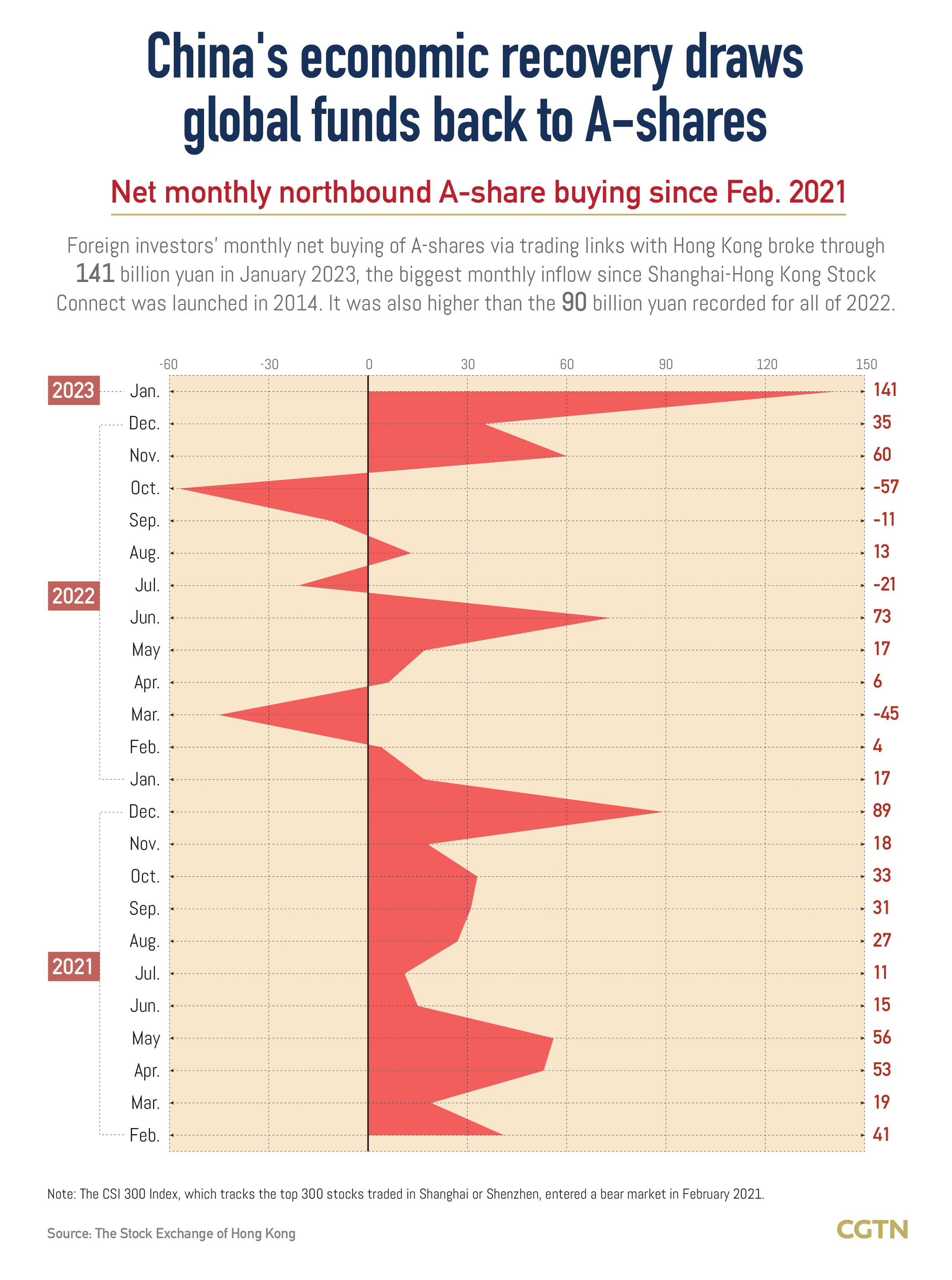

China's stock market kicked off 2023 with a reopening-driven rally, as foreign investors snapped up record Chinese equities worth 141 billion yuan (about $21 billion) in January on bets of the country's strong economic rebound.

The 141 billion yuan last month was the biggest amount of monthly foreign inflows since 2014, when a Stock Connect program was launched to allow foreign investors to buy Chinese mainland shares via Hong Kong. It was also higher than the 90 billion yuan recorded for the whole year of 2022.

