A worker at a gas station in north China's Hebei Province, March 31, 2021. /CFP

A worker at a gas station in north China's Hebei Province, March 31, 2021. /CFP

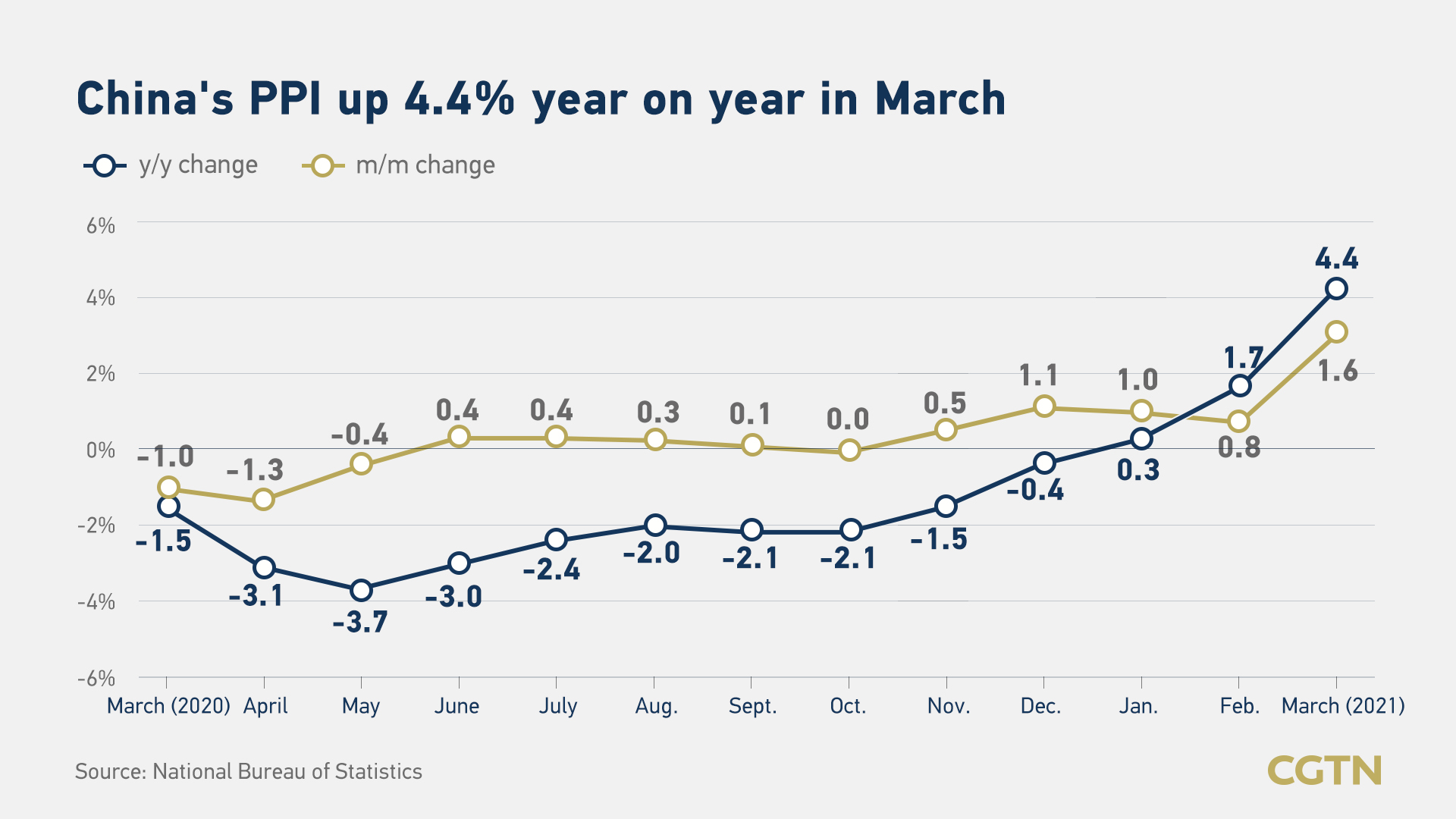

China's producer price index (PPI), a measure of factory gate prices, jumped 4.4 percent in March due to rising international commodity prices, particularly prices for metals and oil, and ramped-up domestic production and investment, data from the National Bureau of Statistics (NBS) showed on Friday.

March PPI data beats a median forecast of a 3.5 percent rise polled by Reuters economists.

"Unlike previous cycles, this recent rise in PPI inflation was mainly the result of surging global commodity prices, which are mainly being driven by monetary easing and huge fiscal stimulus (especially in the U.S.) outside of China," Lu Ting, Chief China Economist at Nomura told CGTN.

Affected by an increase in the price of imported iron ore, the price of ferrous metal smelting and rolling processing industry surged a yearly 21.5 percent, NBS data showed.

"International crude oil prices continued to rise, driving the increase in domestic oil-related industries," said Dong Lijuan, a senior statistician with the NBS.

The oil and natural gas extraction industry rose by 23.7 percent in March year on year, while the chemical raw materials and chemical products manufacturing industry rose by 11.4 percent from the year before.

"Yet the cost increase in raw materials was mostly borne by midstream assembly manufacturers and downstream consumer goods factories. Particularly, prices of durable goods like cars even dropped," Wang Dan, chief economist at Hang Seng Bank (China) told CGTN.

Wang pointed out that upstream raw material processing factories saw profit surge while mid- and low-stream manufacturers' profit was significantly squeezed. "This is why the PPI for means of production jumped by 5.8 percent, while that for consumer goods only rose by 0.2 percent."

"Such profit squeeze will bring additional liquidity pressure for mid- and low-stream manufacturers when monetary policy is tighter than the last year," she said.

Wang expected that targeted monetary expansion from the second quarter will ease the debt burden for small producers.

China's consumer price index (CPI), a key gauge of retail inflation, rose 0.4 percent from a year earlier in March, exceeding economists' expectations of a 0.3-percent rise polled by Reuters.

"The still-low CPI inflation in March was largely due to the decline in pork prices," Lu said.

In the food category, the price of pork fell by 18.4 percent year on year. Among the non-food products, the price of industrial consumer goods rose by 1 percent, the first year-on-year increase, mainly driven by the 11.9 percent and 12.8 percent rise in gasoline and diesel prices, respectively, Dong said.

"Consumer price inflation is rather mild as the increase in fuel prices was largely offset by the decline in pork prices," Wang said, adding core inflation, which excluded food and energy, stayed flat, reflecting weak consumer market in general.

"Although consumption in large cities has recovered almost to the pre-COVID level, that in small cities remains lagging, dragged by low expectation in income growth," she said.

Wang added that "within services, housing rent stayed flat with last year – a result from low levels of migration in the country."

Nomura expects CPI and PPI inflation to rise further to around 1.2 percent year on year and 5.5 percent year on year respectively in April on another month of low bases, rising services prices and increasing energy and commodity prices.