Editor's note: Alexander Ayertey Odonkor is an economic consultant, chartered financial analyst and chartered economist with a focus on the economic landscape of countries in Asia and Africa. The article reflects the author's opinions, and not necessarily the views of CGTN.

In all regions of the world, traditional financial institutions are experiencing a rapid transformation in their modus operandi. The change has altered the nature and delivery of financial services. This disruption is largely attributed to the fact that financial institutions adopt information and communication technology (ICT) and innovative business models to meet consumer demand.

Although financial technology (FinTech) has a significant presence in the United States, UK and other developed economies; the market size and the rate of development of China's fintech ecosystems is unmatched. Advancements in financial technology by fintech hubs in Beijing, Hangzhou, Shenzhen and Shanghai have been pivotal in propelling China to such an unprecedented level.

Highlights from Ernst & Young's Global Fintech Adoption Index for 2019 indicate that China has an impressive rate of fintech adoption. The findings of the survey, which interviewed more than 27,000 consumers in 27 markets, reveal that China's fintech adoption rate of 87 percent is the highest in the world; this far exceeds the global average of 64 percent.

China's superiority in fintech adoption is unrivaled even among developed countries, where the Netherlands has the highest fintech adoption rate of 73 percent; the UK, Germany, United States and Japan have rates of 71 percent, 64 percent, 46 percent, and 34 percent, respectively.

Again the rate of fintech adoption by small and medium-sized enterprises (SMEs) in China overshadows that of the rest of the world. Whiles the global average for fintech adoption for SMEs is 25 percent, China's SMEs fintech adoption rate is 61 percent; markets that come close to China's remarkable feat are the United States, UK, South Africa and Mexico ,which have fintech adoption rates of 23 percent, 18 percent, 16 percent, and 11 percent, respectively.

Small and Medium-sized enterprises are an integral component of any economy as they contribute considerably to job creation and economic growth. Unfortunately, the growth of SMEs is hampered by many factors; notable among these factors is limited access to finance. For most lending institutions the major challenge in extending financial assistance to SMEs is the lack of adequate credit information.

