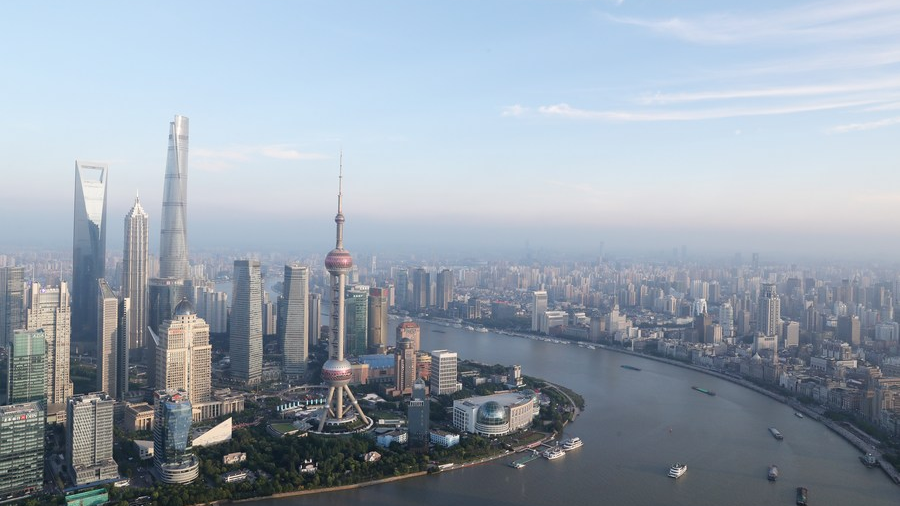

A view of the Lujiazui area in Shanghai, east China. /Xinhua

A view of the Lujiazui area in Shanghai, east China. /Xinhua

Editor's note: John Gong is a professor at the University of International Business and Economics (UIBE) in Beijing and a research fellow at the Academy of China Open Economy Studies at UIBE. The article reflects the author's opinions and not necessarily the views of CGTN.

2021 will go down in history as yet another year of pandemic. Officially the COVID-19 scourge has exceeded the 1918-1919 Spanish Flu in terms of its duration, and for many countries in terms of the total death toll as well. For example, in the United States, more than 820,000 of people had died by the end of the year as a result of COVID-19.

In China, the government has been pretty much sticking to the "dynamic zero-COVID" policy so far. Since the third quarter when winter arrived, the economy inevitably got a beating, as China couldn't be immune from the rest of world's wild spread of the Delta and Omicron variants.

Nevertheless, this policy does save lives above anything else. Officially the total death toll since the outbreak in Wuhan has been kept below 5,000. China indisputably ranks among the top performing countries in the world in terms of handling the pandemic successfully.

GDP growth started off the year with a blockbuster 18.3 percent for the first quarter, followed by 7.9 percent for the second quarter. By the third quarter, the momentum began to lose steam as the COVID-19 variants started to arrive ashore: 4.9 percent for the third quarter was way below expectations. The fourth quarter may be even lower. If that is indeed the case, the whole year number may still be around 8 percent GDP growth, which means, combined with last year's 2.3 percent growth rate, the two pandemic years averaging above 5 percent annually. That is still an extraordinary achievement compared to many countries around the world.

Workers weld at a workshop of an automobile manufacturing enterprise in Qingzhou City, east China's Shandong Province, February 28, 2021. /Xinhua

Workers weld at a workshop of an automobile manufacturing enterprise in Qingzhou City, east China's Shandong Province, February 28, 2021. /Xinhua

In a counterfactual sense, suppose we didn't have COVID-19 at all. Consensus expectations would put the Chinese economy to deliver a 6 to 6.5 percent annual growth rate. But in reality we only got 5 percent on average for the last two years. So the bottom line of this pandemic is to knock off China's growth rate by 1 to 1.5 percent. In dollar terms, this would translate into $177 billion to $265 billion of lost GDP this year.

There are several interesting implications if my forecast here is right. First, per capita GDP in China is likely to reach $12,500, partly helped by the RMB appreciation and partly helped by the downward population trend. The World Bank's GNI classification scheme puts the threshold point for high-income countries at $12,700. So it is almost certain that next year China will become a member of the high-income club of some 70 countries.

The size gap between the U.S. economy and the Chinese economy has also shrunk quite a bit. China had about 70 percent of the U.S. GDP at the beginning of 2020, but has now reached about 78 percent. Next year it is highly likely that China will be above 80 percent of the U.S. economy. When will China finally catch up with the U.S. in that regard? I am still sticking to the end-of-the-decade forecast, which appears to be conservative and maybe even earlier.

Moving forward, the first quarter of 2022 will still be a difficult time. The pandemic shows no signs of ending, and China will host the Winter Olympic Games, which means the tight pandemic measures are still going to be in place and rigorously enforced. The economy, particularly the service sectors, will continue to be under pressure. Hopefully by the second quarter the tide is going to turn, and also hopefully the COVID-19 will be finally behind us – for good.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)