People at the vegetables section in a supermarket in Lianyungang, east China's Jiangsu Province, November 10, 2021. /CFP

People at the vegetables section in a supermarket in Lianyungang, east China's Jiangsu Province, November 10, 2021. /CFP

China's factory-gate inflation hit a 26-year high in October, while consumer prices rose slightly amid public concern over food shortages, data from the National Bureau of Statistics (NBS) showed on Wednesday.

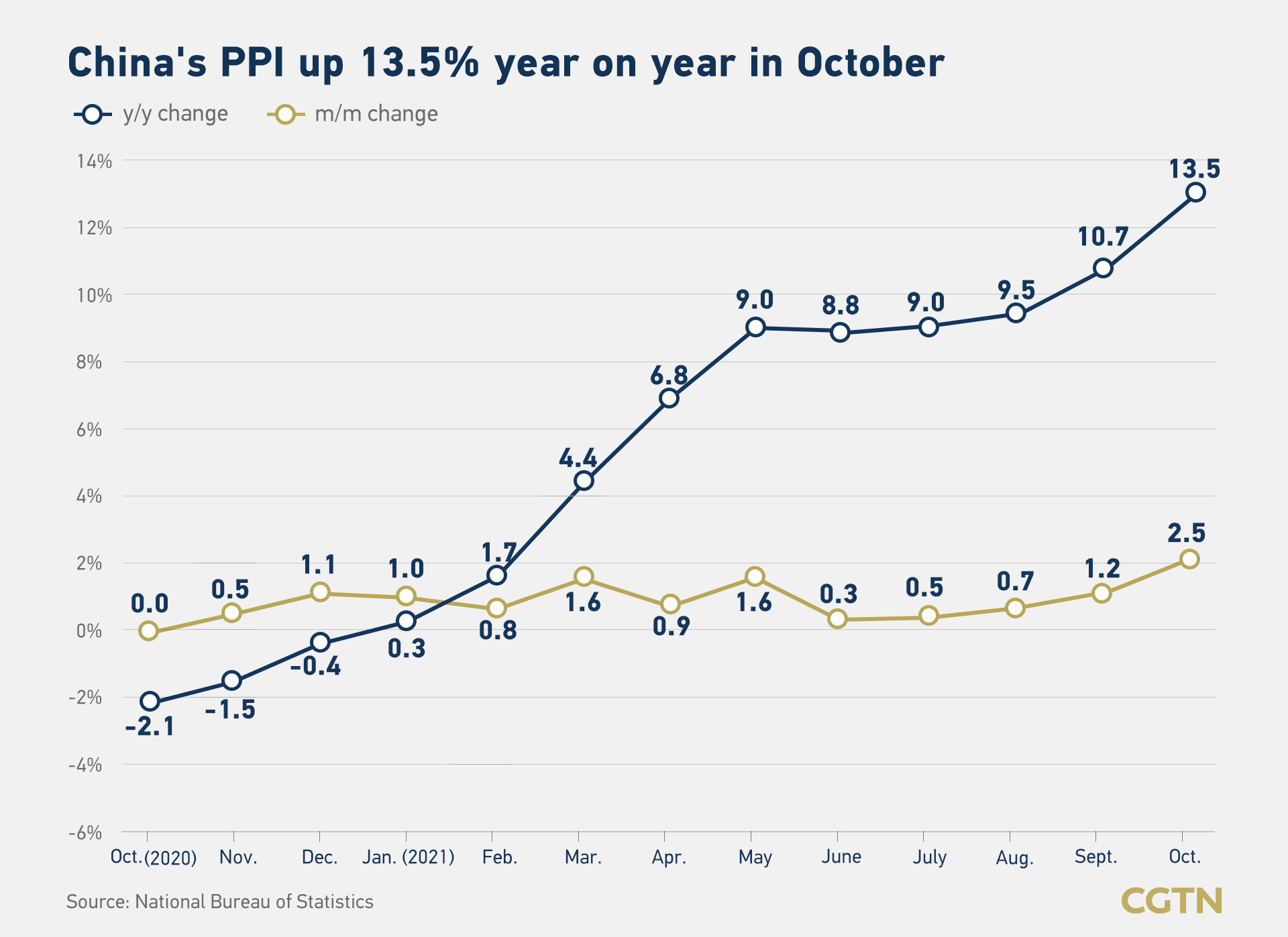

The country's official producer price index (PPI), which reflects the prices factories charge wholesalers for their products, rose by 13.5 percent in October from a year earlier, hitting the highest level since July 1995.

PPI growth in October was 2.8 percentage points higher than that in September, and above 12.3 percent predicted by Bloomberg and 12.4 percent by Reuters.

"In October, due to the imported international factors and tight domestic supply of major energy and raw materials, the increase in PPI expanded," said Dong Lijuan, a senior statistician with the NBS.

The jump in October was fueled by a 103.7-percent year-on-year surge in the coal mining sector, up from an increase of 74.9 percent in September, according to Dong.

