As U.S. President Joe Biden signed a historic $52.7 billion chip act to boost domestic chip production on August 9, it included a caveat: Companies that receive subsidies shall not increase their production of advanced chips in China for 10 years, else they need to pay back the funding in full.

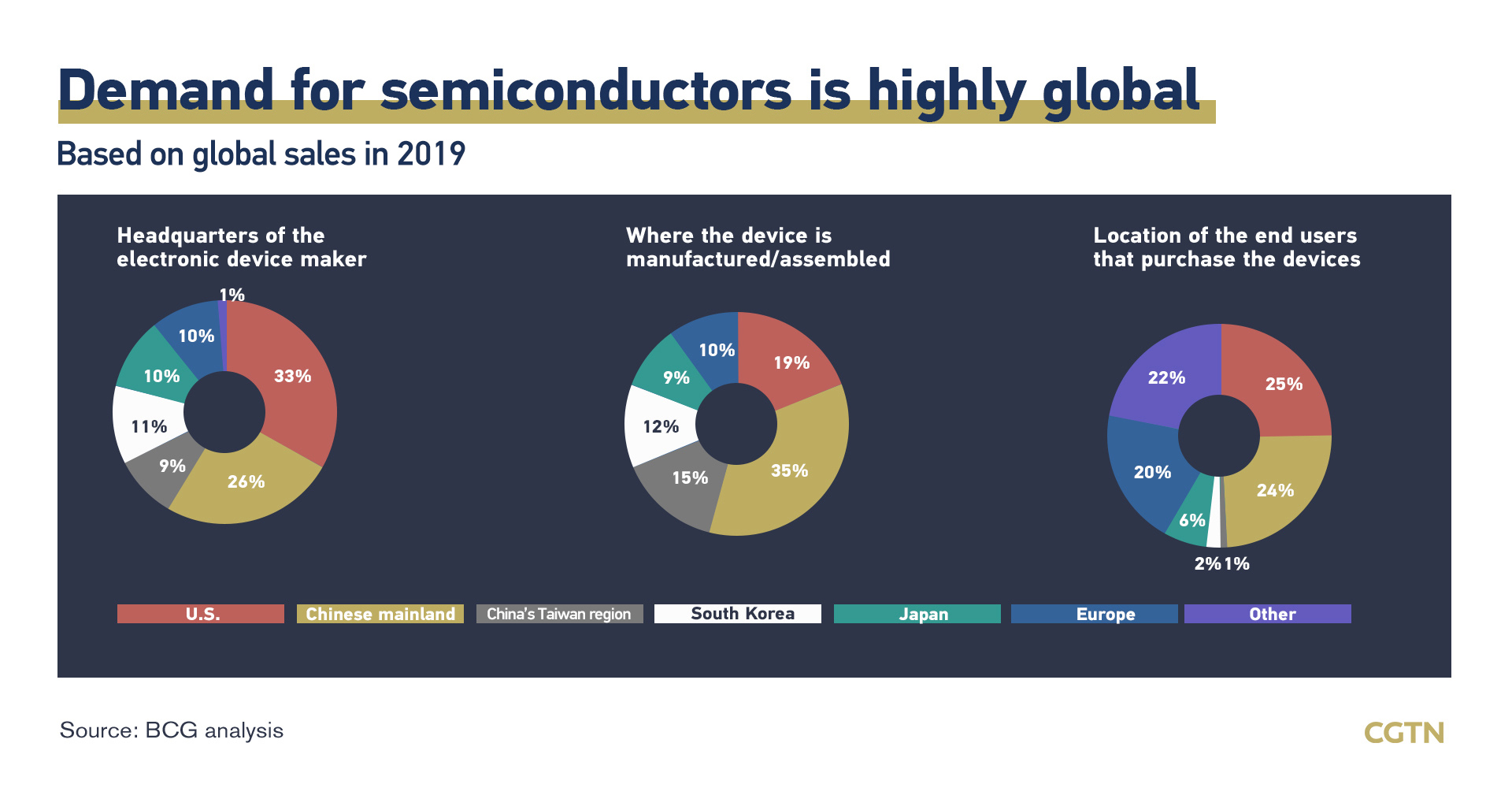

The curbs will hit leading chipmakers such as Intel and Samsung that have businesses in China. TSMC will also be affected, with chip plants on the Chinese mainland. They have to take sides between the world's two largest semiconductor markets – China and the U.S. – each accounting for about 25 percent of global consumption.

