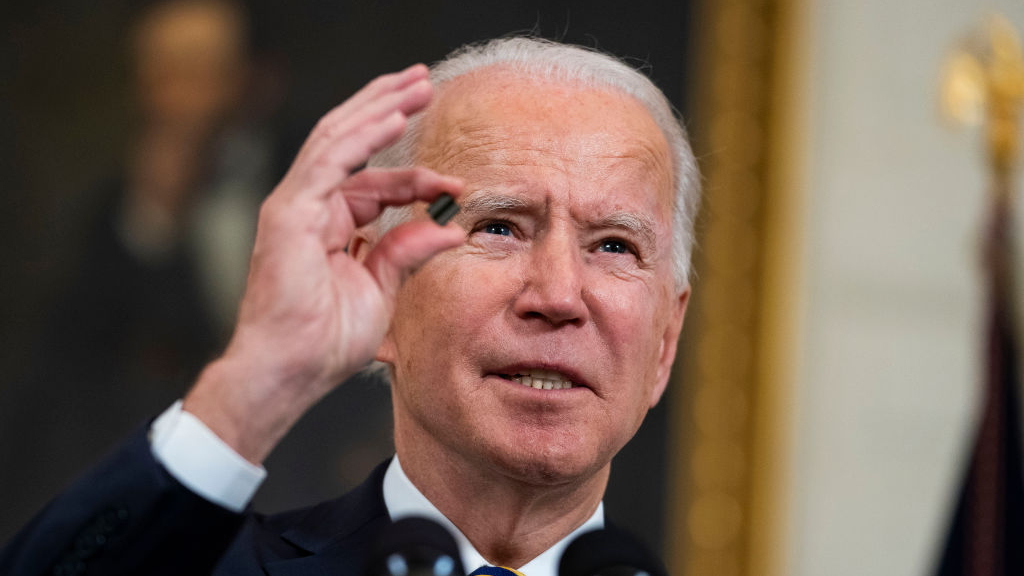

U.S. President Joe Biden holds a semiconductor during his remarks before signing an Executive Order on the economy in the State Dining Room of the White House in Washington, D.C., February 24, 2021. /Getty

U.S. President Joe Biden holds a semiconductor during his remarks before signing an Executive Order on the economy in the State Dining Room of the White House in Washington, D.C., February 24, 2021. /Getty

Editor's note: Djoomart Otorbaev is the former Prime Minister of the Kyrgyz Republic, a distinguished professor of the Belt and Road School of Beijing Normal University, and a member of Nizami Ganjavi International Center. The article reflects the author's views, and not necessarily those of CGTN.

On March 31, U.S. President Joe Biden unveiled a plan aimed at, among other things, subsidizing domestic production and research in the field of semiconductor chips. Administration officials said the $50 billion would stimulate manufacturing, research, and development, including creating the National Center for Semiconductor Technology. On April 12, on behalf of the president, his national security adviser Jake Sullivan will meet with semiconductor and auto industry executives to discuss the global chip shortage.

Quite unexpectedly for many, it turned out in the second part of last year that the demand for microcircuits for some industries exceeds supply from 10 to 30 percent. In the beginning, the deficit arose in connection with the closure of factories due to a lockdown. When production resumed, a surge in demand was caused by a change in the population's habits fueled by the pandemic. Demand has grown from manufacturers of new car models and booming sales of computers, televisions, and household appliances, releasing the latest game consoles and mobile phones.

Many are now wondering why companies did not prepare for such a situation in advance. One of the reasons for this was the unpredictability of the pandemic's course since it was all for the first time. Another reason was fresh memories from 2018 that there was a considerable overproduction of chips and a sharp decline in their prices. As a result, there was an abrupt drop in producer stock prices.

Stocks of many semiconductor manufacturers are now skyrocketing to all-time highs. This week, the PHLX Semiconductor TR Overview Index, which tracks dozens of major chipmaker stocks, rose more than 220 percent over the past 12 months. According to analysts, the shortage of chips will remain at least until the end of this year, as the coronavirus continues to "push" people into the digital world.

As a result, even Apple, the $2 trillion company and the world's largest semiconductor buyer spending $58 billion a year, was forced to delay the much-touted iPhone 12 launch by two months due to chip shortages. Another prime example of the crisis is Samsung, the second largest semiconductor user, spending $36 billion last year to purchase chips. The company has recently announced that it will have to postpone due to a chip shortage releasing its newest smartphones. This happened despite Samsung being the second-largest chipmaker with annual sales of $56 billion.

Surprisingly, the automotive industry has become one of the most affected by the chip supply shortage. More than 100 microprocessors are used in a modern car, and the global automotive industry buys chips worth about $37 billion a year. According to the calculations of the consulting firm AlixPartners, due to a shortage of chips, car manufacturers are forced to cut production. The car industry might lose up to $64 billion this year. Of course, this is not disastrous when you consider that the industry has annual sales of two trillion dollars.

However, sales of modern and best-selling vehicles have been hit hardest. Companies such as Daimler, Fiat, Ford, Honda, Nissan, Subaru, and Toyota have reportedly suspended production for weeks due to a shortage of specialized chips.

Multi-colored computer silicon wafer. /Getty

Multi-colored computer silicon wafer. /Getty

As a result, sales and profits of the largest car companies declined. According to Moody's Investor Service experts, the annual drop in gross revenue for General Motors compared to 2020 may reach 30 percent, or about $2 billion. For Ford, revenue losses may amount to about $2.5 billion. In unit terms, only U.S. automakers can under-supply up to 350,000 vehicles only in the first quarter of 2021, while the industry's problems may also spill over into the whole year.

It is already noticeable that China, which ranks first in car production, has also suffered from the current problems with the chips' supply. Research firm IHS predicts that due to a shortage of chips in the first quarter of 2021, China will produce 250,000 fewer cars than expected.

In connection with the large-scale government support for the industry, companies that develop and produce high-tech chips are actively opening in China. As reported by the business database company Qichacha, the number of such companies in China increased by 22,800 in 2020, an increase of 195 percent a year earlier.

According to the China Semiconductor Industry Association, sales of integrated circuits in China increased 17 percent in 2020, reaching $135 billion. But the industry continues to be dependent on the most sophisticated supplies from abroad. In 2020, China purchased $350 billion worth of foreign integrated circuits, up 14.6 percent from a year earlier.

Late last year, the U.S. Department of Commerce imposed additional sets of restrictions to acquire U.S.-based parts and technology needed to make advanced microcircuits with the sizes of 10 nanometers and below for Chinese companies.

Back in February 2020, I wrote: "The largest gap currently lies in design and manufacturing of high-end semiconductor chips, where China lags far behind the United States." Obviously, the problem not only remains but has become much more acute.

More efforts will be required to close the high-tech chip design and manufacturing gap in China. There will be no external support. The country will have to invest much more human and financial resources in science and the high-tech sector in the shortest possible time.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com)