The European Union's (EU) import ban on all forms of coal imports from Russia, which had been announced in April, came into effect on Wednesday after a transition period of 120 days. It was the block's first sanction imposed on Russian energy exports.

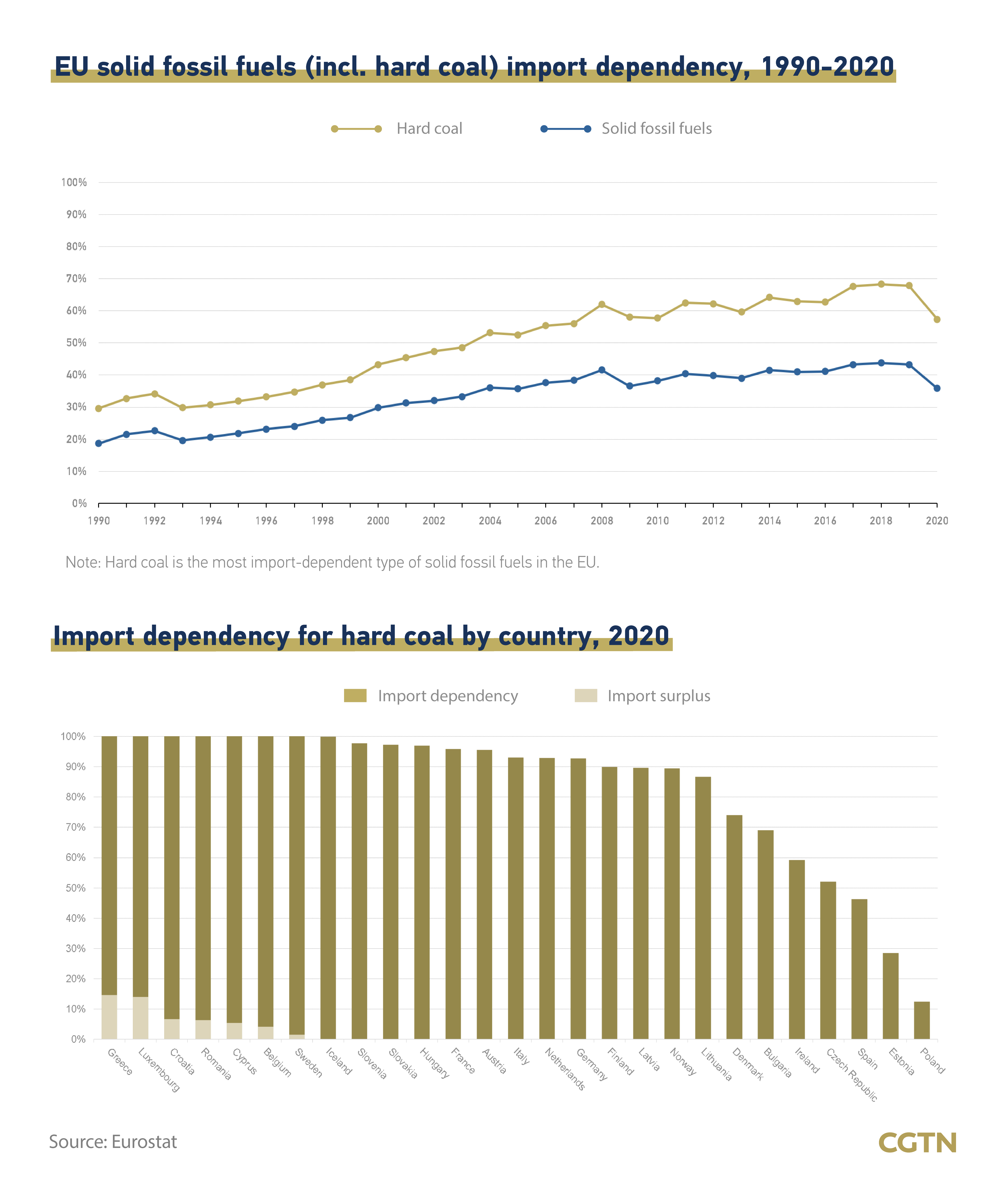

Coal, also known as solid fossil fuel, includes hard coal, brown coal and other coal products. In EU, hard coal is the most import-dependent type, with a dependency rate reaching 57.4 percent in 2020, according to the European Statistical Office (Eurostat).

Many EU members have stopped production of hard coal in recent years, but their consumption has decreased slower than their production, resulting in heavy dependency on imports. For instance, in France, Italy, Iceland, Germany and many other countries in Europe, over 90 percent of hard coal supply was from imports in 2020.

Russia had been the largest supplier of solid fossil fuel imports to the EU in recent years. Almost half of the EU's coal imports came from Russia, and the block's coal imports from Russia reached 62,106 million tonnes in 2018.

The ban may benefit suppliers from the U.S., Australia, Poland, and Colombia that are likely to be called upon to increase exports to Europe.

However, the EU was less dependent on the import of coal than natural gas and oil, with only 35.8 percent of coal supply from imports, compared with 83.6 percent of natural gas and 97 percent of oil, according to Eurostat.

The block is a net energy importing region, relying on imports for most of its energy consumption. The energy consumption data between 2011 and 2020 showed that the EU had a tremendous demand for oil and natural gas consumption, and less demand for coal consumption.

In June 2022, the EU adopted the sixth package of sanctions prohibiting the purchase, import, or transfer of crude oil and certain petroleum products from Russia to the EU.

Although the EU has issued import bans on two major energy products – coal and oil – the EU sanctions do not cover natural gas, a major source of imported energy from Russia. The EU's dependency on Russian energy imports is rigid.

The EU's announcement of an import ban on Russian coal has added volatility to coal futures prices. The price of Rotterdam, a Europe-wide coal price benchmark, was $149.8 per 1,000 metric tons on February 21, days before the Russia-Ukraine conflict broke out. As of Monday, API2 Rotterdam coal futures amounted to $320 per 1,000 metric tons for contracts with delivery.