Silicon Valley Bank headquarters in Santa Clara, California, U.S., March 13, 2023. /CFP

Silicon Valley Bank headquarters in Santa Clara, California, U.S., March 13, 2023. /CFP

Editor's note: Ross Dong is the managing partner at Morning Cloud Fund Management, a U.S.-based asset management firm focused on macro strategy and U.S.-listed stocks. The article reflects the author's views and not necessarily those of CGTN.

U.S. regulators have closed down Silicon Valley Bank (SVB) due to inadequate capital and insolvency issues.

The Federal Deposit Insurance Corporation (FDIC) has assured that all depositors of SVB will have access to their funds.

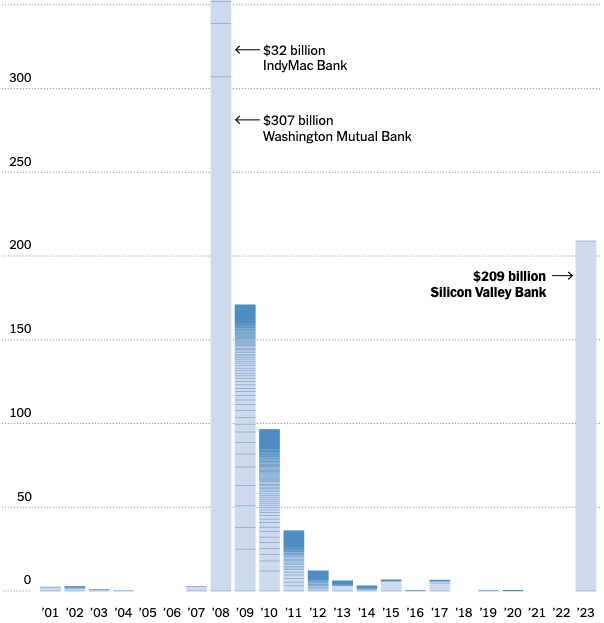

SVB's total assets amount to about two-thirds of Washington Mutual (not adjusted for inflation), which itself failed in 2008.

SVB is facing significant liability issues, relying heavily on institutional and venture capital-backed funding instead of traditional retail deposits.

Source: Federal Deposit Insurance Corporation

Source: Federal Deposit Insurance Corporation

Ironically, most banks failed in the past due to credit risk issues. However, SVB is unique in that its primary issue was a duration mismatch between high-quality assets and deposit liabilities.

According to former Treasury Secretary Larry Summers, "SVB committed one of the most elementary errors in banking: borrowing money in the short term and investing in the long term."

Our perspective is that the management of SVB bears primary responsibility for the collapse of the nation's 16th-largest bank. It was a man-made disaster.

Investment securities accounted for as much as 57 percent of SVB's balance sheet, with a large exposure to liquidity risk.

The credit ratings of bond assets such as institutional housing mortgage loans and institutional commercial mortgage loans were not low, and they could be fully paid off upon maturity.

However, their liquidity was far lower than that of U.S. Treasuries. And given the Federal Reserve's continuous increase in overnight interest rates in the current macro environment, the interest rates that SVB had offered to depositors before were no longer attractive.

Once faced with a run on deposits, problems were inevitable.

We believe that the impact of the SVB incident on the U.S. financial system is far lower than the risk portrayed by the media, at least for the time being.

Since the 2008 financial crisis, Basel III agreements have tightened banking regulations significantly and the balance sheets of large U.S. banks are currently healthy, with risks at small- and medium-sized regional banks temporarily manageable.

This does not mean that problems will not arise in the future, but at least the risks are currently under control.

Regarding potential financial risks in the future, I would like to describe it with a saying: When you see one cockroach in the kitchen, there are already many more wandering around.