China's move to boost the number of stocks eligible for margin financing and securities lending took effect Monday. Analysts believe this will help the government's efforts to aid the economy, support key sectors and attract more capital.

Last Friday, both the Chinese mainland's main bourses announced that they would collectively add 600 stocks to the current pool of stocks eligible for margin financing and securities lending.

In terms of market value, most of the newly-added 600 stocks are below 20 billion yuan ($2.76 billion), according to data collected by CICC Research.

"The new measures further broaden the coverage of stocks with small- and medium-sized market capitalization, and are conducive to promoting the allocation of market resources to key areas supported by the government," Li Qiusuo, managing director of market strategy at CICC Research, told CGTN.

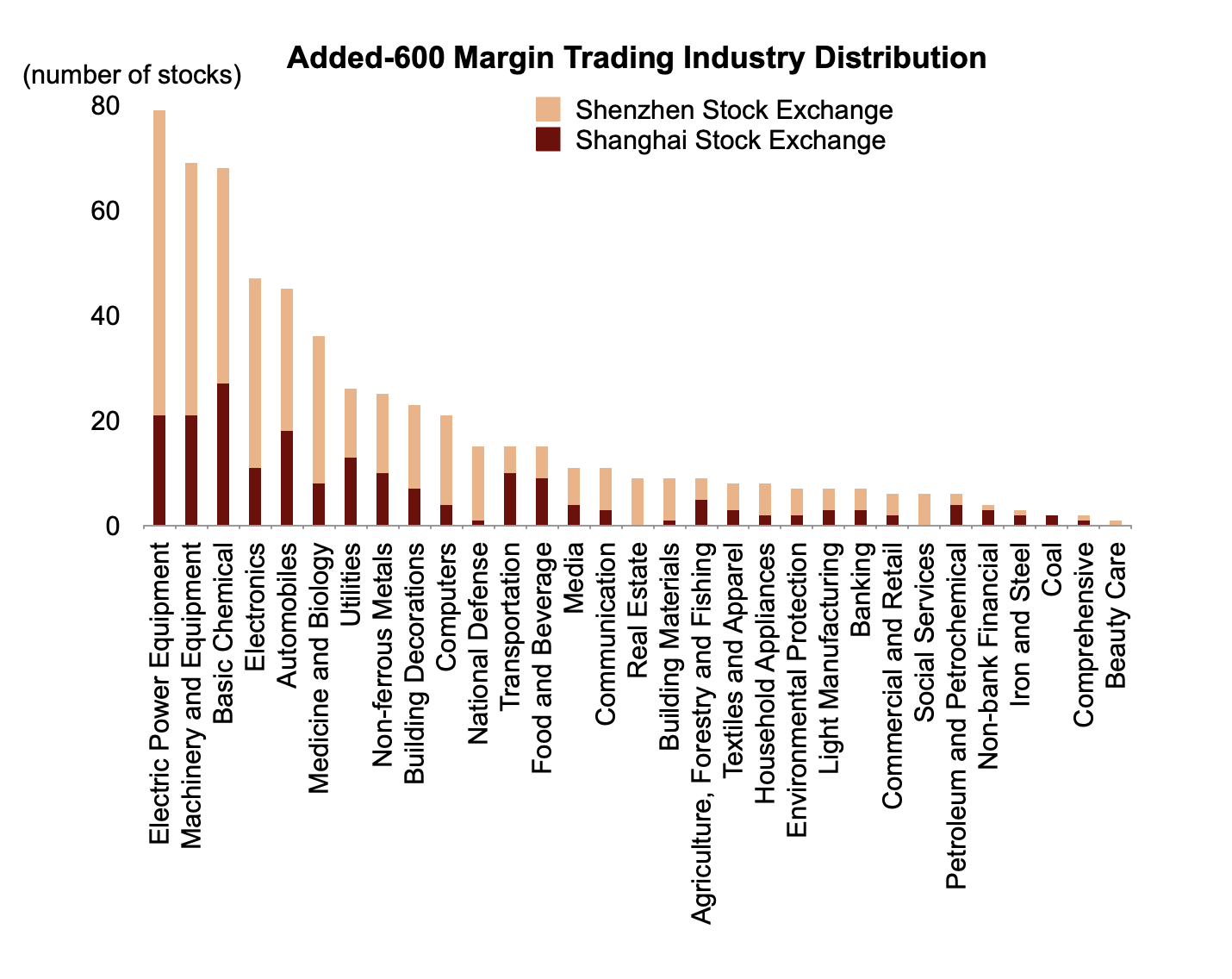

A graph shows the industry distribution of the newly-added 600 stocks eligible for margin financing and securities lending on the Shanghai and Shenzhen stock exchanges. Data courtesy of CICC, Wind. /Graphic by CGTN

A graph shows the industry distribution of the newly-added 600 stocks eligible for margin financing and securities lending on the Shanghai and Shenzhen stock exchanges. Data courtesy of CICC, Wind. /Graphic by CGTN

Industry-wise, the stocks are mainly focused on advanced manufacturing, the digital economy, low-carbon businesses and other key sectors.

The inclusiveness of the industry can better meet the trading needs of different types of investors in the market. Besides, it can help to improve the liquidity and trading activity and thus attract more incremental funds into the market, Wang Dan, chief economist at Hang Seng Bank told CGTN.

China introduced margin trading to its A-share market in 2010 to diversify its capital market. This latest move marks the seventh expansion of margin trading in China.

"The further broadening shows the maturity of the investors, the improvement of the corporate governance level, and the development of China's financial system," said Wang Jianhui, the general manager of the research and development department at Capital Securities.

(Cover image: CFP)