U.S. President Joe Biden announces student loan relief on August 24, 2022, in the Roosevelt Room of the White House in Washington, DC./CFP

U.S. President Joe Biden announces student loan relief on August 24, 2022, in the Roosevelt Room of the White House in Washington, DC./CFP

Editor's note: Zhu Xingfu is a former veteran diplomatic reporter. The article reflects the author's opinion, and not necessarily the views of CGTN.

U.S. President Joe Biden made the most controversial policy decision of his presidency on Wednesday, two months before the midterm congressional elections. He announced a plan to cancel up to $20,000 of federal student loan debt for low-income recipients of low-interest federal loans (Pell Grants), and up to $10,000 in debt cancellation for non-Pell Grant recipients. Borrowers are eligible for this relief if their income is less than $125,000 or $250,000 for married couples.

Debt forgiveness is expected to free up billions of dollars for new consumer spending. Moreover, political observers believe the move could boost political support for President Biden's fellow Democrats in the November congressional elections.

However, more experts and economists fear it might fuel inflation. Some Republicans in the U.S. Congress even questioned whether Biden had the legal authority to cancel a huge amount of student loan debt.

The financial burden on millions of borrowers

The White House said in a statement that the plan would provide relief to up to 43 million low- and middle-income borrowers, a majority of more than 45 million borrowers in total.

Among federal student loan borrowers, almost a third of them owe less than $10,000, and more than half owe less than $20,000, according to data from the U.S. Education Department.

The total outstanding student loan debt in the U.S. now tops $1.75 trillion after ballooning for years, accounting for 6.5 percent of U.S. GDP.

According to a Department of Education analysis, a typical undergraduate student now graduates with nearly $25,000 in debt.

One of the main reasons behind the ballooning student loan debt is rising college tuition. Many U.S. universities offer high-quality education, but they are not cheap.

In the past three decades, the cost of higher education has skyrocketed. Average tuition and fees more than doubled at public four-year institutions, and the cost grew by 96 percent at private four-year institutions, according to a research on college pricing from the nonprofit College Board.

From 2021 to 2022, undergraduate students paid $10,740 on average for a four-year in-state college, and $27,560 for a public four-year out-of-state college. The private college was the most expensive at $38,070 each year, according to College Board.

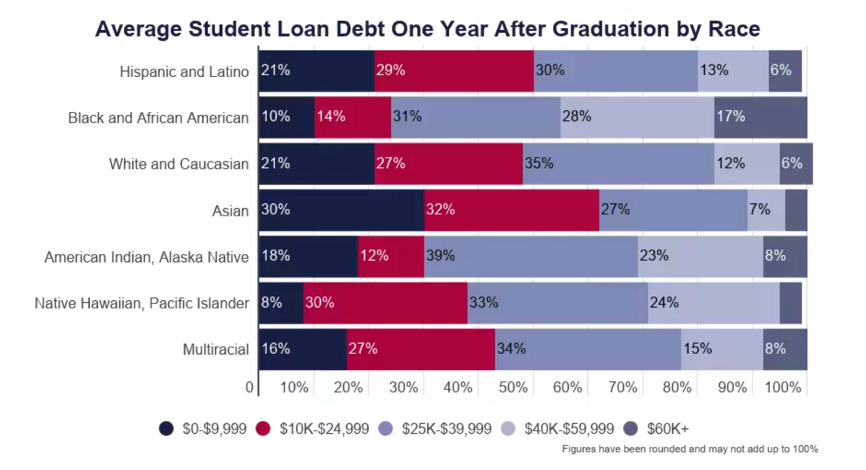

Student debts weigh more heavily on people of color. Black (African-American) borrowers, on average, carry about $40,000 in federal student loan debt, $10,000 more than white borrowers. Under the new relief plan, one in four Black borrowers would see their debt cleared entirely, U.S. News reported on Thursday, citing federal education data.

Source: U.S. Education Data Initiative

Source: U.S. Education Data Initiative

Democrats and Republicans fight over Biden's plan

Many radical Democrats had pushed for Biden to forgive as much as $50,000 per borrower. But moderate Democrat Sen. Catherine Cortez Masto said loan cancellation "doesn’t address the root problems that make college unaffordable." Instead, she called for expanded Pell Grants reserved for low-income students, and targeted forgiveness for borrowers in need, AP reported on Friday.

An article on the website of the Republican National Committee said Biden’s plan "robs Peter to pay Paul."

Democrat Sen. Michael Bennet said the forgiveness should have been joined by action to address the "absurd" cost of college. "We cannot continue to trap another generation of Americans in this cruel cycle," Bennet said, according to AP.

Republicans mostly opposed student loan forgiveness, calling it unfair because it will disproportionately help people earning higher incomes. Some Republicans sought to undermine Biden’s debt forgiveness plan by attacking it as a "reckless and illegal handout," "a vote bribe" and "a radical agenda." They claimed that Biden's plan would worsen inflation and does nothing to stop the runaway cost of college for most families.

Some Republicans and economists also argued that the consumer spending power unleashed by the loan relief could worsen already high inflation.

"Student loan debt relief is spending that raises demand and increases inflation. It consumes resources that could be better used helping those who did not, for whatever reason, have the chance to attend college. It will also tend to be inflationary by raising tuitions," said former U.S. Treasury secretary Larry Summers Monday on Twitter.

More actions needed

Despite fights over the plan, bipartisan support remains for overhauling the federal loan system. Both parties show support for expanded Pell Grants, simplified loan repayment options, and a system to hold colleges accountable when their students get stuck with debt they can't afford, AP reported.

Higher-education leaders applauded Biden's plan but also said it is only a first step toward college affordability and called on the U.S. Congress to make more efforts.

"Congress can and should take a variety of steps, including lowering student loan interest rates, capping the interest that accrues on loans and streamlining a complicated and confusing repayment system, and restoring the ability to discharge student loan debt through bankruptcy," the American Council on Education, a nonprofit higher education association, said in a statement on Wednesday.

Fundamentally, more investment in education and improvements to the federal loan system are needed. "Students will continue to take on more debt and borrowers will continue to face rising debt levels," Democratic Rep. Bobby Scott of Virginia, chair of the House Education and Labor Committee, was quoted as saying in the AP report.