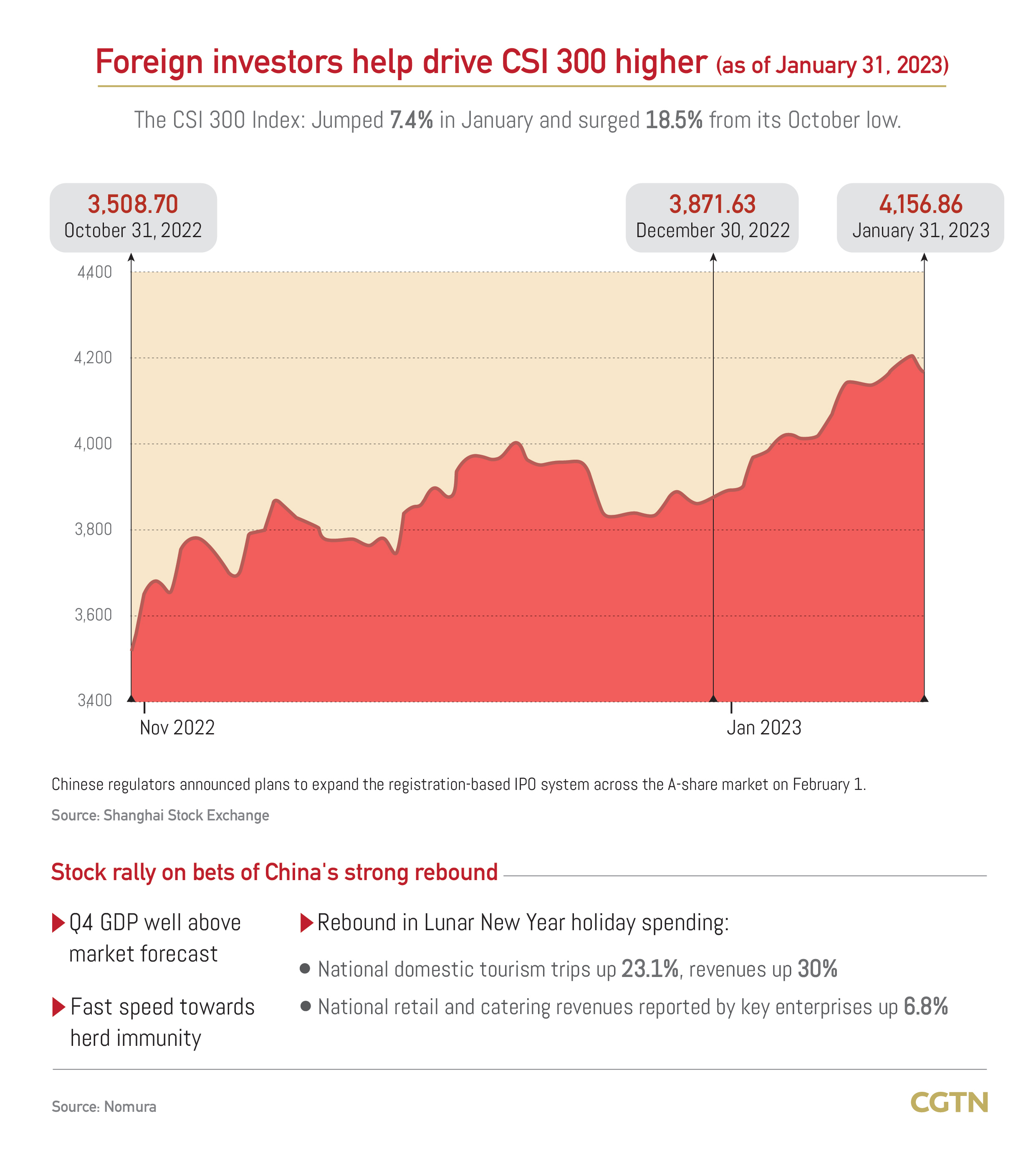

The foreign funds inflows help drive the benchmark CSI 300 Index to reach the brink of a bull market at the end of January. Tracking the top 300 stocks traded in Shanghai or Shenzhen, the CSI 300 Index jumped 7.4 percent in January and surged 18.5 percent from its October low.

The surge in foreign demand for A-shares was boosted by robust economic data published after the Chinese Lunar New Year holiday, which had reinforced foreign investors' confidence in China's economic recovery.

During the seven-day holiday, China's domestic tourism trips and revenues surged 23.1 percent and 30 percent from a year earlier respectively, while national retail and catering revenues reported by key enterprises rose by 6.8 percent year on year.

The consumption rebound was due to faster-than-expected speed towards herd immunity after China lifted COVID-19 restrictions last December, as data from the Center for Disease Control and Prevention showed around 80 percent of China's population has been infected with COVID-19.

"China's recent reopening has paved the way for a faster-than-expected recovery," said the International Monetary Fund in its latest version of the World Economic Outlook published on January 30, where it raised China's GDP growth forecast for 2023 to 5.2 percent.

