An aerial drone view of ships berthed at the Port of Oakland in California, U.S., June 15, 2020. /CFP

An aerial drone view of ships berthed at the Port of Oakland in California, U.S., June 15, 2020. /CFP

Editor's note: Shen Jianguang is vice president of JD.com and chief economist of JD Technology. The article reflects the author's opinions, and not necessarily the views of CGTN.

As COVID-19 unfolded, U.S. import prices of manufactured goods from most of its trade partners rose significantly. In January, import prices from neighboring Canada went up by as much as 9.3 percent year on year. Yet import prices from China remained flat throughout despite the dollar's depreciation against the renminbi. As the United States' top source of imports in 2020, China helped tame U.S. inflation at a time when the pandemic caused remarkable supply-demand imbalances.

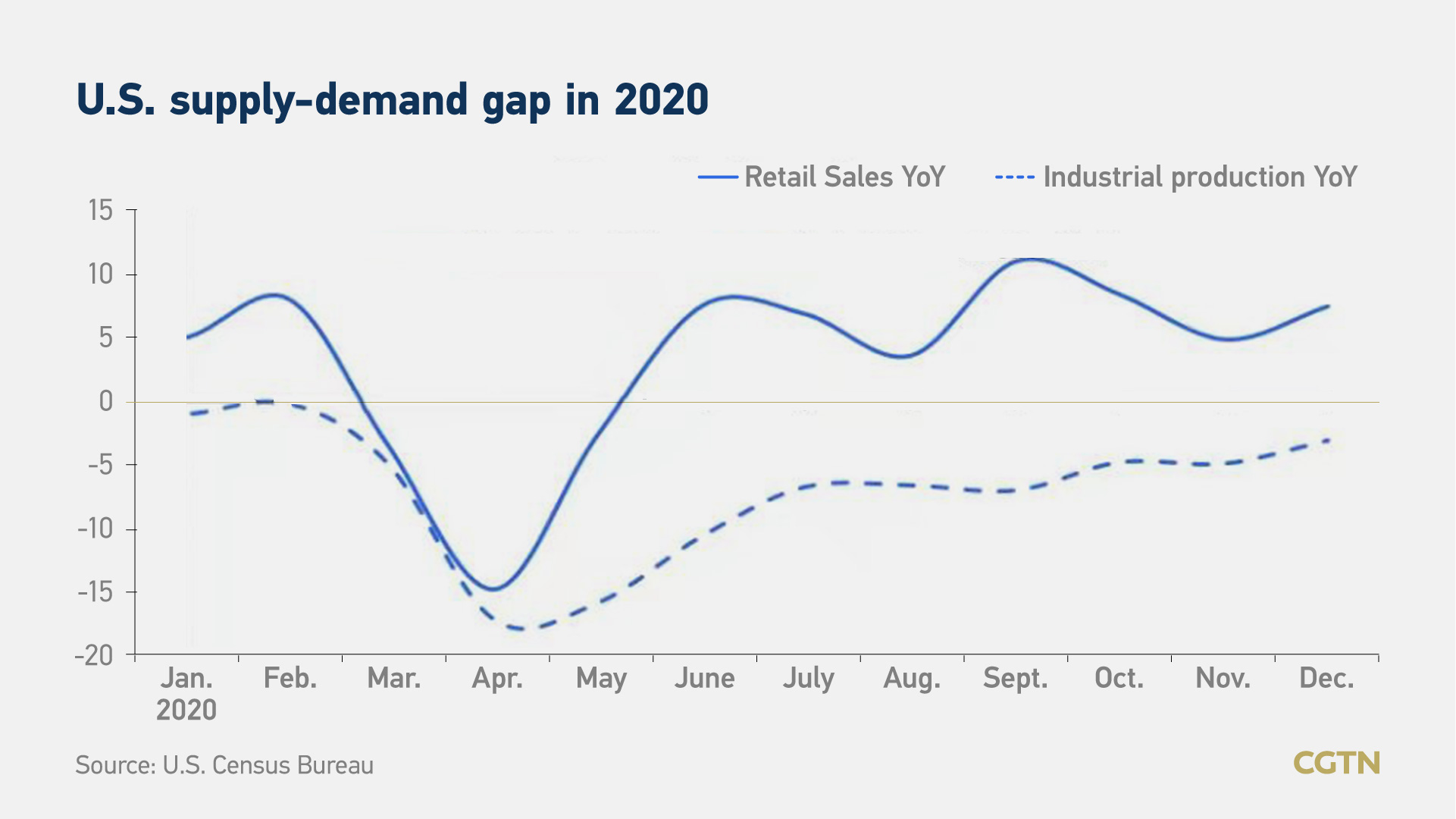

In the wake of the COVID-19 outbreak last March, the United States promptly introduced unprecedented fiscal and monetary stimulus – including direct cash transfers – to support demand. Retail sales were back to positive growth by June. But ineffective public health responses put a dent on production recovery, creating a large output gap.

That gap was partly filled by China. The country was the earliest to emerge from COVID-19 and regain productive capacity, exporting everything from protective equipment, ventilators and computers to furniture, home appliance and other consumer goods. China's export to the United States was up by 8.2 percent in 2020, having grown at more than 20 percent year on year in every single month since last August. In November, the rise was close to 50 percent.

