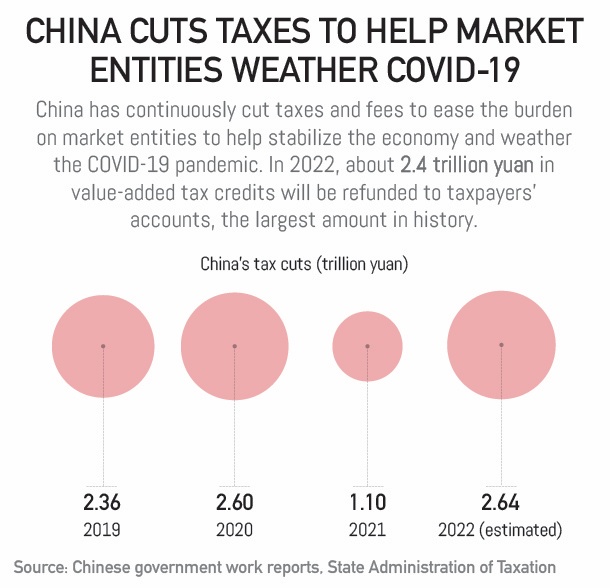

China has continuously cut taxes and fees to ease the burden on market entities and stabilize the economy to weather the COVID-19 pandemic.

In 2022, about 2.4 trillion yuan ($340 billion) worth of value-added tax credits will be refunded to taxpayers' accounts, which is the largest refund in history, according to the Chinese Ministry of Finance.

The country has increased tax cuts for micro-, small- and medium-sized enterprises this year, and tax refunds along with cuts and deferrals of tax and fee payments will exceed 4 trillion yuan this year.

Thanks to a series of supportive tax and fee policies adopted by the government, over 80 percent of the country's privately or individually-owned businesses currently do not need to pay taxes, and the average tax paid monthly by eligible businesses this year is 40 percent lower than that in 2019.

Over the past three years, approximately 1.03 trillion yuan of tax and fee reduction has been granted to the privately or individually-owned businesses, according to the State Administration of Taxation.

(Data edited by Yao Nian; graphics designed by Mukesh Mohanan)