Some investors believe strong foreign inflows will help keep China's stock market going up in the coming months after a short-term pullback.

"From a macro standpoint, the Chinese economy is on path to a solid recovery, supported by post-COVID reopening and a multitude of policy support," Aidan Yao, senior emerging Asia economist at AXA Investment Managers, wrote in an opinion on the South China Morning Post.

Yao noted, "Equity markets have started to price in these improvements, but there is room for further rerating." He added that underpinnings of China's equity market are solid enough to support further recovery.

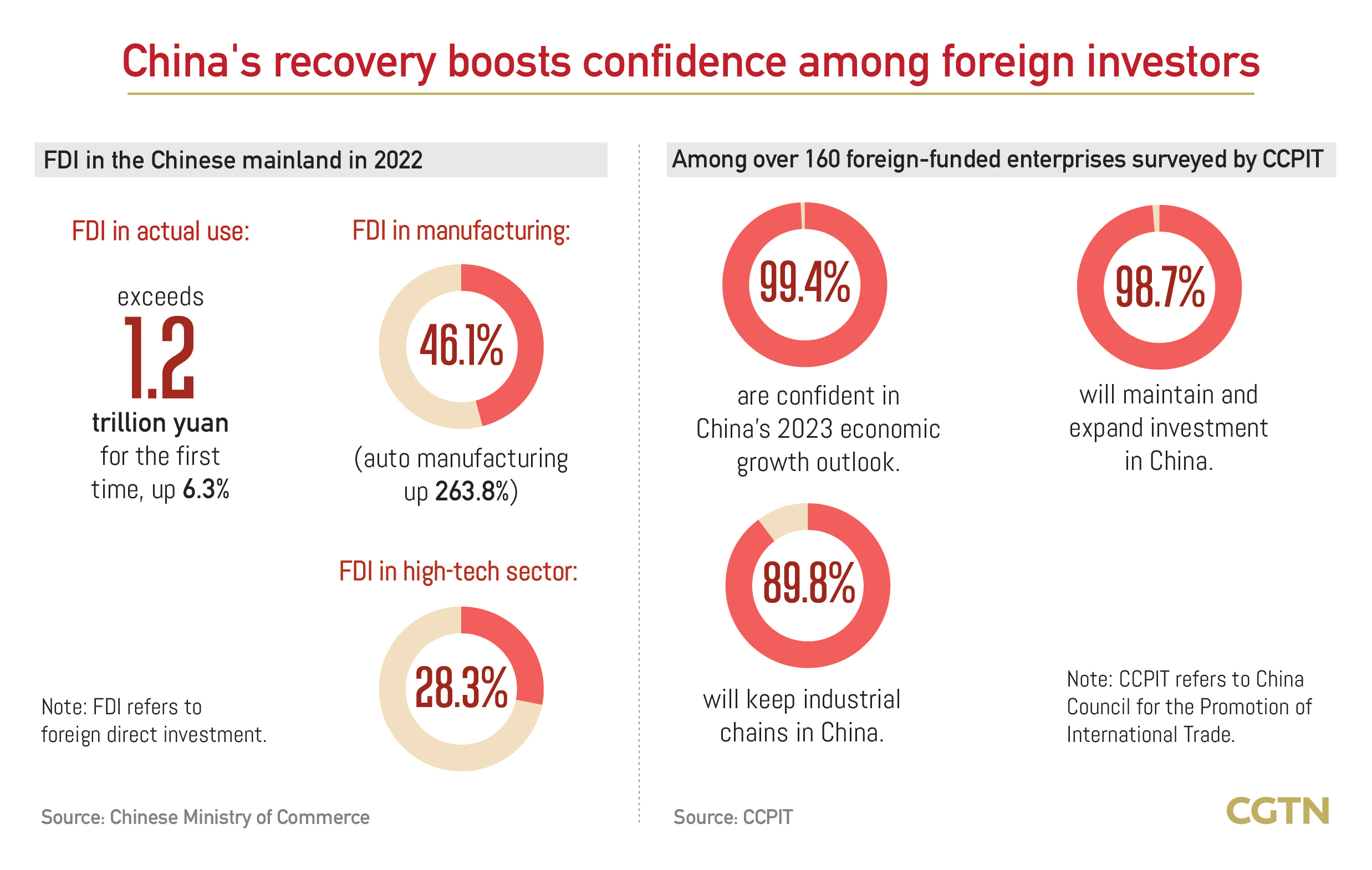

China's economic recovery is boosting confidence among foreign investors. Among over 160 foreign-funded enterprises surveyed recently by the China Council for the Promotion of International Trade, 99.4 percent are confident in China's economic growth outlook this year.

(Data editor: Yao Nian; Graphics designer: Mukesh Mohanan)