China's first-quarter GDP data confirms that the country's recovery momentum has well stayed in the first quarter. /CFP

China's first-quarter GDP data confirms that the country's recovery momentum has well stayed in the first quarter. /CFP

Editor's note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

China's first-quarter GDP data, including some of the key economic data in March, confirmed that the recovery momentum has well stayed in the first quarter. Even with the facts that base effect largely disrupted the data comparing to a year ago, some evidence, including the consumption data pointed that the recovery is likely to extend into the second quarter.

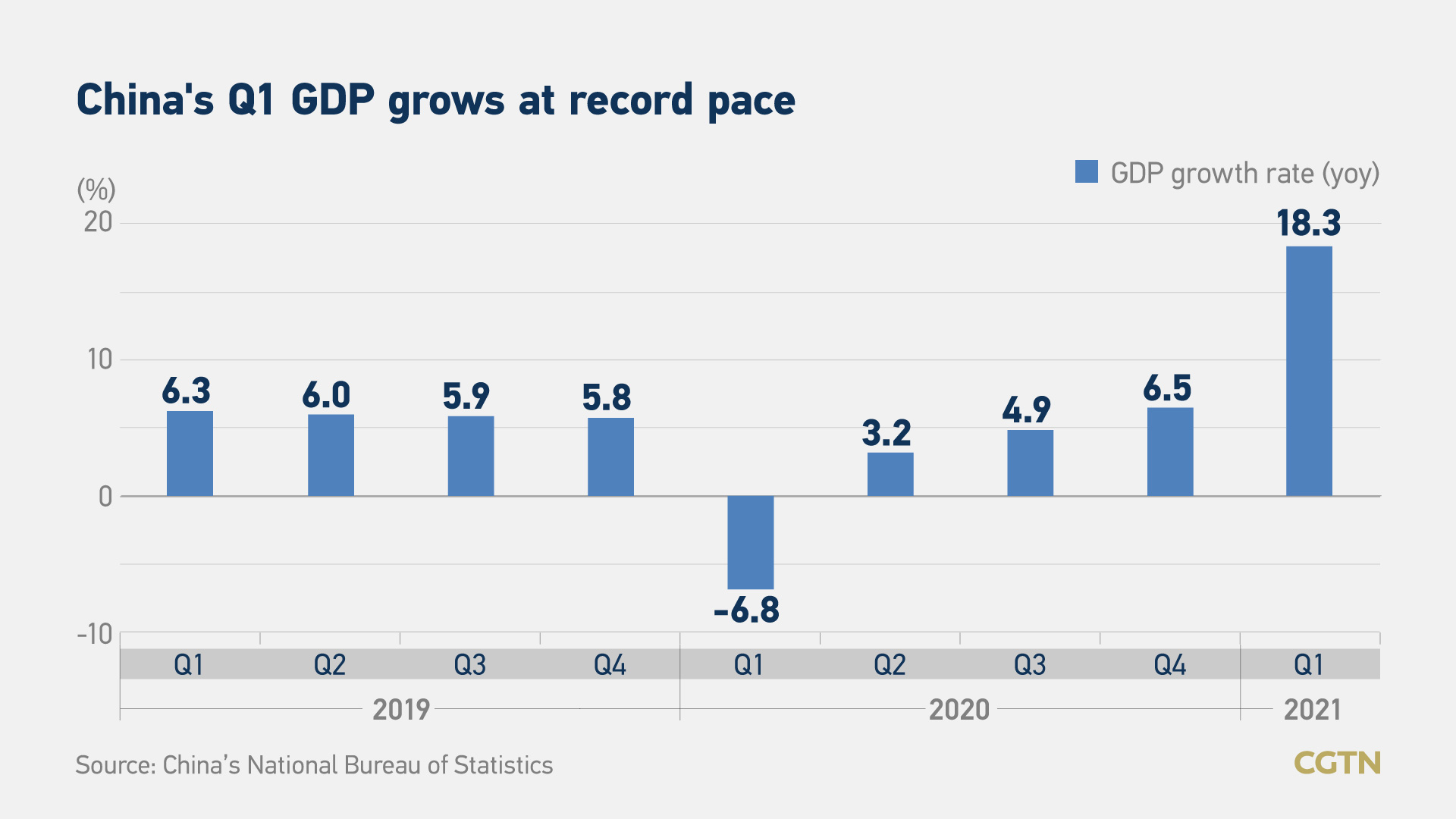

Chinese economy jumped 18.3 percent in the first quarter from a year ago, marking the fastest growth rate back to early 1990. The record GDP growth rate in the first quarter was also largely due to base effect, as the country was the first one to implement stringent measures to control the coronavirus spreading in the first quarter last year, that caused the economy to fall 6.8 percent in that period. Meanwhile, the growth rate was also much higher than the 6.5 percent in the final quarter last year.

As the data in early 2020 largely disrupted the first-quarter economic data this year, it's more meaningful to compare the data on a quarter-on-quarter basis. The GDP grew 0.6 percent from last quarter, versus a 2.6 percent quarter-on-quarter GDP increase in the prior quarter. There are some key signals from these readings. First, it showed that the Chinese economy may have normalized after the pandemic, and the virus's impact on the domestic growth activities is getting less so long as no new substantial surge in virus spreading in the country again.

Second, some stimulus measures withdrawal in the first quarter may have also slowed growth activities from the earlier quarter. People's Bank of China (PBOC) drained a net 40.5 billion yuan ($6.2 billion) of one-year funds in the first quarter, and the monetary authority aims to keep macro leverage "basically stable" in 2021. This showed that further fresh monetary measures to be implemented this year will be quite limited. On the fiscal stimulus side, the nation lowered its fiscal deficit target to 3.2 percent of GDP this year, from 3.6 percent in 2020, which revealed that the country may have prepared to reduce the spending to curb the pace of debts growing.

Still, the high-frequency data showed that the recovery momentum in domestic activities will continue. Industrial output rose 14.1 percent last month from a year ago, slower from 35.1 percent year-on-year growth in January to February period and slightly below the expectation.

The slower growth in production number was mainly due to the base effect disruption. If compared with the industrial output in the first quarter of 2019, it grew 14 percent in the first three months this year, which is another evidence that the Chinese economy has been normalized after it suffered from the pandemic early last year. Also, the falling commodity prices most of the time in March may also cause the industrial output to stay below the estimates. But if referring to China and its major trading partners' factory PMIs in recent times, it showed that the gradual openings in the global economy will continue to benefit China's manufacturing activities.

Surging retail sales in March were another sign that consumers' confidence in the economic outlook has been largely improving. Retail sales gained 34.2 percent from a year earlier in March after it rose 33.8 percent in the first two months this year. Retail sales also rose 1.75 percent in March from February, which is the month of Chinese New Year. Since the pandemic hit the global economy, China has been emphasizing more to boost the domestic demand.

The rising retail sales in China are crucial to its growth in the coming months. The virus spreading around the world is accelerating again, after it slowed down earlier the year. The National Bureau of Statistics of China said the COVID-19 epidemic is still spreading globally and the international landscape is complicated with high uncertainties and instabilities. Such comments reflect that uncertainties on external demands remain high. Thus, the rising domestic demand, including the consumption activities would be one of key supports to its growth.

Overall, those economic data released earlier hinted that further fresh broad-based stimulus in the first half is not likely to happen in the next six months, and policy will start leaning toward more neutral as the economy has started normalizing. We expect the PBOC to continuously drain some liquidity but keeps the money-market rates stable at the current levels.