A business talk between two Chinese young men. /Getty

A business talk between two Chinese young men. /Getty

Editor's note: Djoomart Otorbaev is the former Prime Minister of the Kyrgyz Republic, a distinguished professor of the Belt and Road School of Beijing Normal University, and a member of Nizami Ganjavi International Center. The article reflects the author's views and not necessarily those of CGTN.

We will likely remember the first half of 2020 due to the panic that gripped the planet associated with the outbreak of the coronavirus pandemic. However, another type of panic was occurring around the same time in many developed countries. It was associated with a fear of a takeover of their "cheap" companies by Chinese investors.

Manfred Weber, head of the center-right EPP group in the EU parliament, told the German newspaper Welt am Sonntag in May last year that he favors a ban on Chinese investors who want to buy European firms. "We need to see that Chinese companies, supported in part by public funds, are increasingly trying to buy up European companies that are cheap to acquire or are in economic hardship due to the coronavirus crisis," he said.

Margrethe Vestager, the European competition commissioner, suggested that governments buy out stakes in vital companies to prevent Chinese takeovers.

On March 25, 2020, the European Commission published guidelines for EU member states urging them to adopt or strengthen foreign investment screening mechanisms to protect vulnerable assets from overseas seizure during the crisis.

Were the fears of European politicians justified, and what results did 2020 bring in terms of Chinese investments in Europe? Last year China's foreign direct investment (FDI) in Europe hit a 10-year low. The fourth consecutive fall year-on-year was a clear sign that Brussels' fears of a wave of cheap asset purchases were unfounded.

Chinese investors completed mergers and acquisitions of just €25 billion ($30.3 billion), 45 percent less than in 2019. Overall, foreign Chinese investment hit a 13-year low. For quite some time now, China has lost its appetite for direct takeovers of Western companies.

Many Western analysts believe that the decline in China's overseas investment activity is associated with internal restrictions on the export of capital and tight control of the authorities over Chinese investments abroad. And, of course, the coronavirus pandemic has further exacerbated another drop.

In my opinion, such assessments are fair. But how can one explain the fact that China has been restricting the export of fixed capital investments and reducing capital investments abroad for several years in a row? After all, it is evident that China needs new knowledge and modern technologies that developed countries possess.

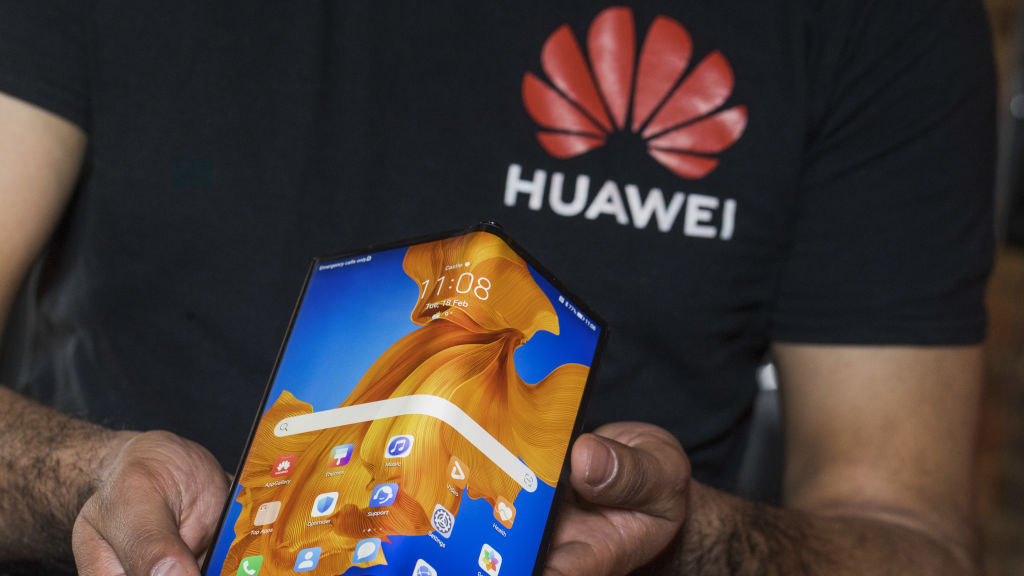

An employee holds a Mate Xs folding smartphone, manufactured by Huawei Technologies Co., at a launch event in London, UK, February 18, 2020. /Getty

An employee holds a Mate Xs folding smartphone, manufactured by Huawei Technologies Co., at a launch event in London, UK, February 18, 2020. /Getty

You don't need to be a great professional to understand that those specific restrictions imposed by the European politicians will not stop the desire of Chinese and European companies to work together and prohibit the interaction of their scientists and engineers.

Indeed, in addition to the direct legal takeover of legal entities on the territory of these countries, there are a considerable number of other methods of knowledge and technology exchange. I will give as an example only 3 of them - a creation of joint ventures, invitation of specialists, and greenfield investments.

Many prominent Western companies have been present in the Chinese market for a very long time. For the fastest promotion of their products to the vast Chinese market, the creation of joint ventures for marketing, research and development (R&D) has become ubiquitous.

The history of high-speed rail is a prime example of how China has caught up with and surpassed the collective West without directly acquiring competitors and copying technology from Western companies.

The rapid development of Contemporary Amperex Technology Co., Limited (CATL), which is in just 10 years has become a world leader in the production of modern batteries, is another prime example of how, among other things, the prominent Western professionals helped to create the reigning world champion.

In 2020, Chinese greenfield investments in Europe jumped to their highest level since 2016, amounting to almost 20 percent of the total FDI. Such high-tech companies as Huawei, Lenovo, ByteDance, Haier, and Hisense have become the largest investors in new projects.

Among the most significant multi-year new greenfield projects announced last year were SVolt Energy Technology's €2.1 billion ($2.51 billion) battery plant for electric vehicles in Germany, Huawei's €1 billion ($1.19 billion) investment in R&D center in the UK, and €438 million ($522.8 million) data centers in Ireland for ByteDance subsidiary TikTok.

Currently, political relations between China and the EU have deteriorated. In March, following EU sanctions against Chinese officials and government agencies for alleged human rights abuses, Beijing retaliated by imposing its sanctions on EU individuals.

China's sanctions forced MEPs to accept a proposal to suspend parliamentary ratification of the Comprehensive Agreement on Investment between the EU and China (CAI). The adoption of CAI in the short term is now unlikely.

Thus, the panic observed last year over the possible aggressive behavior of Chinese companies in the "cheap" European M&A market was unnecessary behavior. The fears of European politicians to limit the influence of China were in vain. There is no point in reviving such measures this year.

Even as global M&A activity recovered and rose to a 10-year high of €1.08 trillion in the first quarter of 2021, Chinese FDI activity in Europe and other markets continued to decline. European politicians can bring these investments to zero. But whether these efforts will benefit the citizens of these countries is a big question.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)