01:48

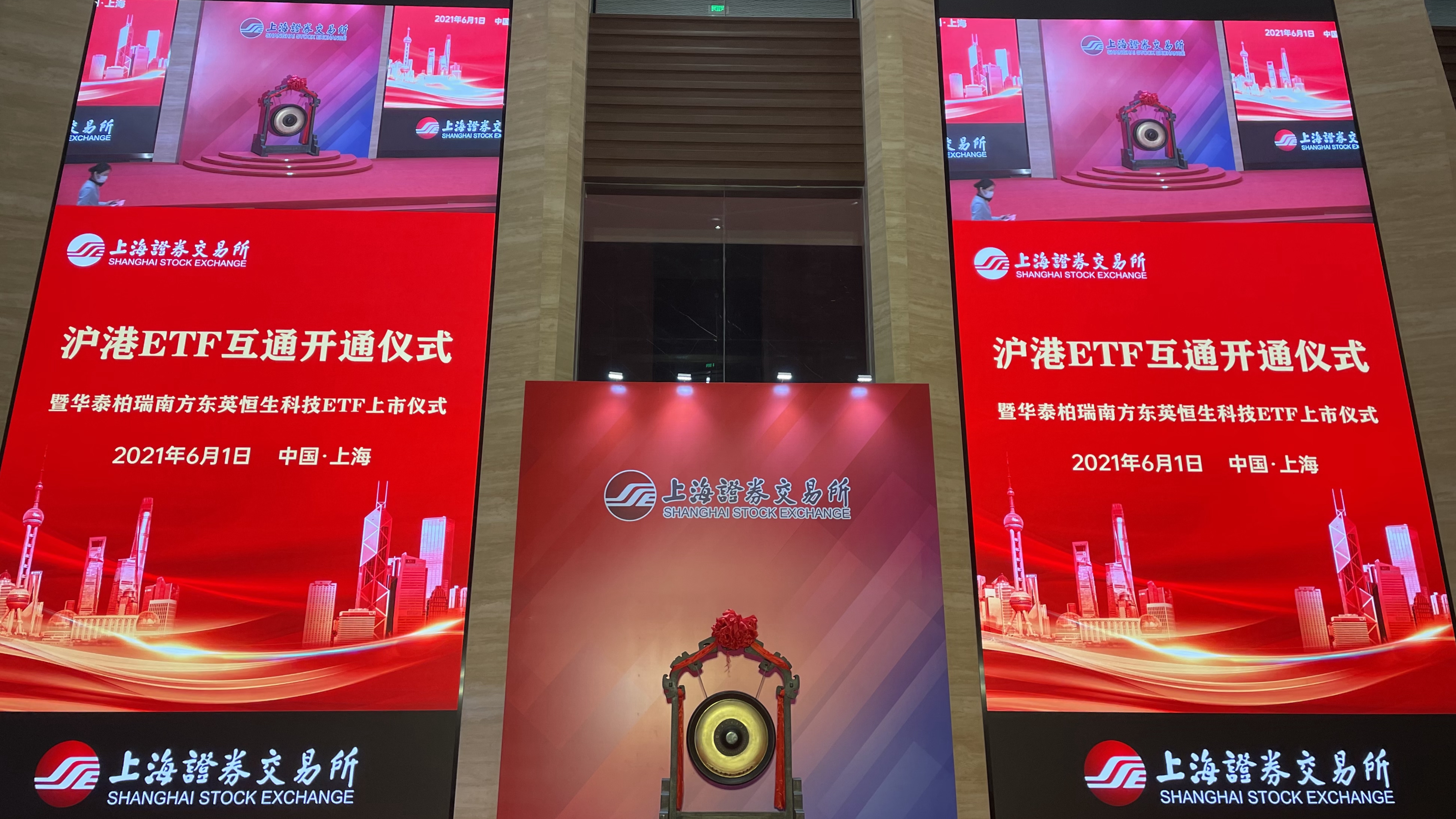

The first pair of exchange-traded funds (ETF) under a cross-listing scheme has officially gone public in Shanghai and Hong Kong on Tuesday.

Investors can now directly invest in ETF via the Shanghai-Hong Kong ETF Connect. The new mechanism allows investors to invest in both locations without opening new local accounts.

ETF is a fund that tracks changes in the underlying indexes and is listed on the stock exchange, featured by investment diversification, greater transparency and simple operation.

The two fund products listed in Shanghai and Hong Kong are managed by Huatai-Pine Bridge Investment, while their transactions will go through the China Construction Bank.

"The technology industry will offer huge investment opportunities over the next 10 or 20 years. So we're selecting tech firms listed on the Hang Seng market. Investors can directly purchase outbound listed tech shares more easily," said Liu Jun, fund manager of Huatai-Pine Bridge Investments.

"The total issuance value has currently reached more than 1 billion yuan ($156 million), attracting 40,000 retail investors," said Yuan Ding, deputy general manager of Investment Custody at China Construction Bank.

The official start of the Shanghai-Hong Kong ETF Connect marks the further opening up of China's financial market.

The total value of funds listed in Shanghai reached more than 1 trillion yuan, or some $157 billion, by Friday, up more than 18 percent from the end of 2020.

Shanghai's ETF transaction volume now ranks first among all stock exchanges in Asia. And in addition to Hong Kong, its ETF products have also connected to Japan.