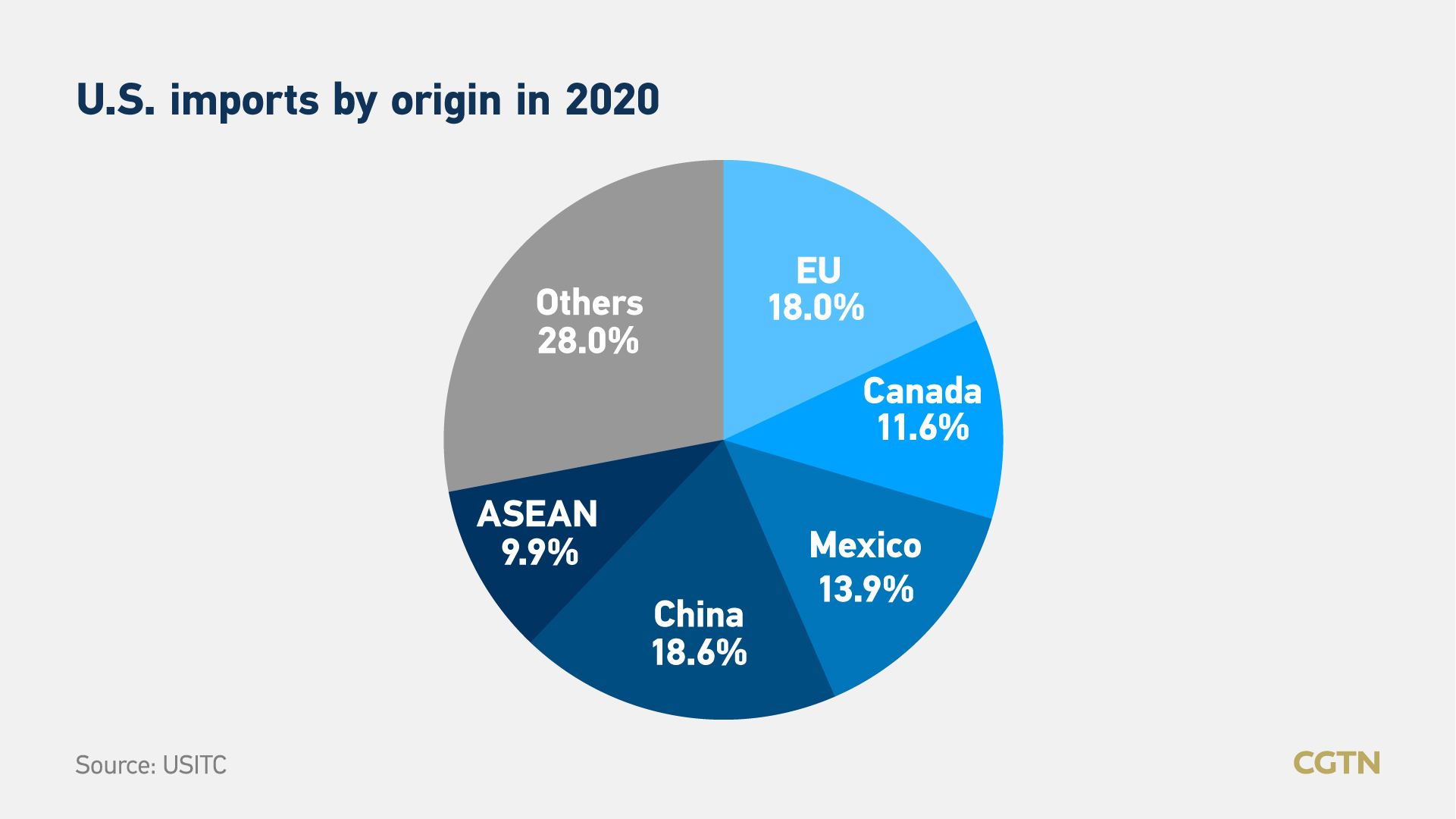

All this built on China's already immense and resilient supply capacity, which allowed it to increase its market share in international trade. In 2020, China retook the status as America's largest trading partner, accounting for 18.6 percent of U.S. imports, overtaking the European Union and leading Canada, Mexico and Association of Southeast Asian Nations (ASEAN) by far. This is also an example of how the United States became more dependent on trade with China despite punitive tariffs on Chinese exports.

Inflation expectations are simmering in the United States. Demand is propped up by two factors. The first includes improvements on the public health front, notably a dip in daily infections and speeding vaccination. With 600 million doses of vaccines ordered, the United States is expected to immunize all its population by summer. This will prove a big lift to the country's service spending – which bore the brunt of COVID-19 in 2020 – and cause service prices to rise.

On the other hand, following the two rounds of large stimulus money last year under Donald Trump, President Biden now looks determined to push ahead with his spending package worth $1.9 trillion. As part of the new stimulus plan, the proposed $1,400 in direct cash transfer to eligible U.S. residents and expanded unemployment insurance could help boost the already elevated household savings and unleash more purchasing power.

According to an estimate from the Congressional Budget Office, actual economic output in the United States is $650 billion lower than its potential output, one third of Biden's spending plan. This means the new stimulus will more than offset the U.S. output gap, adding to inflationary pressure.

On the supply side, a rebound in headline job data blinds us from the worrying signs of rising permanent unemployment and falling labor participation, something that could dampen production. Even with a potential increase in capital investments, their contribution to capacity expansion will take years to crystallize.

In addition, the U.S. monetary authority has become more tolerant of inflation. In 2020, the Federal Reserve introduced an average inflation target of 2 percent, in which it would not tighten monetary policy immediately when inflation exceeded 2 percent. During a House hearing on February 24, Fed Chairman Jerome Powell said it might take more than three years to achieve the 2 percent inflation target.

As a result, anticipations of a post-pandemic recovery have turned into concerns of overheating and inflation. In a series of debates with Treasury Secretary Janet Yellen, former Treasury Secretary under Bill Clinton Larry Summers warned that "inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability." As of February 26, expected inflation as implied by the Treasury inflation-protected securities reached 2.39 percent, a level that almost paralleled the post-2008 peak. Recent equity and bond selloffs, and a rally across commodities, were also a reflection of widespread anxiety over inflation. All these underscore China's crucial stabilizing role in taming U.S. prices; absent the China buffer, the inflation pressure in the United States would only be more pronounced.

(Graphics by CGTN's Chen Yuyang)