04:00

Over the past few years, speculation has been rife over whether Hong Kong can maintain its global financial center status against the backdrop of the rising geopolitical tensions between China and the U.S.

Now some years have passed since the concern first emerged. Let's take a look back for some clarity, with eyes on the city's banking sector, stock market and foreign direct investment.

First, the banking sector. In 2020, customer deposits and foreign currency reserves, two of the main banking indicators, hit record highs in Hong Kong.

Specifically, customer deposits increased by 5.4 percent to HK$14.5 trillion (about US$1.9 trillion), while the foreign currency reserves soared by 11.5 percent to about US$492 billion.

These growth rates followed the political shocks in 2019, and given the economic impact of COVID-19 in 2020, this recovery is even more impressive.

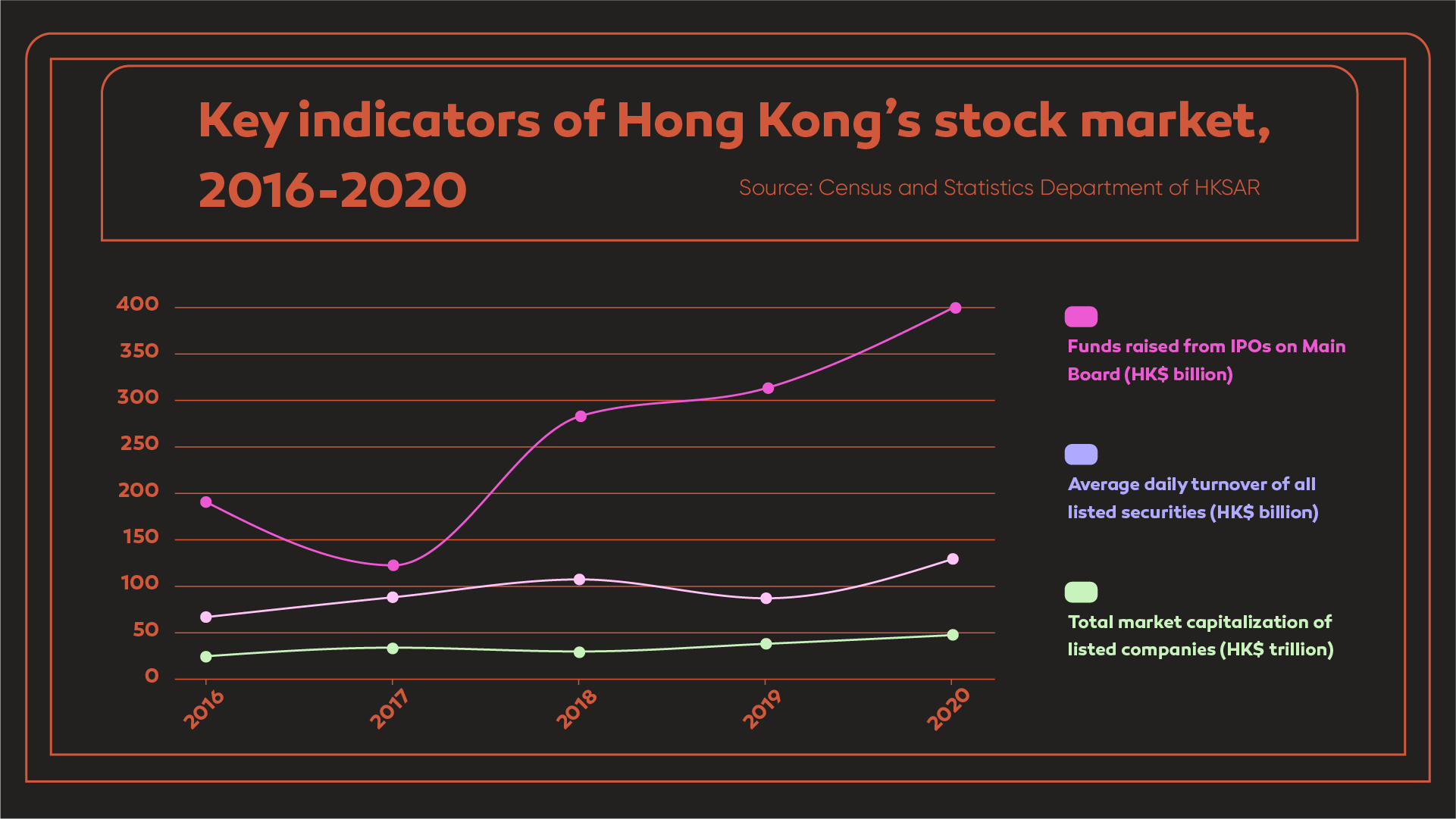

Second, in regard to the city's stock market, the total market capitalization of companies listed on the Hong Kong Stock Exchange expanded substantially by 24.5 percent in 2020, amounting to a record high of HK$47.5 trillion (about US$6.2 trillion).

