02:36

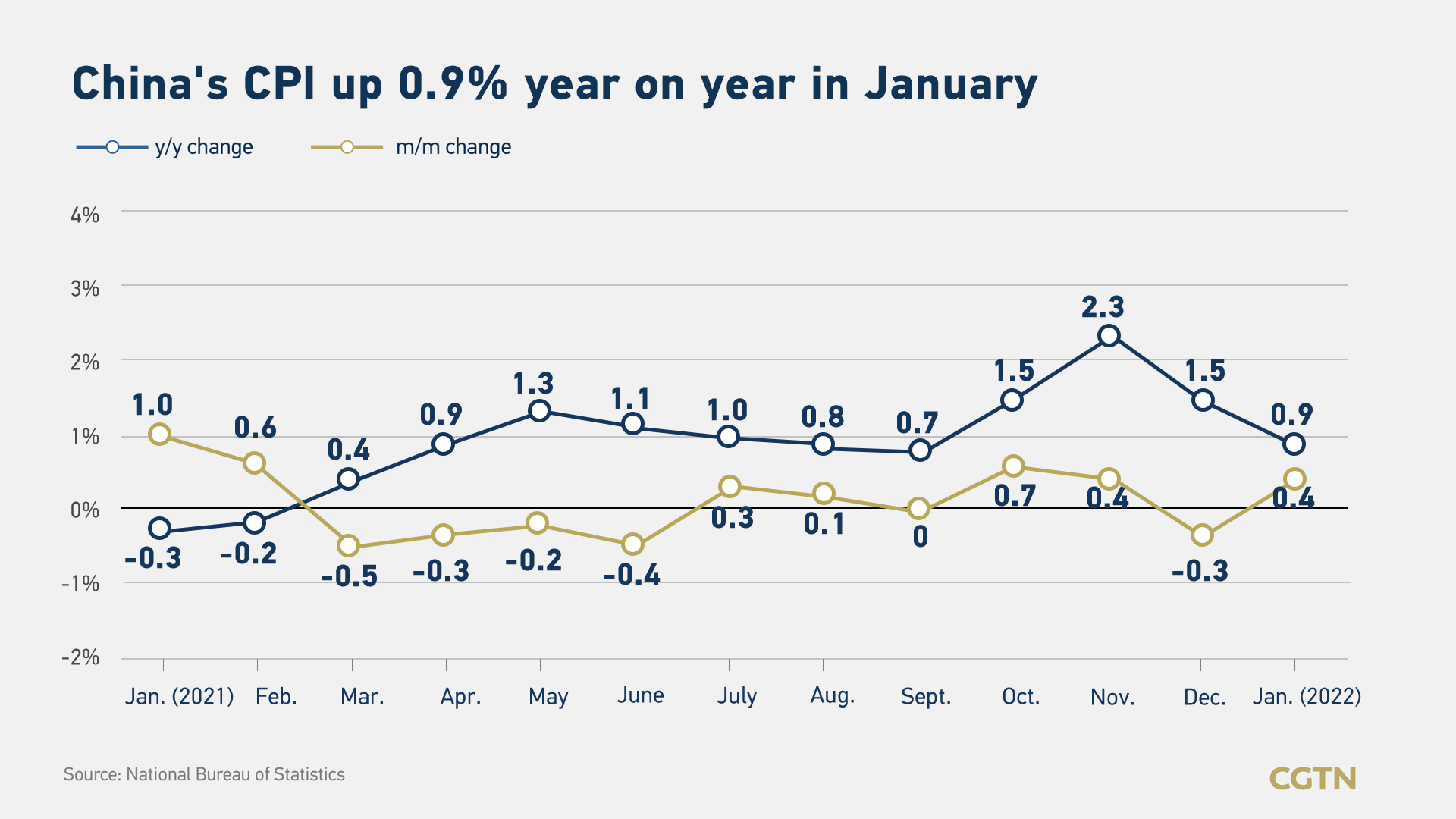

China's consumer price index (CPI), a main gauge of inflation, rose by 0.9 percent year on year in January, down from the 1.5-percent increase a month ago, the National Bureau of Statistics (NBS) said Wednesday.

The figure was below institutions' expectations. Bloomberg and Nomura economists had forecast a 1-percent increase and a 1.1-percent increase, respectively.

The January CPI is generally stable as related departments worked to secure supply during the Spring Festival, said senior NBS statistician Dong Lijuan.

Food prices fell by 3.8 percent last month compared with a year ago, contributing to a 0.72-percentage-point decline in the CPI.

Due to the high-base effect of the same period last year, the price of pork dropped by 41.6 percent on an annual basis, compared with a 36.7-percent drop in December. Vegetable prices fell by 4.1 percent year on year, compared with a 10.6-percent increase in December, Dong said.

China's falling CPI growth paves the way for more aggressive easing measures against growth headwinds, Lu Ting, Nomura's chief China economist, said in a note.

Nomura expected the easing measures, which could include one more rate cut for policy loans by the central bank, a cut in the bank reserve requirement ratio and a significant rise in foreign exchange purchases to add liquidity and limit RMB appreciation, to take place after the annual National People's Congress session in early March.

Non-food prices increased by 2 percent last month, contributing to a 1.64-percentage-point increase in the CPI, according to the NBS. Among them, the prices of gasoline and diesel increased by 20.7 percent and 22.7 percent year on year, respectively. The prices of air tickets and family services increased by 20.8 percent and 6.2 percent, respectively, data showed.

Meanwhile, China's official producer price index (PPI), which reflects the cost of goods at the factory gate, rose by 9.1 percent year on year in January, easing from a 10.3-percent rise in December.

The figure was also lower than both Bloomberg and Reuters predictions of 9.5-percent growth.

Dong said among the 9.1-percent year-on-year increase in January, the impact of last year's price changes was about 9.3 percentage points, and the impact of new price increases was about minus 0.2 percentage points.

The NBS said the easing in PPI was due to high-base effect and measures containing high raw material prices like coal and steel.

Senior China Economist at UBS Zhang Ning said the slowdown in the PPI will continue throughout this year. The figure will drop to near or even below 0 percent in the fourth quarter. That's mostly due to a high comparison base, subdued demand from the property sector and a more practical decarbonization approach.

Against the same backdrop, Nomura expected PPI inflation to fall to 8.6 percent year on year in February.

Inflation is also a major concern for central bank in setting monetary policies. Zhang said the slowdown in the factory-gate price will ease concerns of the People's Bank of China (PBOC) over elevated producer prices.

He added that the CPI will likely return to the 2-percent level, but that "will not be a hurdle for PBOC's further easing." Zhang believed that the central bank will prioritize economic growth in setting its monetary policies.

"We see more reserve requirement ratio cuts, lower extra funding costs and further credit rebound in the first half of this year," said Zhang.

(CGTN's Zhu Feng also contributed to the story.)