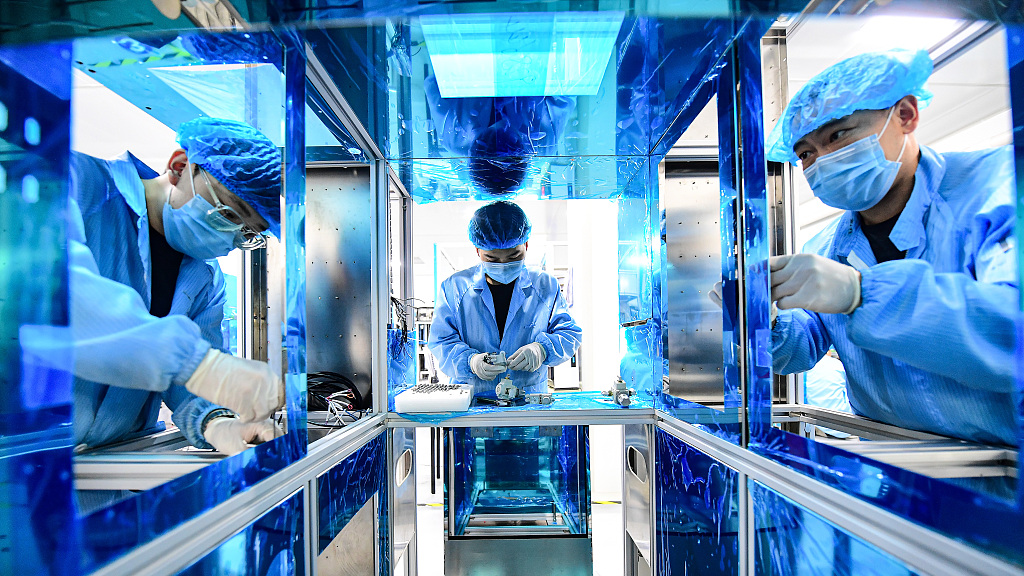

Technical personnels work at the semiconductor manufacturing company Shenyang Xinda Equipment Mfg Co. Ltd., in Shenyang, northeast China's Liaoning Province, June 23, 2022. /CFP

Technical personnels work at the semiconductor manufacturing company Shenyang Xinda Equipment Mfg Co. Ltd., in Shenyang, northeast China's Liaoning Province, June 23, 2022. /CFP

Editor's note: Djoomart Otorbaev is the former prime minister of the Kyrgyz Republic, a distinguished professor of the Belt and Road School of Beijing Normal University, and the author of the forthcoming book "Central Asia's Economic Rebirth in the Shadow of the New Great Game"(Routledge, 2023). The article reflects the author's views and not necessarily those of CGTN.

The World Conference on Integrated Circuits in Hefei, capital of east China's Anhui Province, which ended on November 18, was attended by about 200 participants from more than 20 countries, including the U.S., Japan, South Korea, Germany and the UK. Organized by the Chinese government, it is considered the most significant event in microelectronics.

In light of the latest U.S. semiconductor export restrictions in October, Beijing is keen to ensure stability in its chip supply chains. The event adopted a communique under the title "Hefei Initiative," calling for win-win international cooperation, but what is happening in this critically crucial high-tech area?

This year has become a rubicon in the ongoing competition between the two world powers for leadership in the newest semiconductors. On August 9, U.S. President Joe Biden signed into law the CHIPS and Science Act of 2022. His government provides $52 billion in subsidies to the American semiconductor industry. U.S. politicians wanted to reduce their reliance on foreign chip makers, such as Taiwan Semiconductor Manufacturing Company (TSMC), which makes up 90 percent of the world's most advanced chips, according to a 2021 Boston Consulting Group report.

The law specifically placed restrictions on companies doing business in China, the world's largest consumer of semiconductors. Washington also intends to form an anti-China alliance called Chip 4, which will include the U.S., Japan, South Korea and the Taiwan region to cooperate in producing future semiconductors.

On October 7, the U.S. Department of Commerce introduced additional drastic measures to prevent China from acquiring Western technology and equipment to produce the newest semiconductor chips. Nine new rules have been issued that will tighten controls on the export of advanced chips and parts for supercomputing centers.

The paradox is that with those discriminatory actions, the U.S. government, on the one hand, undermines the commercial interests of their own companies and, on the other hand, forces other competitors to take retaliatory actions both to subsidize their companies and to increase even further investment in research and development (R&D). As Mark Lipacis of the Jefferies investment bank estimated, other leading chip-producing countries and regions such as China, the EU, Japan, South Korea and Taiwan plan to subsidize domestic chip production over the next three years by $85 billion annually.

Due in part to these actions, the combined market capitalization of U.S. semiconductor companies has already fallen by more than $1.5 trillion this year. Since July, third-quarter sales of major U.S. chipmakers have fallen from $99 billion to $88 billion.

China imported $400 billion worth of semiconductors in 2021. For example, Intel's sales in China in 2021 amounted to $21 billion out of a total of $79 billion. Nvidia said a previous round of restrictions that limited sales of advanced data center chips to Chinese and Russian customers would cost it $400 million in third-quarter sales, equivalent to six percent of its total revenue.

People visit the booth of Intel during the 2022 China International Fair for Trade in Services, in Beijing, capital of China, September 4, 2022. /CFP

People visit the booth of Intel during the 2022 China International Fair for Trade in Services, in Beijing, capital of China, September 4, 2022. /CFP

Earlier restrictions targeting Chinese companies developing chips for supercomputers and artificial intelligence devices have dealt a massive blow to Applied Materials, KLA and Lam Research, which are among the top five global companies in this field, as about 30 percent of their revenue comes from China. Goldman Sachs says the U.S. government's actions will cost global chip makers $6 billion in lost revenue this year, the equivalent of nine percent of their projected sales.

The prevailing opinion among the public and politicians has long been that Chinese firms cannot produce advanced equipment for manufacturing the latest chips. For example, without equipment for lithography using the latest Extreme Ultra-Violet technology developed by industry leaders such as Dutch ASML and U.S.' Synopsis and Cadence. Or without Electronic Design Automation equipment from Siemens from Germany.

There is also an unsubstantiated belief that China cannot produce semiconductors without making equipment like those produced by industry leaders such as the American companies Applied Materials and Lam Research or control equipment manufactured by the American KLA. Most experts emphasize that this is true, but this lag is only temporary. Chinese companies are rapidly catching up with their competitors in all these industries.

With the imminent tightening of U.S. semiconductor sanctions, China outlined an ambitious program to develop a fully autonomous supply chain to produce the latest microchips a long time ago. Now the electronic industry association SEMI, which monitors the entire electronics manufacturing and design supply chain, has estimated that about 80 Chinese companies are actively engaged in R&D and production of the latest manufacturing equipment.

Today, experts rank AMEC as one of the most successful Chinese semiconductor producers, selling etching and chip testing tools to global market leaders such as Intel, TSMC, Samsung, and Micron. According to CS Insight and other sources, AMEC has demonstrated the ability to produce a dielectric with a chip size of five nanometers. Another Chinese lithography equipment manufacturer, SMEE, is reportedly working on a new argon fluoride immersion lithography tool that can be used to fabricate multi-patterned seven nm chips.

It has become crystal clear to all leading countries that their future will be determined by their ability to be successful with the latest technologies. Therefore, in these industries, the best talents are drawn, and massive investments are made. Closing yourself from everyone and thinking everything will succeed is a naive and short-sighted policy. Today's world has become more interdependent than ever, and the life of humankind can only be improved together.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com. Follow @thouse_opinions on Twitter to discover the latest commentaries in the CGTN Opinion Section.)