This was bolstered by a surge in fundraising activities during the same year, with data showing that the amount of funds raised from IPOs on Hong Kong's Main Board increased by 27.6 percent to about HK$400 billion (about US$52 billion), ranking second globally in 2020.

Meanwhile, trading in Hong Kong's stock market was also very active, as the average daily turnover in the securities market soared by 48.6 percent to HK$129.5 billion (about US$16.8 billion) in 2020, the highest in recent years.

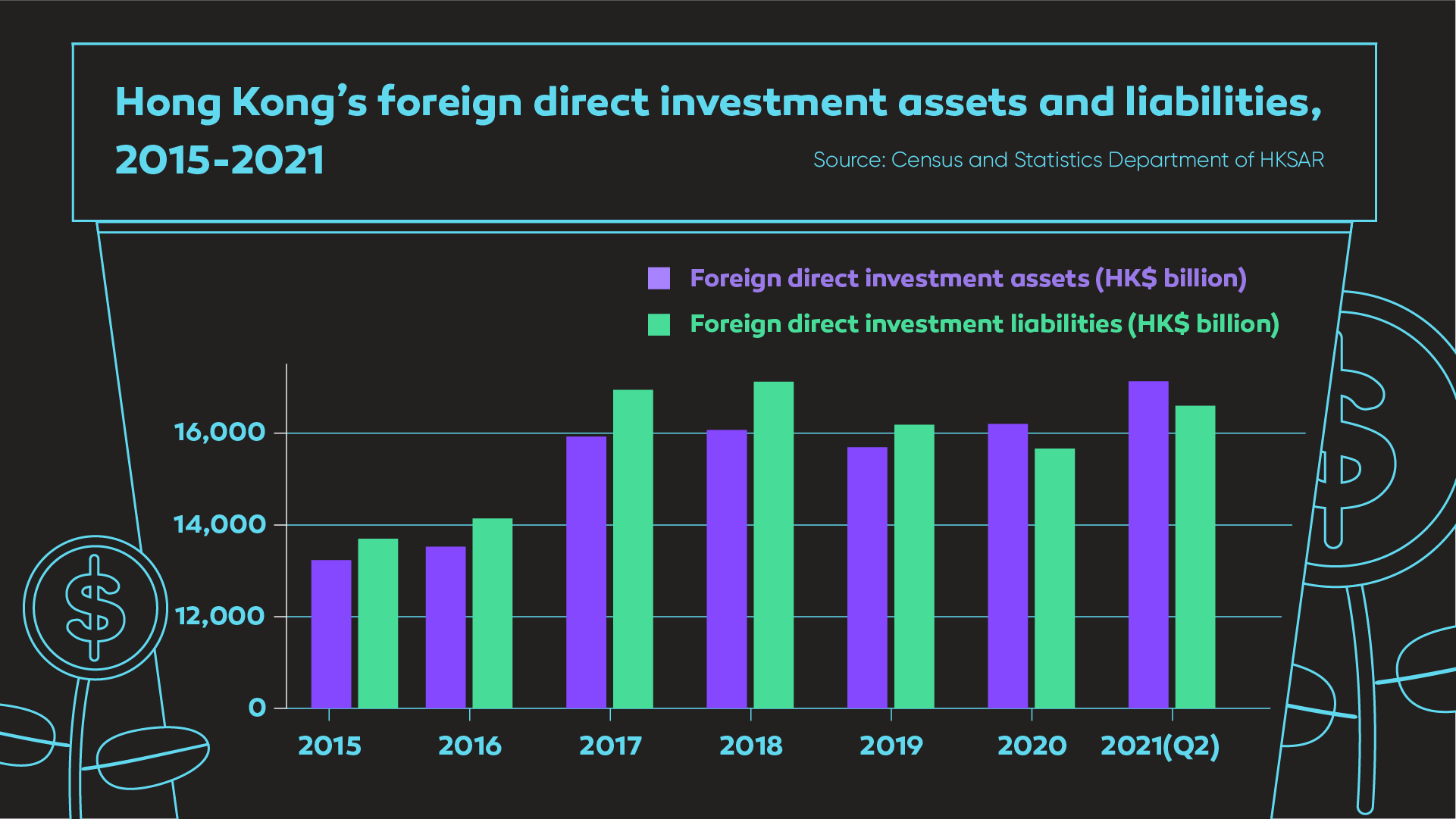

Then, what about the city's Foreign Direct Investment (FDI)? In 2020, Hong Kong's FDI assets increased by 3.2 percent after experiencing a decrease of 2.3 percent in 2019. This reflects the city's restored strength as a major investor in other economies of the world.

On the other side, however, Hong Kong's FDI liabilities declined by 3.2 percent, showing the lasting impact of geopolitical tensions, combined with the COVID-19 pandemic, on its position as a major global investment destination.