Semiconductors are the world's fourth most traded product, just after crude oil, refined oil and cars, according to Boston Consulting Group (BCG). More than 120 different countries, which are over 60 percent of the countries in the world, were involved as an exporter or importer of semiconductor products.

As semiconductor supply chain is highly global, with Chinese and American enterprises being deeply integrated, the restrictions will disrupt the global semiconductor supply chain and "hurt others without benefiting oneself," the Chinese Ministry of Foreign Affairs (MOFA) said a day after the chip act was signed.

Semiconductor supply chain is highly global

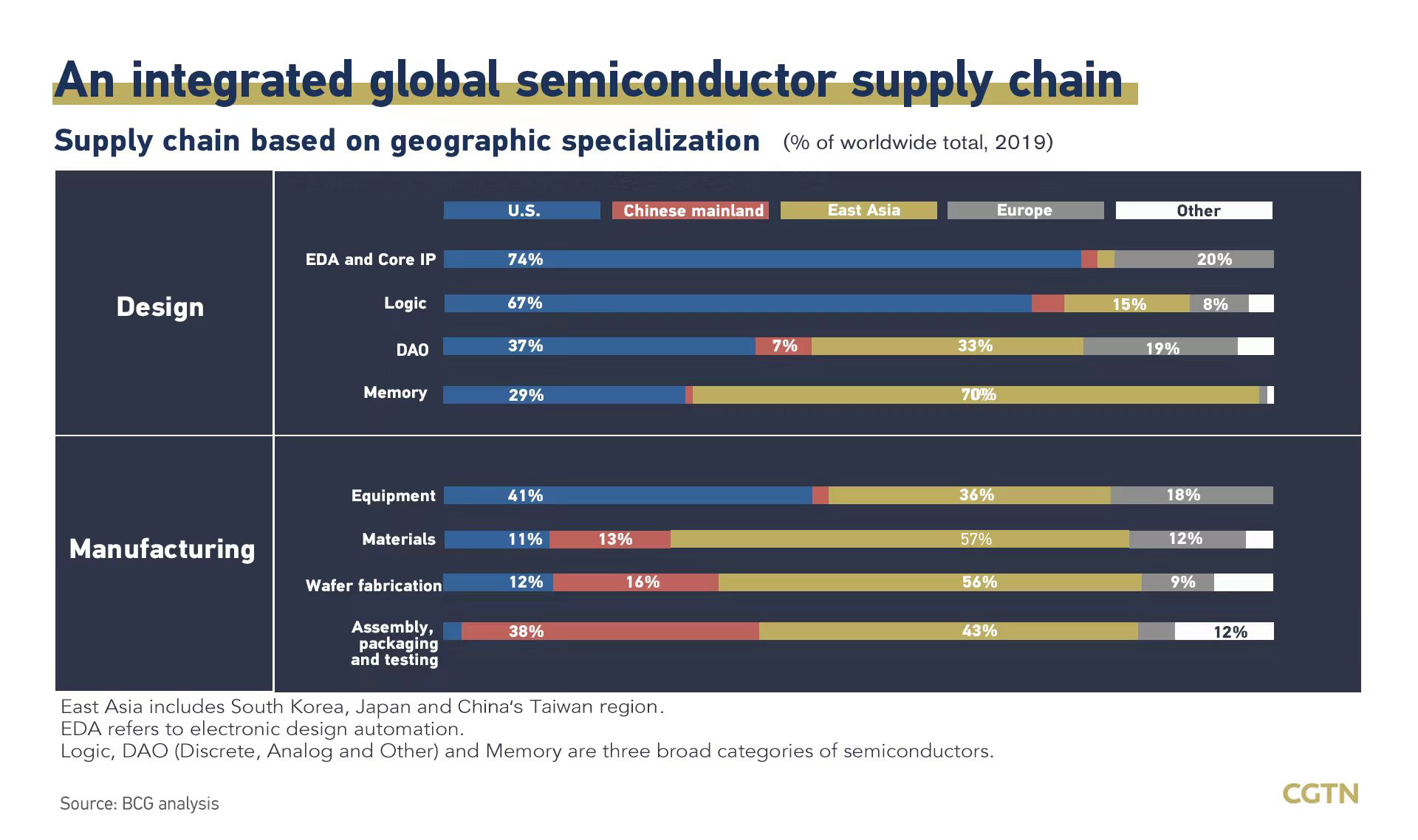

Semiconductors are highly complex products essential to design and manufacturing, with production involving over 50 types of sophisticated specialized equipment and hundreds of unique materials and specialty chemicals.

The need for deep technical know-how and scale has led to a highly specialized global supply chain, where there are six major regions – the U.S., South Korea, Japan, Chinese mainland, China's Taiwan region and Europe – which take different roles based on their comparative advantages.

Broadly speaking, the U.S. leads in the most R&D-intensive (research and development) activities, like chip design and manufacturing equipment. Asian countries are at the forefront of raw materials and manufacturing – wafer fabrication as well as assembly, packaging and testing.

Countries are interdependent on the integrated global supply chain, relying on free trade to move materials, equipment, Intellectual Property and products across the world to the optimal locations for performing each activity.

The U.S. chip act "is set to affect the optimized layout and security of the global chip supply chain and disrupt normal trade and investment activities," the China Council for the Promotion of International Trade said a day after the chip act was signed.

Semiconductor self-sufficiency is costly

Geographic specialization across the supply chain allows deep focus required for innovation, and the continuous innovation will ultimately benefit consumers and promote economic growth through better technology at lower prices, according to BCG's analysis.