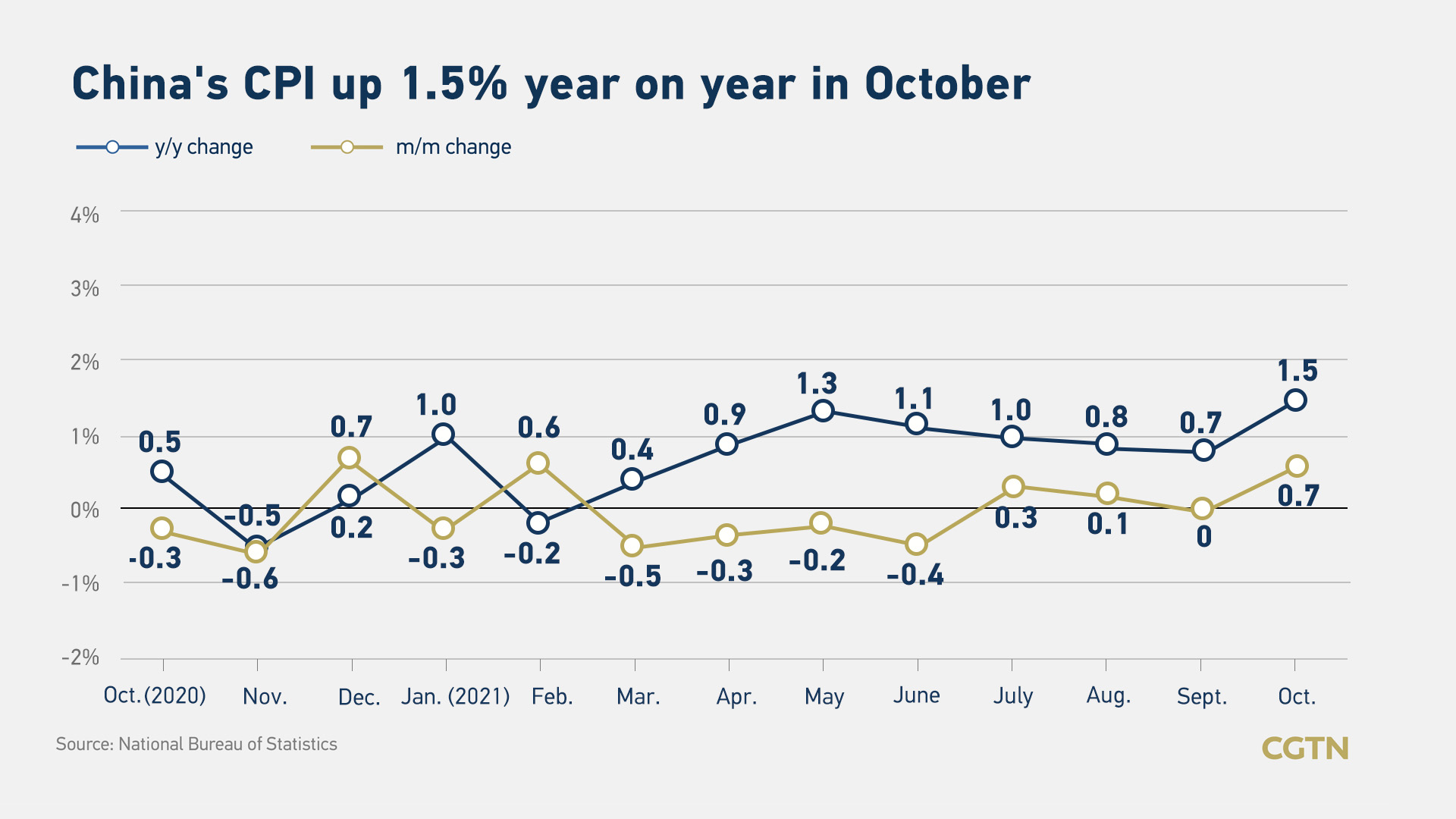

NBS data on Wednesday also showed that China's consumer price index (CPI), a major gauge of inflation, went up by 1.5 percent in October from a year ago, up from 0.7 percent in September.

This was above the 1.4-percent gain estimated by both Bloomberg and Reuters.

"In October, affected by factors such as special weather, the contradiction between supply and demand of some commodities as well as rising costs, CPI rose slightly," added Dong.

Food prices dropped 2.4 percent year on year in October, up from a fall of 5.2 percent in September. It was driven by a 15.9-percent year-on-year jump in fresh vegetables price last month, which was up from a fall of 2.5 percent in September.

"We expect CPI inflation to rise to 2.5 percent y-o-y in November but believe year-on-year PPI inflation may have already peaked in October and could drop to 11.6 percent in November," Nomura's Chief China Economist Lu Ting said in a note.

"On policy impact, higher CPI inflation and elevated PPI inflation reduce the probability of a PBoC (People's Bank of China) policy rate cut in the near term," said Lu.

Last week, China's Ministry of Commerce told local authorities to assure supplies and stabilize prices of daily necessities like vegetables for winter and next spring. That caused some cases of panic buying as the public worried about food shortages, but they were quickly reassured by authorities.

The price of pork – a staple meat on Chinese plates – dropped 44 percent year on year, compared with a 46.9-percent plunge in September. China has been buying up pork to support prices that fell earlier this year, as the declining prices resulted in heavy losses for farmers.

Non-food prices increased by 2.4 percent last month, up from a rise of 2 percent in September, according to NBS data.

Core inflation that excludes volatile food and energy prices registered a growth of 1.3 percent in October, up from an increase of 1.2 percent in September.

China has set a CPI growth target of around 3 percent this year, compared with about 3.5 percent last year.