02:11

China's economic growth is projected to reach 8.5 percent this year, reflecting a low base effect, the release of pent-up demand and strong exports, according to an updated forecast published by the World Bank on Tuesday.

That marks an upward revision by 0.6 percentage points from the previous report in December, largely due to stronger-than-expected foreign demand.

"The structure of aggregate demand is expected to continue to rotate toward private domestic demand," the World Bank said. "Real consumption growth is projected to gradually return to its pre-COVID-19 trend, supported by the ongoing labor market recovery and improved consumer confidence. Investment will also remain an engine of growth, but its structure is expected to shift toward private investment as manufacturing capital expenditure improves in response to the robust external demand and stronger revenues, offsetting cooling infrastructure and property investment."

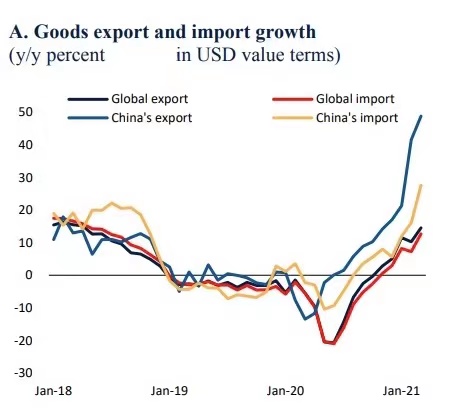

The report said the global recovery had gained strong momentum, but remained uneven. By November 2020, the global goods trade had recovered to pre-pandemic levels, while services, which had been hit harder in 2020, also picked up but remains suppressed by continued travel restrictions.

Commodity prices have seen a sharp increase in 2021, with many now well above their pre-pandemic levels, lifted by a gradual firming in global demand amid various supply constraints and production disruptions. Services activity – especially travel and tourism – remains soft, however, reflecting a general reluctance to travel.

A wider use of carbon pricing together with scaled-up green investment could accelerate China's intended transition to low carbon growth in line with its long-term objective of achieving carbon neutrality by 2060, according to the report.

The World Bank suggested that Chinese policymakers should redouble their efforts toward promoting growth-enhancing structural reforms and steering the economy toward a greener, more resilient and inclusive development path.

"Focusing additional fiscal efforts on social spending and green investment rather than traditional infrastructure investment would not only help secure the recovery and bolster short-term demand but also contribute to the intended medium-term rebalancing of China's economy," said the report.

According to Sebastian Eckardt, World Bank's lead economist for China, both the monetary and fiscal policies of China are expected to normalize.

"Our view remains that financial support should be deployed primarily with the object to boost consumption and private consumer spending, meaning providing more support to the household sector," Eckardt told CGTN.

On the monetary side, Eckardt said China's central bank has already started to normalize the policy standards and managed liquidity very carefully. He also expected the policy standard will return to more neutral settings.