The U.S. Capitol building in Washington, D.C., the United States, January 25, 2021. /Xinhua

The U.S. Capitol building in Washington, D.C., the United States, January 25, 2021. /Xinhua

Editor's note: William Jones is a former White House correspondent for Executive Intelligence Review and a non-resident fellow of the Chongyang Institute for Financial Studies, Renmin University of China. The article reflects the author's opinions, and not necessarily those of CGTN.

With all the hype about the beauty of American "democracy" by the powers-that-be, the reality of the U.S. election system that has developed over the last several decades is that "the people's choice" is often the choice of those who have the money to finance what a political campaign costs these days.

The various measures that have been taken to create the impression that money is not the issue, such as the proposal to give Federal "matching funds" in a federal election to candidates who show they have a certain amount of popular support, have usually been sops to convince the voters that money is not the issue. But few people are convinced by such token efforts.

Yet, even when a legislator has succeeded in getting elected, the money factor also plays a major role. On the one hand there are numerous and well-funded lobbyists who are interested in crafting legislation that will benefit their particular constituency. And collaboration on crafting beneficial legislation can so lead to major contributions for the legislator when he is again up for reelection.

The opportunities for corruption are rife in the U.S. electoral system. This was recently brought to light by continual incidents of "insider trading" by members of Congress or by their relatives.

"Insider trading" is a matter of placing your money in an appropriate position if you have "inside information" that something is going to happen on the markets which would assure you a "killing," for instance, legislation that would lower or increase the value of a particular financial product.

Congress did pass legislation the Stop Trading on Congressional Knowledge Act of 2012 or STOCK Act, which makes it illegal for congressmen to use insider knowledge for trading and requires that any trading in stocks be made public within 30 to 45 days. There have been numerous violations of this act, however, which results in a simple fine, beginning with a fine of $200.

In 2020, there were a number of cases of congressmen, who violated the somewhat loose restrictions on insider trading, with the then head of the Senate Intelligence Committee Richard Burr having to give up his committee assignment as a result of his abuses, but still holding his seat in the Senate.

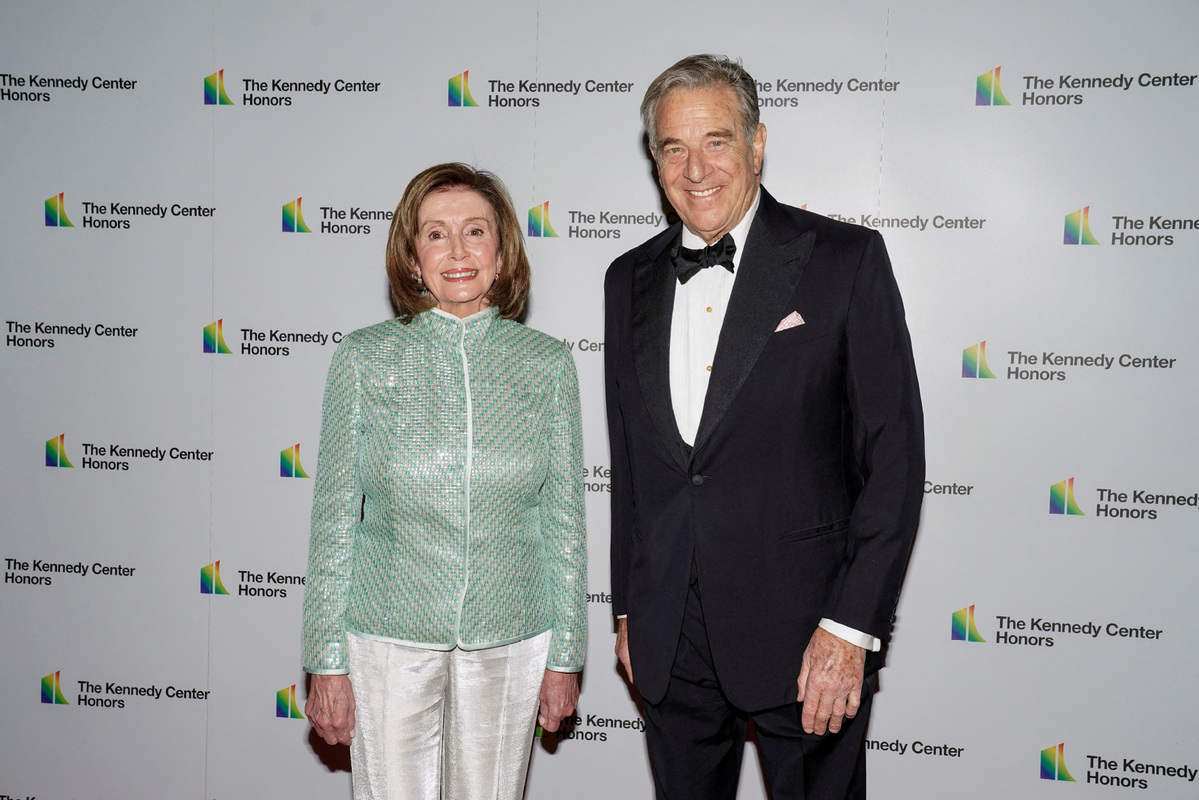

More recently, there were a number of cases, even involving Paul Pelosi, the husband of U.S. House Speaker Nancy Pelosi, and a venture capitalist, who had real access to pending legislation through his wife. Speaker Pelosi has consistently opposed legislation that would ban stock trading by members of Congress or their spouses while they are in office.

U.S. House Speaker Nancy Pelosi and her husband Paul Pelosi at the Library of Congress in Washington, D.C., the United States, December 4, 2021. /CFP

U.S. House Speaker Nancy Pelosi and her husband Paul Pelosi at the Library of Congress in Washington, D.C., the United States, December 4, 2021. /CFP

Once again, the air of corruption has led to new legislation to ban such trading. A resolution by U.S. Senators Mark Kelly and Jon Ossof, the Ban Congressional Stock Trading Act, was introduced in January that would ban stock trading by members of Congress. Both of these members had put their stocks in a "blind trust" when they were elected to Congress, meaning that they could make no decisions themselves on how the stocks would be traded.

But they were the only two members to do so. According to polls – across the political spectrum – 76 percent of voters believe members of Congress and their spouses should not be allowed to trade stocks while in office, including nearly 78 percent of Republicans and 80 percent of Independents.

Nevertheless, very few legislators were willing to give up such a "cash cow" simply because of public demand. A similar bill was also introduced with some Republican backing. But the legislation never went anywhere.

It's not so unusual that many Republicans would be averse to such legislation, often representing major industrial or financial interests for whom the "free market" is sacrosanct.

For Democrats it is another question. They achieved victory in the 2020 election on a campaign where they said they would eliminate stock trading by congressmen. But Pelosi, who is known as the "Queen of Stonks (a share of the value of a company that can be bought, sold, or traded as an investment)," was opposed to the bill.

The Pelosis are worth over $46 million, making her one of the 25 richest members of Congress. Under pressure, she agreed in July to develop an alternative, which she knew would never see the light of day with the press of business before the November elections.

A New York Times analysis published in September showed that 97 current members of Congress had bought or sold stock, bonds or other financial assets that intersected with their congressional work or reported similar transactions by their spouse or a dependent child.

Given these conditions, it should be no wonder why the U.S. population has lost confidence in the people they elected. While they look for honesty and integrity in the people they have elected, they always seem to end up with a Congress that money can – and does – buy.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com. Follow @thouse_opinions on Twitter to discover the latest commentaries in the CGTN Opinion Section.)