Editor's note: Hannan Hussain is a foreign affairs commentator and author. He is a Fulbright recipient at the University of Maryland, the U.S., and a former assistant researcher at Islamabad Policy Research Institute. The article reflects the author's opinions and not necessarily the views of CGTN.

Wall Street investors are up in arms against the U.S. president after his proposal to almost double the capital gains tax on millionaires went public. "The president's tax agenda will ... reform the tax code so that the wealthy have to play by the same rules as everyone else," said the White House in a statement on Wednesday.

Top investment firms, U.S. venture capitalists, conservative tearaways and Silicon juggernauts have continued to moan about the death of the American dream, long-term revenues, and their vested interests in investment retention.

But irking the elite is good news for Biden. It shows his plan can work.

Begin with capital gains, which are best identified as profits from stocks, investments and associated assets. In this case it means all wealthy Americans with millions in annual income to show. Striking the rich with some 43.4 percent in federal capital gains tax can significantly bolster spending for legions of middle-income Americans, and put middle-income childcare and education at the center of U.S. policy. Contrary to Wall Street hype, this is the Biden administration's stated goal under the American Family Plan.

On reining in the wealthy, fundamentals are key. Biden's capital gains pursuit is promising in the sense that it offers an entry point for ordinary Americans on social and redistributive funding, particularly by making their eligibility cyclical in future policy decisions. This reflects in the fact that a wealth-focused tax provision won't jeopardize the way most stocks are held by scores of hardworking Americans.

Consider how most U.S. citizens ground a majority of their valued stocks through very secure, beneficial and tax-deferred instruments, including the 401(k) plan. These very plans have the best chance to self-sustain for a core reason: the identified capital gains tax target is the million-dollar income bracket, not the country's most vulnerable socioeconomic base.

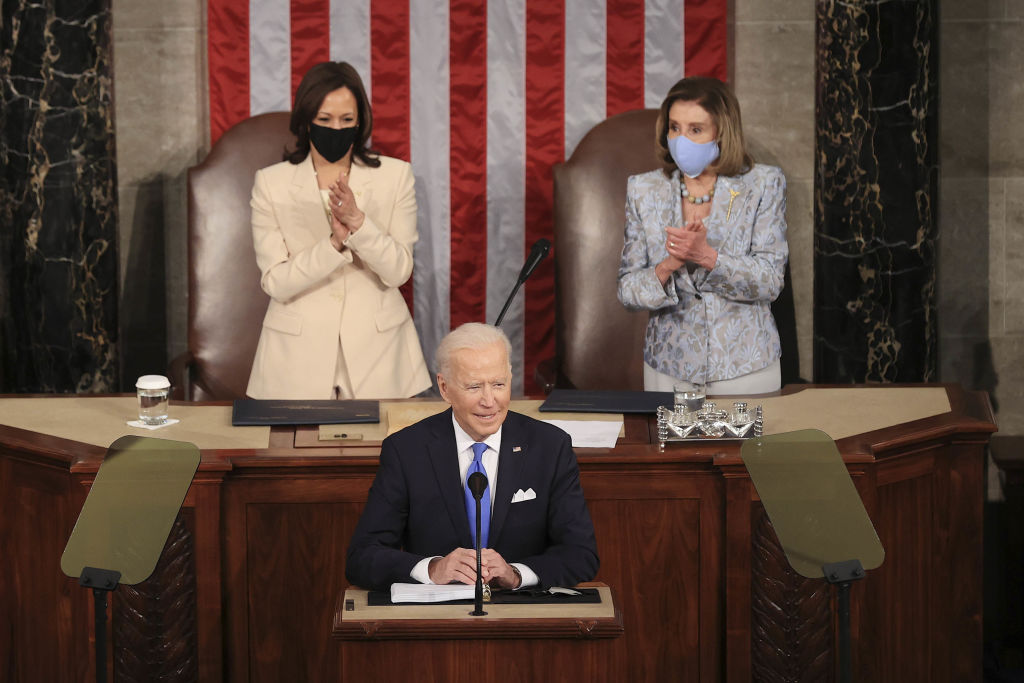

U.S. President Joe Biden (C) speaks during a joint session of Congress at the U.S. Capitol with U.S. House Speaker Nancy Pelosi, a Democrat from California, top right, and U.S. Vice President Kamala Harris in Washington, D.C., U.S., April 28, 2021. /Getty

U.S. President Joe Biden (C) speaks during a joint session of Congress at the U.S. Capitol with U.S. House Speaker Nancy Pelosi, a Democrat from California, top right, and U.S. Vice President Kamala Harris in Washington, D.C., U.S., April 28, 2021. /Getty

This is an important distinction that is currently lost on Wall Street elites because their indifference to Biden's poverty-focused measures, such as the child tax credit push, is without a monetary upside. Financing this child credit, let alone making it permanent, is what several lawmakers deem a "historic opportunity" to cut U.S. child poverty in half. Ironically, the same process of poverty containment is blasted by top American capitalists as either "insanity," an incentive to "avoid triggering" their capital gains, or due cause for top-dollar lobbying against the legislation.

All these complaints identify as privileged reinforcements of America's ever-widening class divides and racial wealth gaps – the polar opposite of what Biden's anticipated Family Plan strives to accomplish.

Interestingly, in their desperation to challenge the new tax provision, American private equity executives significantly exaggerated the centrality of U.S. stock market performance. Note that investor outcry arrived at a time when U.S. stocks slumped and Wall Street indexes fell, empowering pundits to assert that the American stock market was bound to pivot towards a "directionless" state.

It never happened.

In fact, in less than 24 hours, the same directionless stocks rose aggressively on the back of solid economic data, calling the bluff on Wall Street's preferential discourse and the generous magnates that drive its alarmist thinking. Independent tax data spanning five decades confirms that any meaningful change in capital gains tax cannot be measured until after the policy shift is in place. Keeping these nuances out of public knowledge speaks to the thrust of U.S. capitalism, and its iron grip on the freedom of information in America.

Democrats have also been warned: such cosmetic resistance may soon find its match among conservative ranks in the U.S. Senate. Republican Patrick Toomey, the top official on the banking committee and longtime Trump loyalist, has already framed Biden's broader economic plan as an assault on "the best economy" he has ever seen.

But the silver lining for Biden's tax proposal is this: Republicans are relatively keen to negotiate on the broader plan's physical infrastructure and spending contours. In effect, this could position senate Democrats to condition any mutually agreed concessions on their own tax greenlight. Early signs reflect in the resolve of Biden's top economic advisers, who are willing to mainstream Biden's tax spike by operating it along "party lines," as opposed to the more contentious bipartisan route.

Therein also lies Biden's education as a changemaker in deeply polarized America: that putting its middle class first means courting relentless criticism every step of the way.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)