The press center for the 22nd meeting of the Council of Heads of State of the Shanghai Cooperation Organization in Samarkand, Uzbekistan, September 14, 2022. /Xinhua

The press center for the 22nd meeting of the Council of Heads of State of the Shanghai Cooperation Organization in Samarkand, Uzbekistan, September 14, 2022. /Xinhua

Editor's note: Bobby Naderi is a London-based journalist, guest contributor in print, radio and television, and documentary filmmaker. The article reflects the author's opinions and not necessarily the views of CGTN.

Consider it the first postcard delivered from the historic Uzbek city of Samarkand. The Shanghai Cooperation Organization's (SCO) Summit marks tectonic shifts of commercial and economic influence that could transform how Eurasian politics works. The much-anticipated gathering represents geopolitics and harmony among both small and big member states with huge markets across a vast region.

For the first time in three years, the leaders of SCO countries have discussed the bilateral, regional and global issues that have accumulated since the start of the COVID-19 pandemic. The various decisions and agreements for multifaceted cooperation and more will determine the future of the organization's development and growth with interlocking security guarantees.

As per the SCO's charter, the organization is not a bloc to pursue geopolitical goals or mandate specific agendas against other nations. The path put forward is expansion of trade and membership, industrial and technological cooperation, strengthening transport and economic interconnectedness, as well as promoting innovations, digital transformation and green economy. The organization contributes to regional stability and security.

The de-dollarization trend

The trend toward the de-dollarization of regional economies is already underway. We see how countries, including China and Russia, are diversifying their foreign exchange reserves, increasing investments in other currencies, and switching to settlements in national currencies. The intent is to reduce their dependence on the world's main reserve currency – the U.S. dollar – and for good reasons.

But why are more countries striving to switch to settlements in national currencies? Well, the most active participants in de-dollarization are China and Russia. The conflict in Ukraine has had an impact on Russian markets and the ruble, but it didn’t stop its trade with China since a growing percentage of business is done with the Chinese yuan. The de-dollarization in settlements between other regional states has gained momentum, since the yuan is being used by large companies with state participation, such as producers of energy resources and agricultural products.

The trade and tariff wars have had a negative impact on business worldwide and the negative consequences of this are felt both by direct and indirect participants. The U.S. is gradually losing its advantage and position in world markets. Trade and tariff wars, as well as the application of sanctions by the U.S. have hindered economic integration of the country and the world economy as a whole. In a multipolar world, a multipolar currency is required, and the only way out of this situation would be negotiations and unity in purpose at the SCO.

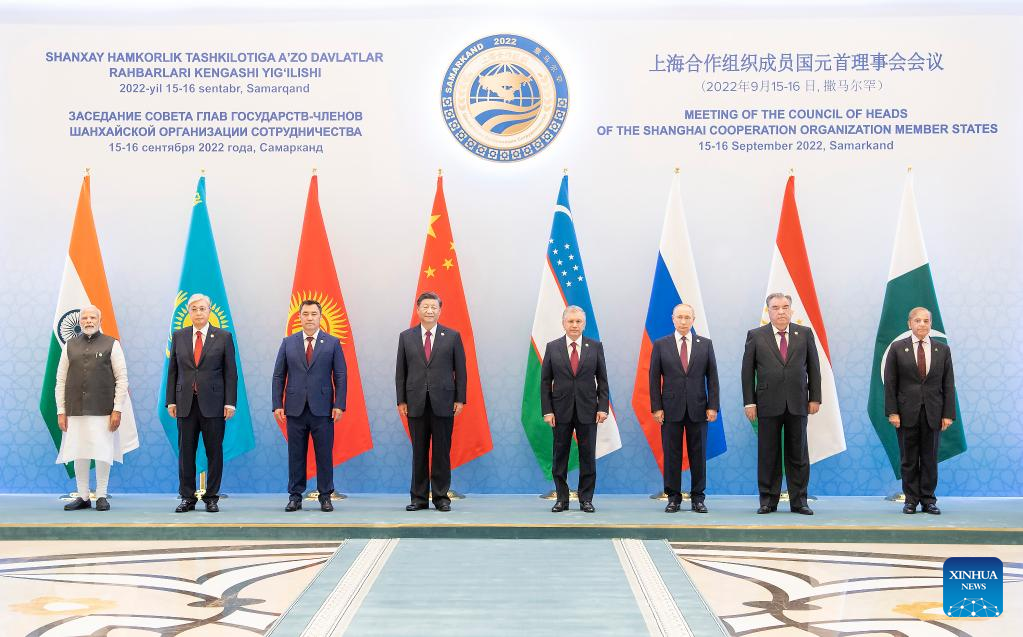

Chinese President Xi Jinping (4th L) poses for a group photo with other leaders of the SCO member states before the 22nd Meeting at the International Conference Center in Samarkand, Uzbekistan, September 16, 2022. /Xinhua

Chinese President Xi Jinping (4th L) poses for a group photo with other leaders of the SCO member states before the 22nd Meeting at the International Conference Center in Samarkand, Uzbekistan, September 16, 2022. /Xinhua

The Eurasian order

The SCO is a successful model of Eurasian integration. The groundwork for a new Eurasian order has been laid out as America's narrative about how the world works is collapsing. This year's summit sees an assembly of heads of state opposed to American unilateral dominance. It offers a vision of an emerging, coordinated geopolitical structure anchored in the Eurasian order and integration.

In the wake of an ongoing economic downturn and energy crisis in Western Europe and the waning of America's relative power, the SCO is increasingly becoming a relevant institution. This emerging organization is poised to expand: Three observer states are interested in acceding to full membership (Afghanistan, Belarus, Iran and Mongolia) and more.

Judging by the tone of recent pronouncements, the SCO is ready to snag new members in its embrace. Just like Beijing and Moscow, the potential member states also look upon Washington's foreign policy course with concern and do not share its policy of isolating countries. Accordingly, the SCO is strengthening itself and counterbalancing Washington's self-centered role in Eurasia.

By giving the green light on admiting new members, the SCO shows that it stands capable of rejecting exhausted policies and norms. It's no small geopolitical irony that Beijing and Moscow have both rejected Washington's application for observer status in 2006.

Additionally, the SCO seeks to modernize and diversify the economies of its member states with efficient logistics channels of incredible length. Among other things, the tying together of the Belt and Road Initiative (BRI) can translate into myriad transportation and construction projects for which China's industrial and engineering know-how will prove crucial.

The SCO countries are reconfiguring their transportation systems and economies to integrate with China and the BRI. Thanks to Beijing's political institutions and leadership, there will be new BRI investment funds, development banks, financial systems and infrastructure projects for those on board. The key agreements reached at this year's SCO summit are game-changing developments across Eurasia. Think of it as a basket of "win-win" deals for everyone.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com. Follow @thouse_opinions on Twitter to discover the latest commentaries on CGTN Opinion Section.)