But a positive sign is, in the second quarter of 2021, Hong Kong's FDI liabilities recorded long-awaited growth of 5.9 percent, putting the city back on the track of attracting international investment.

Before ending our statistical journey, it is important to point out the challenges Hong Kong is facing as a result of geopolitical uncertainties.

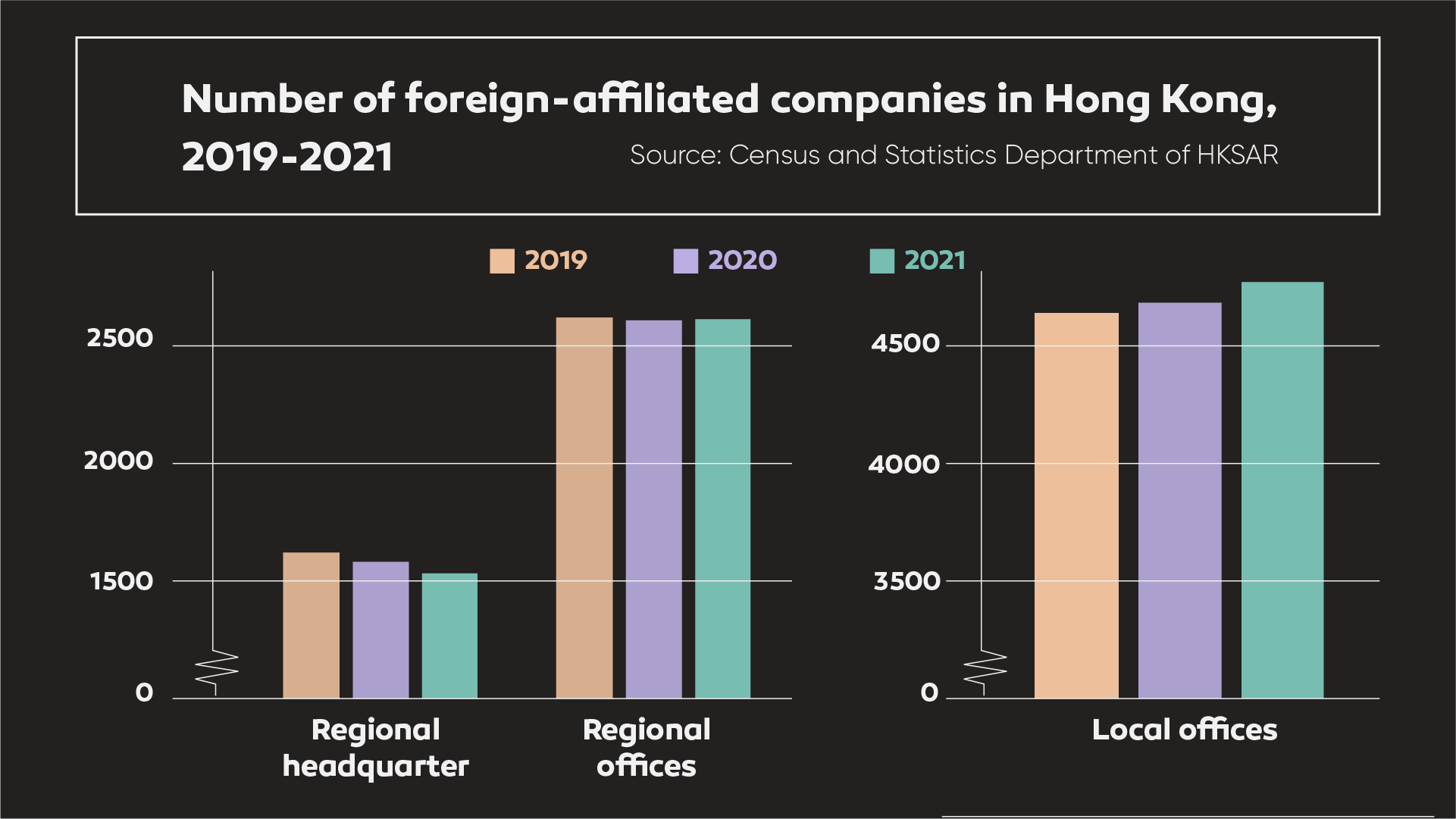

Since 2019, the number of regional headquarters set up by foreign companies in Hong Kong has decreased for two consecutive years, resulting in the loss of 84 HQs in the city.

This loss, however, was offset by the gain of 100 local offices set up by foreign companies in Hong Kong during the same period, indicating perhaps a wait-and-see strategy undertaken by some, as they downgraded their regional headquarters to local offices, rather than completely remove them.

As the data shows, Hong Kong's global financial center status is largely secure. And in the newest Global Financial Centers Index published in September 2021, Hong Kong was ranked in third place, behind only New York and London, up from fourth in 2020.

This, perhaps, is the strongest verdict on the city's much speculated financial future.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com. Follow @thouse_opinions on Twitter to discover the latest commentaries in the CGTN Opinion Section.)