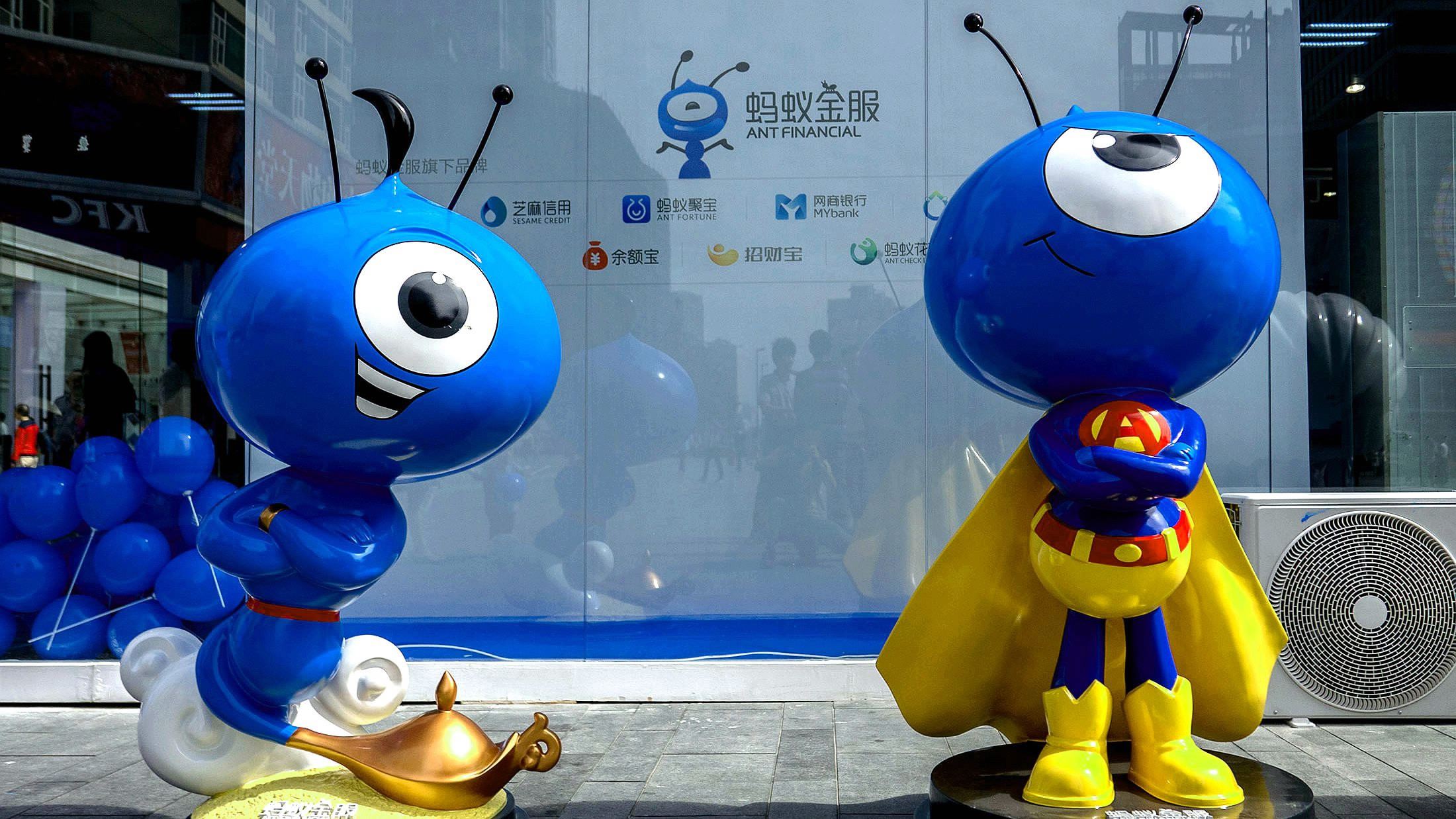

In recent years, lending institutions in China have been spearheading a revolution that is transforming financial services that are offered to SMEs. One of such lending institutions is MyBank; China's first digital bank and a subsidiary of the Ant Group. The online commercial bank, which was established in 2015 to focus on SMEs, is one of the leading lending institutions that are performing exceptionally well in bridging the financial gap.

Foreigners experience Alipay in China. /VCG

Foreigners experience Alipay in China. /VCG

The digital bank relies largely on an efficient credit risk assessment framework that is supported by a data-driven approach that uses over 3,000 variables to assess the credit worthiness of an applicant with three minutes. Through this innovative financial technology, MyBank is able to extend credit to micro, small and medium-sized enterprises (MSMEs) which are considered to be highly risky by traditional banks.

A new study conducted by the Asia Pacific Department of the International Monetary Fund (IMF) and the Institute of Digital Finance at the Peking University, which compares the fintech approach to credit risk assessment using machine learning models and big data to the traditional approach where scorecards models and standard financial information are mainly used, suggests that the fintech approach to credit risk assessment is propitious in strengthening credit risk management and stimulates financial inclusion for MSMEs.

The research, which relied on data from MyBank, further indicates that the fintech approach to credit risk assessment is more accurate in ascertaining the credit worthiness of loan applicants. This is because while the fintech approach relies on real-time data to predict loan defaults, the traditional credit risk assessment approach uses lagging historical data that does not fully reflect the borrowers' capacity to repay the loan within the required duration.

The merits of the fintech approach to credit risk assessment over the traditional credit risk assessment practice plays a vital role in harnessing SMEs access to financing, irrespective of their size.

The impact of financial technology in China goes beyond bridging the financial gap in the SMEs industry. Financial technology is improving financial inclusion, especially among low-income households and residents of remote and rural areas. With the aid of mobile phones, computers and other handheld devices, a large proportion of the country's population are now accessing financial services.

Through financial technology, the underserved and unbanked population in China are able to access financial services. For instance, non-bank digital payment providers in China do not only provide payment solutions to stores and MSMEs on e-commerce platforms but they also make available convenient payment channels to consumers in remote and rural areas who mostly do not have the equal access to financial services as those in the cities.

At the end of the first quarter of 2017, Alipay users in rural markets were about 163 million, according to a report from the World Bank and the People's Bank of China; this percentage clearly indicates the impact of financial technology in improving financial inclusion. Smallholder farmers who could not access financial services from traditional banks are now accessing loans via e-commerce platforms.

With the rise of fintech companies in China, traditional financial institutions have started to adopt innovative business models and efficient information and communication technology that have the capacity to serve the underserved or the unbanked population.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)