The Nasdaq MarketSite in New York City, the U.S. /CFP

The Nasdaq MarketSite in New York City, the U.S. /CFP

U.S.-listed Chinese stocks rallied over the past week as companies' share buyback boosted investor confidence following a key meeting that gave positive policy signals about Chinese companies' overseas listings.

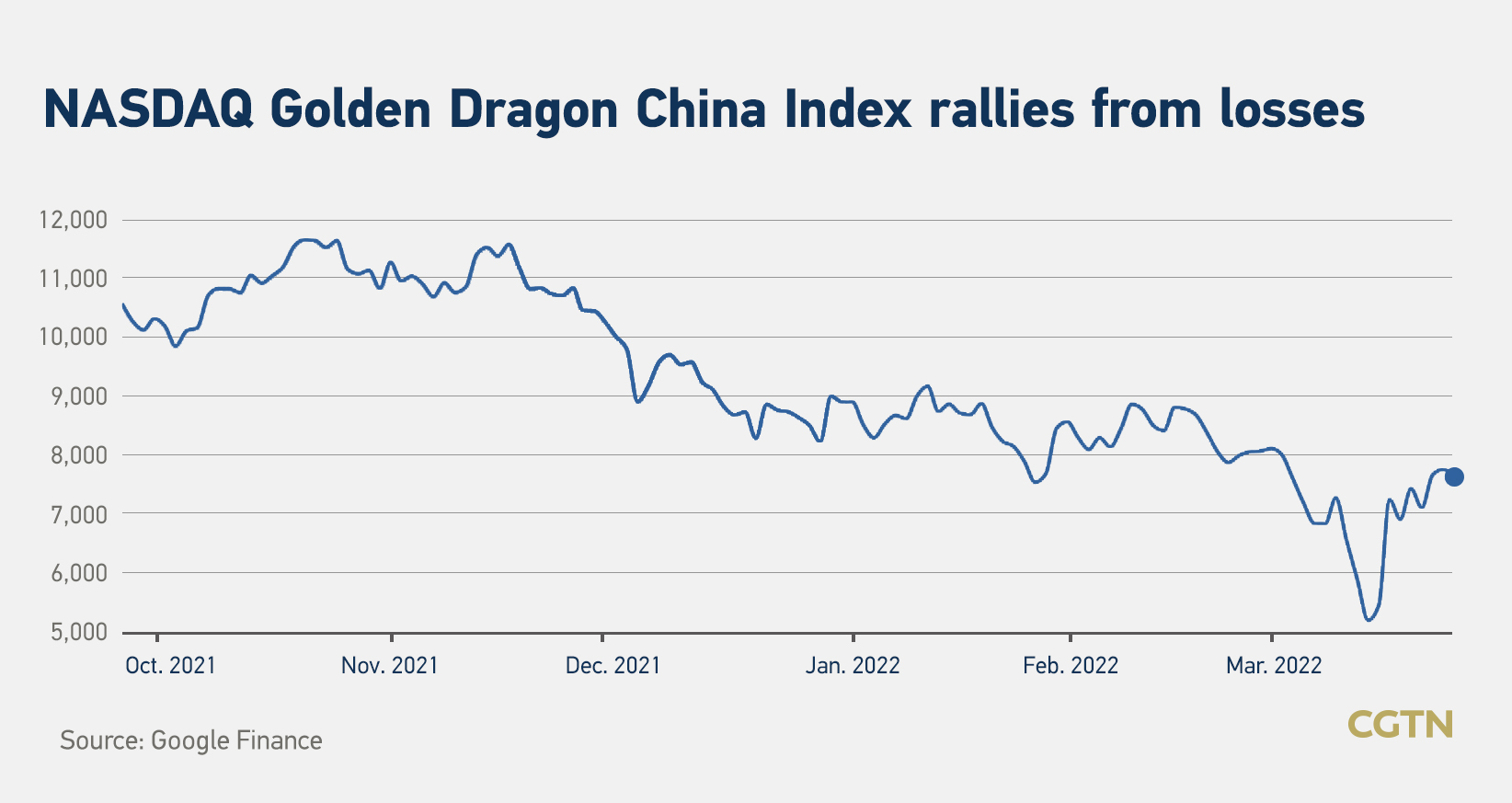

The Nasdaq Golden Dragon China Index, which comprises U.S.-listed Chinese stocks, rose 1.25 percent on Wednesday after a 7.84-percent jump on Tuesday. Over the past week, the index has posted an 11.77-percent gain.

Shares of Chinese e-commerce giant Alibaba climbed up 11 percent in New York trading on Tuesday after the company announced the biggest stock buyback by a listed Chinese company to a record $25 billion. Its shares have increased 18.32 percent in New York over the past week.

Read more: Alibaba increases share buyback to $25 billion

Following Alibaba, Chinese smartphone maker Xiaomi also announced a share buyback of up to HK$10 billion ($1.28 billion) to demonstrate confidence in its business outlook. It spurred hopes that other Chinese tech firms may follow suit as well.

Since March, the U.S.-listed Chinese stocks have suffered great losses. The Nasdaq Golden Dragon China Index plunged 35.71 percent to 5,181 points on March 14 from 8,058.63 points on February 28.

Last week, Chinese officials expressed optimism over China-U.S. regulatory talks and support for companies' overseas listings in a meeting of the State Council's Financial Stability and Development Committee.

Read more: China vows to stabilize markets and economy

On the same day of the meeting, three Chinese companies – engineering machinery maker Sany Heavy Industry, medical equipment manufacturer Lepu Medical Technology, and battery producer Gotion High-Tech – unveiled plans for secondary listings on the SIX Swiss Exchange.

(With input from agencies)