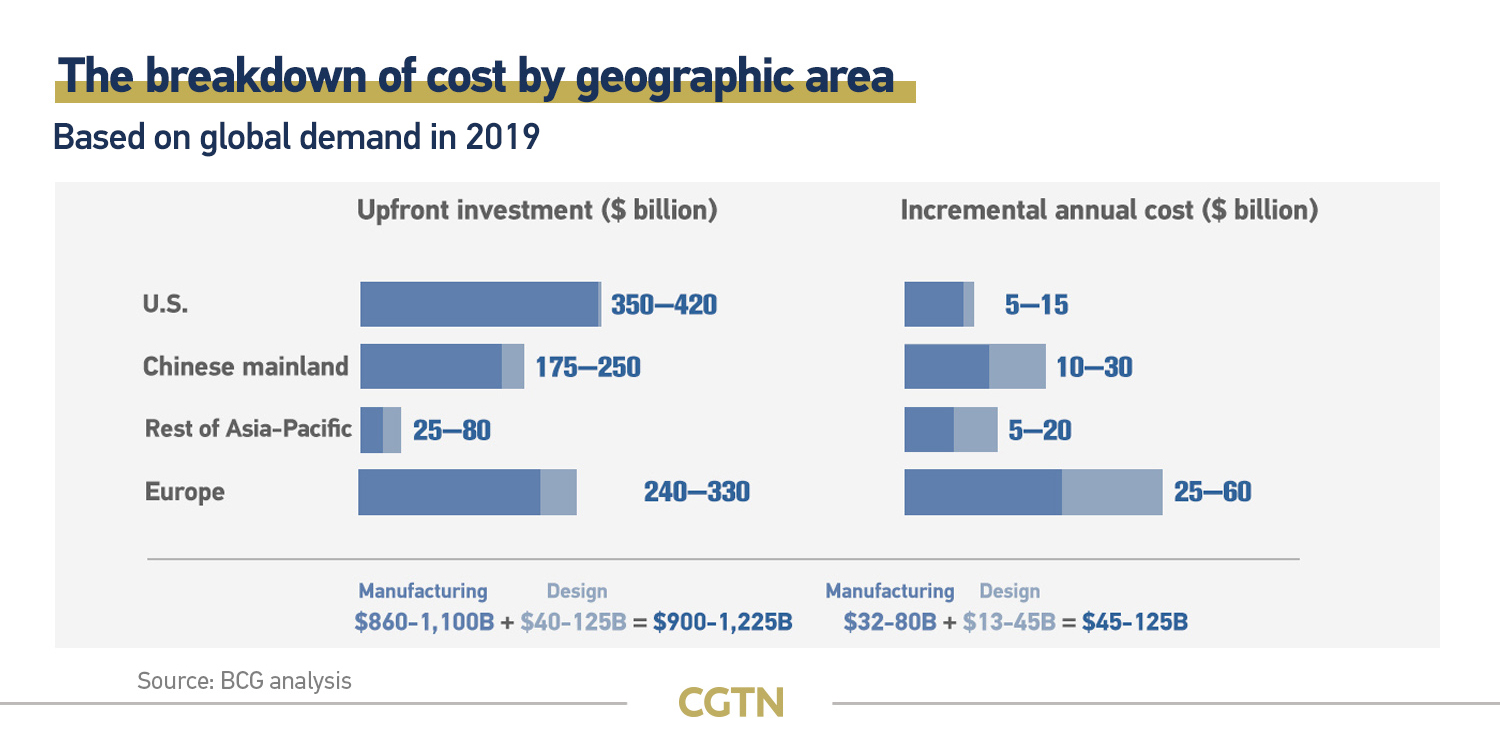

Risks fronted by the COVID-19 pandemic and geopolitical tensions may impair global access to semiconductor suppliers or customers. However, self-sufficiency is not the answer to addressing the risks, as the cost is staggering.

Self-sufficient supply chains would have required at least $1 trillion in upfront investment to meet global chip consumption in 2019, which would result in an increase of 35-65 percent in chip prices and ultimately higher costs of electronic devices for end users, BCG said.

BCG added that the solution to the risks is not to pursue self-sufficiency through large-scale national industrial policies with a staggering cost and questionable execution feasibility. "Government policies and incentives must also be in compliance with the norms of international trade."

The curbs hit leading chipmakers

Intel (U.S.), Samsung (South Korea) and TSMC (China's Taiwan region) are three companies in the world that can produce advanced chips at 10 nanometers or below, which are crucial for data centers, AI servers, PCs and smartphones.

China is the largest source of net revenue for Intel. The American chipmaker earned about $21.1 billion net revenue from China in 2021, accounting for a quarter of its global revenue. In contrast, its revenue in the U.S. was $14.1 billion last year, down 14.9 percent, according to Intel. It has been lobbying hard against the chip act's investment restrictions.

