A supermarket in Sanya, south China's Hainan Province, April 5, 2022. /CFP

A supermarket in Sanya, south China's Hainan Province, April 5, 2022. /CFP

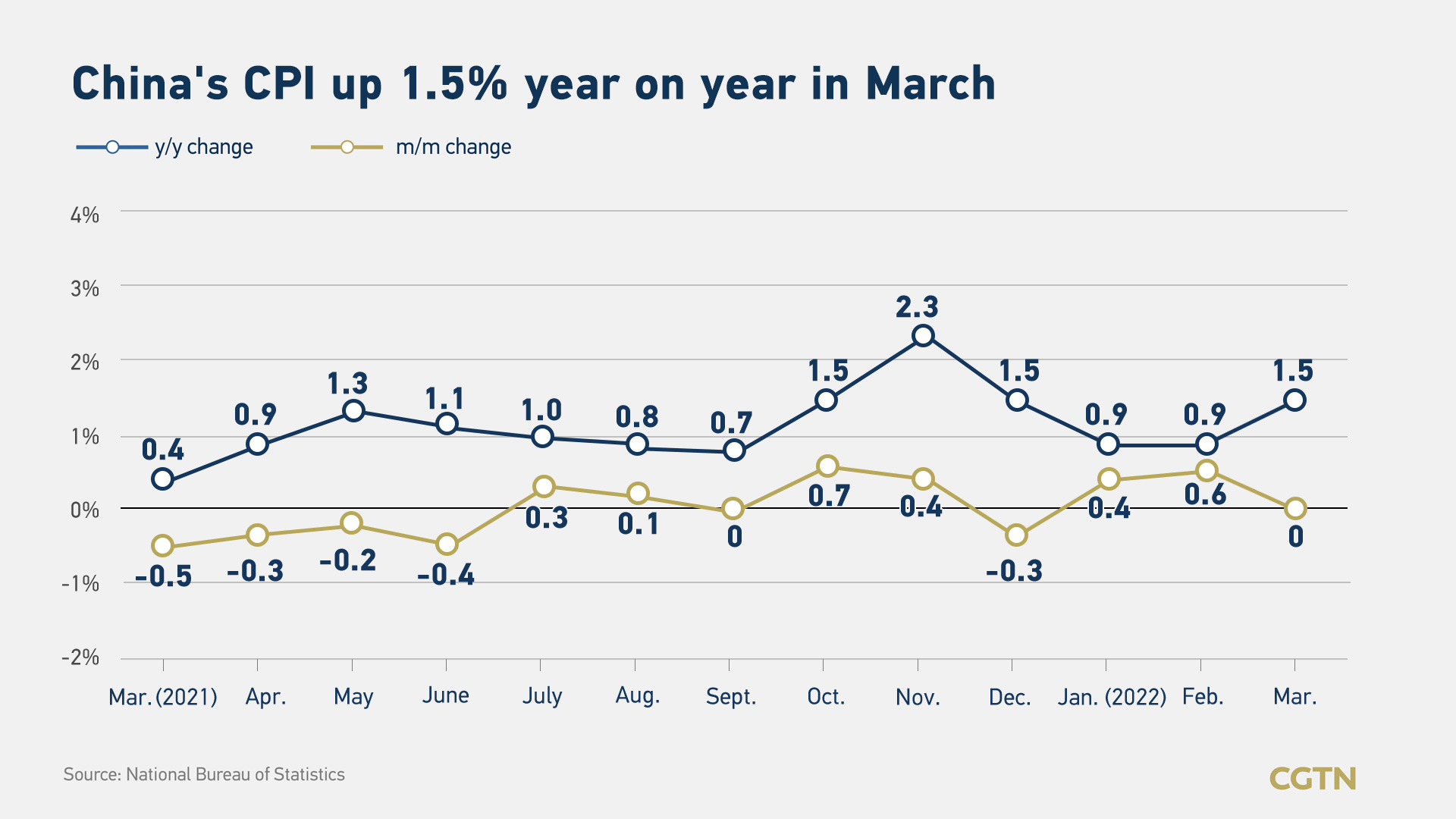

China's consumer price index (CPI), a main gauge of inflation, rose 1.5 percent year on year in March, driven by the rising cost of global commodities as well as epidemic outbreaks, data from the National Bureau of Statistics (NBS) showed Monday.

The figure surpassed the unchanged 0.9-percent reading for the past two months, and beat Bloomberg economists' projection of a 1.4-percent increase.

Food prices fell by 1.5 percent year on year in March, compared with a drop of 3.9 percent in February, contributing to a 0.28-percentage-point decline in the CPI, NBS data showed.

The price of pork dropped by 41.4 percent on an annual basis, further down from a 42.5-percent drop in February. The price of vegetables rose 17.2 percent, compared with a drop of 0.1 percent in February.

Non-food prices increased by 2.2 percent year on year last month, contributing to a 1.77-percentage-point increase in the CPI.

Gasoline, diesel and liquefied petroleum gas prices rose 24.6 percent, 26.9 percent and 27.1 percent, respectively, year on year. Air ticket prices fell 0.2 percent in March from an 18.0-percent increase in the previous month.

