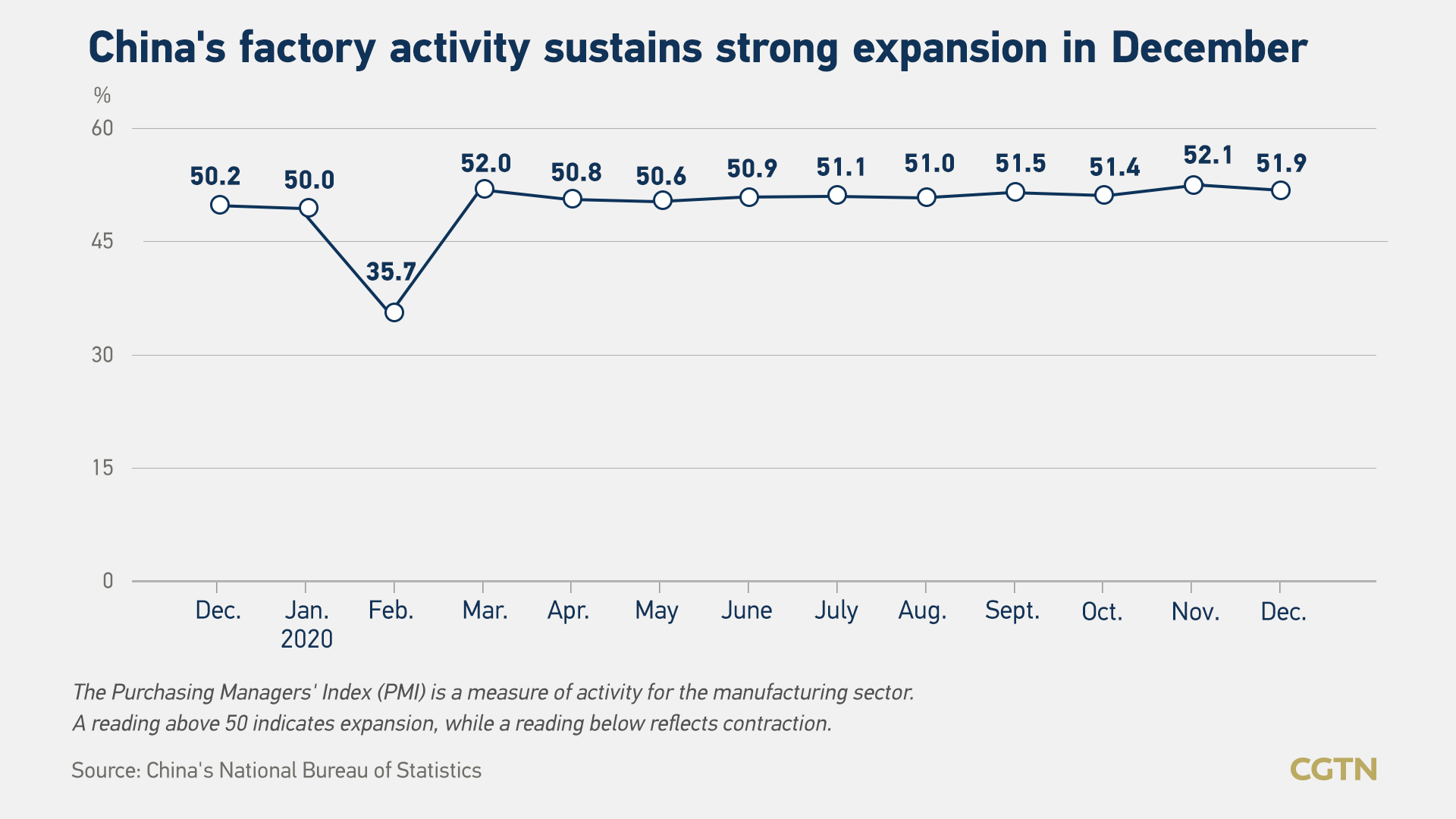

The purchasing managers' index (PMI) for China's manufacturing sector edged down to 51.9 in December from 52.1 recorded last month, the National Bureau of Statistics (NBS) said Thursday.

The index serves as a key gauge of China's manufacturing activity. A reading above 50 indicates expansion, while a reading below reflects contraction.

Although the reading is slightly dim as compared to the preceding month, it has been operating in the expansionary territory for 10 months in a row and basically matches the 52.0 median forecast of 27 economists polled by Reuters.

The country's industrial sector has staged a star-spangled recovery from COVID-19 thanks to the surprisingly strong exports and targeted, timely measures.

The sub-index of new orders inched down by 0.3 percentage points from a month earlier, yet it was still above the benchmark level in that the market demand continues to pick up.

On the other hand, the sub-index for production dropped by 0.5 percentage points to settle at 54.2 in December, pointing to slackened growth in manufacturing sector.

Improvements were seen in both the supply and demand sides. Among the 21 industries surveyed, the number of sectors holding production and new orders in the expansion range came in at 18 and 17, respectively, said Zhao Qinghe, senior statistician at the NBS.

Profits at China's major industrial firms ticked up in November for a seventh month of gains to reach 729.3 billion yuan ($112 billion), backed by strong industrial production and sales.

"In December, China's economy kept up the momentum of expansion, albeit slowed in pace. The main difficulty was faced by small firms, of which employment, new orders and production all continued to contract, due to issues in financing and relatively weak recovery in consumption," Wang Dan, chief economist of Hang Seng Bank China, told CGTN.

"PMI's price index, a leading indicator for PPI (producer price index), surged to the highest point in the year, driven by strong demand for raw materials, in particular coal and metals. We expect raw materials inflation to stay high throughout at least the first half of 2021 as construction activities pick up pace."

"New orders for large and mid-sized firms have expanded strongly, bolstered by export demand. The economic recovery in the U.S. and Europe will drive new orders to rise in the coming month as the new vaccinations have raised consumer confidence," said Wang.

AFP's survey anchored China's full-year growth for 2020 at roughly 2.3 percent, slightly above the IMF's revised prediction of 1.9 percent – a trough in over three decades but still much stronger than the rest of the major economies struggling to rein in COVID-19 infections.

The non-manufacturing PMI, which measures sentiment in the services and construction sectors, came in at 55.7 in December to extend the steady snapback momentum.

A breakdown of the data showed the service sector in December slightly tumbled as the sub-index tracking business activities narrowed to 54.8 from 55.7 in the previous month. Albeit at a somewhat slower clip, service activity expanded for the 10th straight month.

The construction industry continued its robust growth as the sub-index for business activities stood at 60.7, up from 60.5 in November.

The business activity indexes tracking industries of air transportation, capital market service as well as money and finance services all operated with relatively high ranges above 60.0 percent in the interim.