Samsung cannot afford to exclude Chinese companies from the supply chain, as 60 percent of South Korea's exported chips go to China. Semiconductors rank first in both exports and imports value between China and South Korea, according to China's General Administration of Customs.

TSMC ex-spokesperson Sun Youwen said there is not much to do with $52.7 billion subsidies, which is just a year of capital expenditure for a chip manufacturer. U.S. fabs ( a microchip manufacturing plant) require additional $40-45 billion of private sector investment to build and operate for 10 years, said BCG.

The total 10-year cost of ownership of a new fab in the U.S. is about 25-50 percent higher than in Asia. The average wages for skilled labor in Asia are up to 80 percent below the U.S.. It is an expensive move to increase chip production in the U.S., said TSMC founder Morris Chang.

"How to develop itself is the U.S. own business, but the approach needs to be in line with WTO rules," MOFA Spokesperson Wang Wenbin told a regular press briefing a day after the chip act was signed. He added that the U.S. chip act cannot undermine China's legitimate development interests.

U.S. chip stocks plummeted on the signing of the act. On August 9, Nvidia fell by 4 percent, while Intel dropped by 2.4 percent, the lowest since September 2017. The iShares Semiconductor ETF, which tracks performance of U.S.-listed chip equities, plunged about 20 percent over the past six months.