Dong Lijuan, a senior NBS statistician, said among the 1.5 percent year-on-year increase in March, the impact of last year's price changes was about 0.4 percentage points, and the impact of new price increases was about 1.1 percentage points.

CPI inflation could rise further in April to above 2.0 percent year on year, said Lu Ting, chief China economist at Nomura.

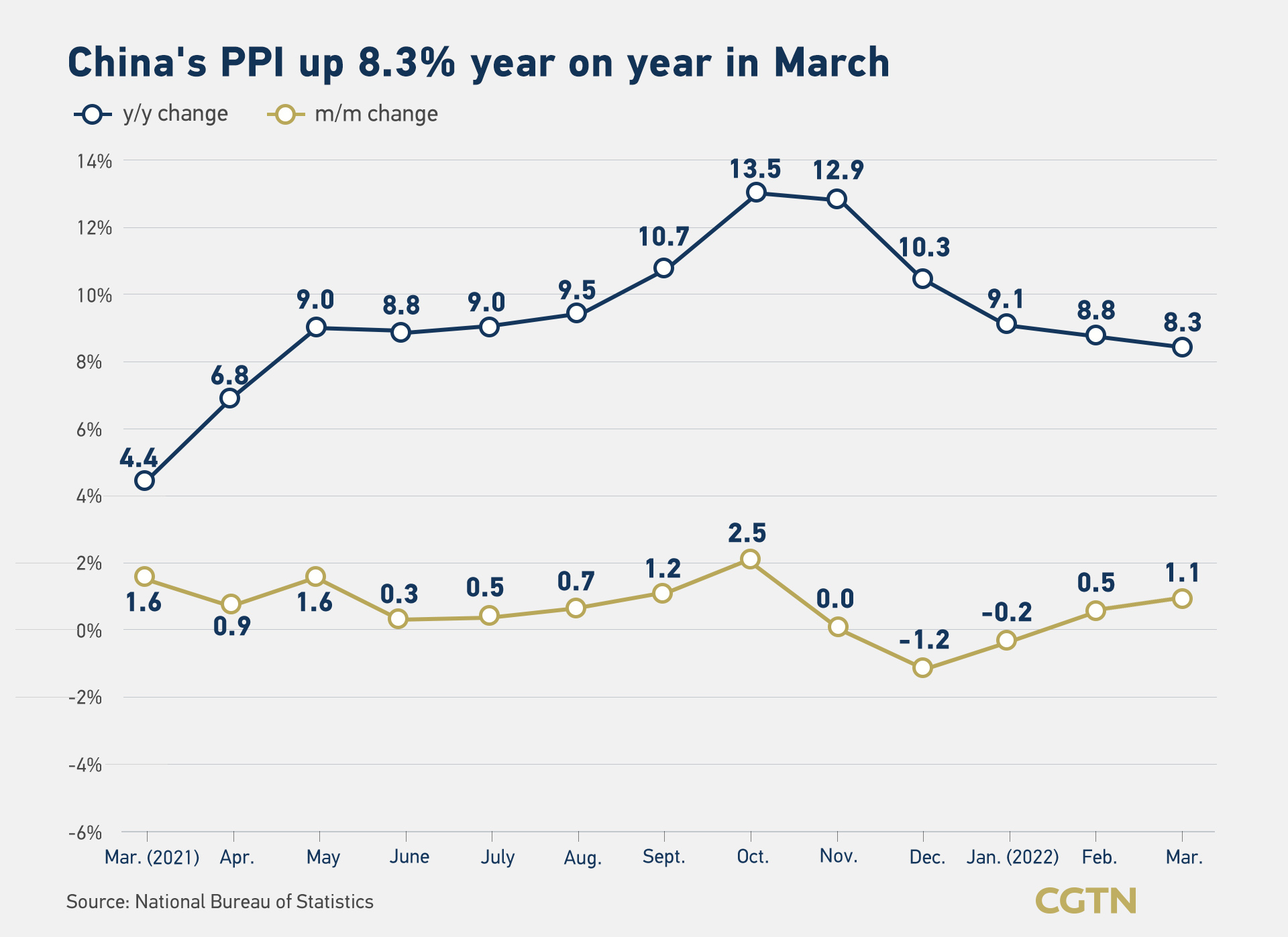

Meanwhile, the official producer price index (PPI), which reflects the cost of goods at the factory gate, increased by 8.3 percent year on year in March, down 0.5 percentage points from the previous month, data showed.

It is above Bloomberg's estimate of an 8.1-percent increase.

Dong said the drop is due to a high base during the same period last year and price hikes in bulk commodities.

In the PPI, the prices increased 53.9 percent, 47.4 percent and 32.8 percent, respectively, in coal mining and washing, oil and natural gas extraction, and oil, coal and other fuel processing. The price rose 8.7 percent in electricity and heating production and supply.

Lu said PPI and CPI inflation were largely in line with market expectations in March. The PPI inflation may fall further to 7.6 percent year on year in April on weak demand and a high base.

Rising food and energy price inflation may limit the space for the central bank to cut interest rates, Lu added.