Editor's note: CGTN's First Voice provides instant commentary on breaking stories. The column clarifies emerging issues and better defines the news agenda, offering a Chinese perspective on the latest global events.

According to reports, the G7 summit from May 19 to May 21 in Hiroshima, Japan, will focus on countering "economic coercion." Reuters has reported that the G7 statement is set to include "a section specific to China" with a list of concerns that include "economic coercion and other behavior that we have seen specifically from the [People's Republic of China]." And a separate "economic security statement will speak more to tools" used to counter coercive efforts.

In a regular press conference, Chinese Foreign Ministry Spokesperson Wang Wenbing responded that "if any country should be criticized for economic coercion, it should be the United States." Indeed, as the largest economic coercer in the world, U.S.'s actions can be likened to a thief crying "stop thief!" As of 2021, the U.S. has imposed sanctions on nearly 40 countries around the globe, affecting almost half of the world's population.

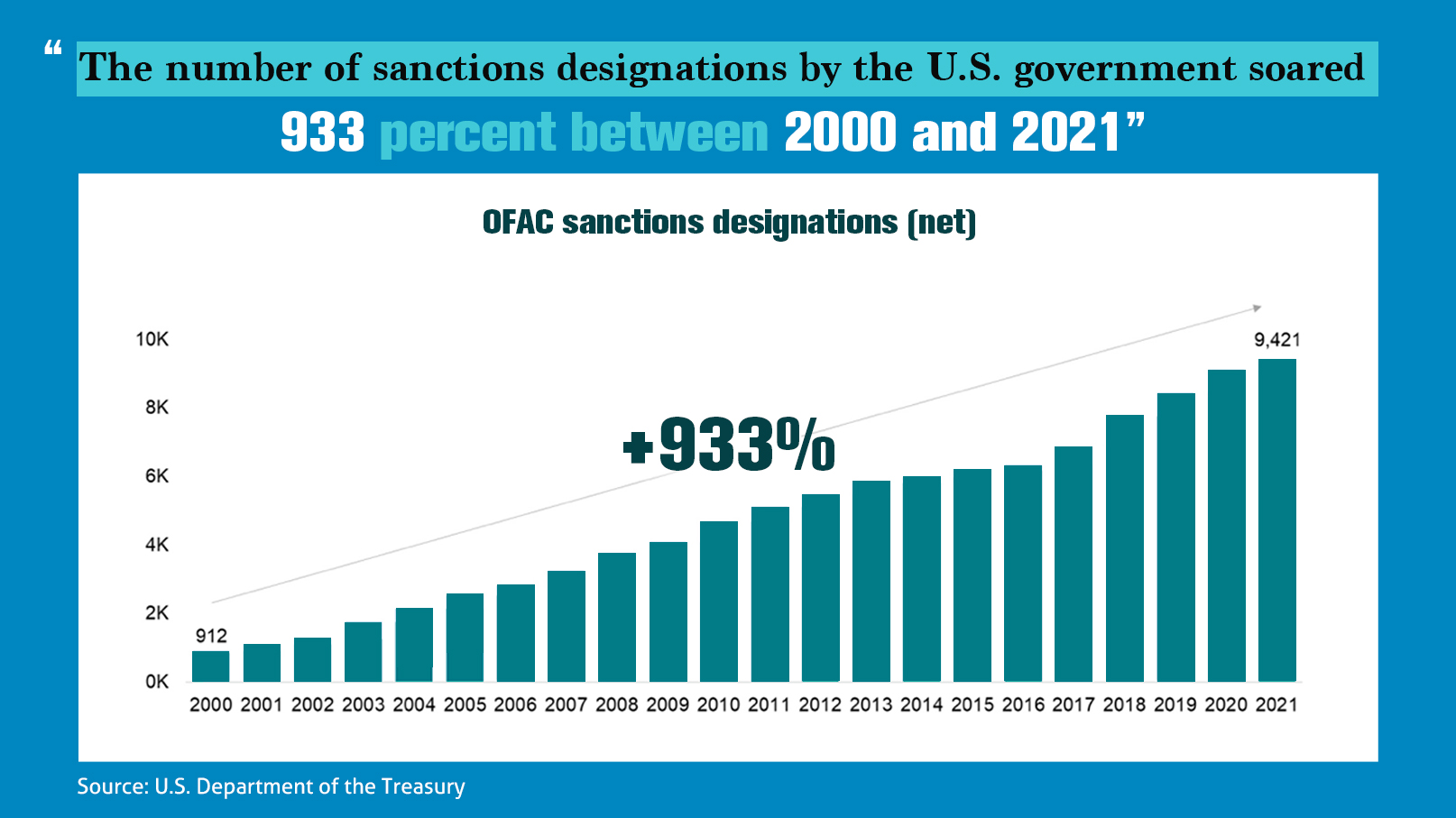

The number of sanctions designations by the U.S. government soared by 933 percent between 2000 and 2021, according to Newsweek. The Trump administration alone imposed more than 3,900 sanctions, or three per day on average within four years. More than 9,400 sanctions designations had come into effect in the U.S. by fiscal year 2021. As a Newsweek editorial aptly put it, "Washington has become addicted to sanctions like a 5-year-old is addicted to candy."

G7 members are also victims of U.S. economic coercion and bullying. Touting an alliance with shared values, the U.S. government stands ready to sacrifice G7 countries for its "America First" and "American Company First" doctrine. Washington's economic coercion is an irrefutable fact. The U.S. Inflation Reduction Act is forcing European firms to transfer their production line onto the American soil. Companies such as Toshiba of Japan, Siemens of Germany, and Alstom of France have all been subjected to these seemingly retaliatory or protectionist U.S. sanctions.

Considering that the U.S. has been so "friendly" even to its allies, it's even easier for it to coerce and bully other countries. For 60 years, the U.S. has imposed a blockade on Cuba's economy, commerce, and finance. It introduced SWIFT bans on Iran twice in 10 years, and prohibited individuals and estates from importing crude oil from Venezuela. It joined hands with other Western countries to intensify sanctions on Russia, blatantly forcing other countries from using China-made equipment and cooperating with China.

In addition, the U.S. has for a long time implemented "long-arm jurisdiction" over other countries, forcing its own laws onto other countries. It has been using laws such as the Foreign Corrupt Practices Act, the Patriot Act and the CLOUD Act to control global information flow, intelligence and data. It has imposed its "long-arm jurisdiction" over the entire world.

From 2009 to 2017, the United States took away $190 billion in fines from Europe alone, and has obtained a large amount of internal corporate data. Some international companies were acquired by the U.S. companies after been forced to close down due to the long-arm jurisdiction sanctions. The Alstom case and the BNP Paribas case are the typical example of it.

American politicians and media have been adept at taking advantage of the discursive hegemony to distort facts and manipulate the public opinion. The theory of China's "economic coercion" is Washington's old tactic of containing China. In reality, China is now the primary trading partner of more than 140 countries and regions in the world. It has made significant contribution to global economic development.

According to World Bank's estimates, China's Belt and Road Initiative is set to lift approximately 7.6 million people out of extreme poverty and 32 million people out of moderate poverty worldwide by 2030. Chinese infrastructure projects are assisting countries in their economic development across the globe. Indeed, China has contributed to 38 percent of global growth between 2013 and 2021.

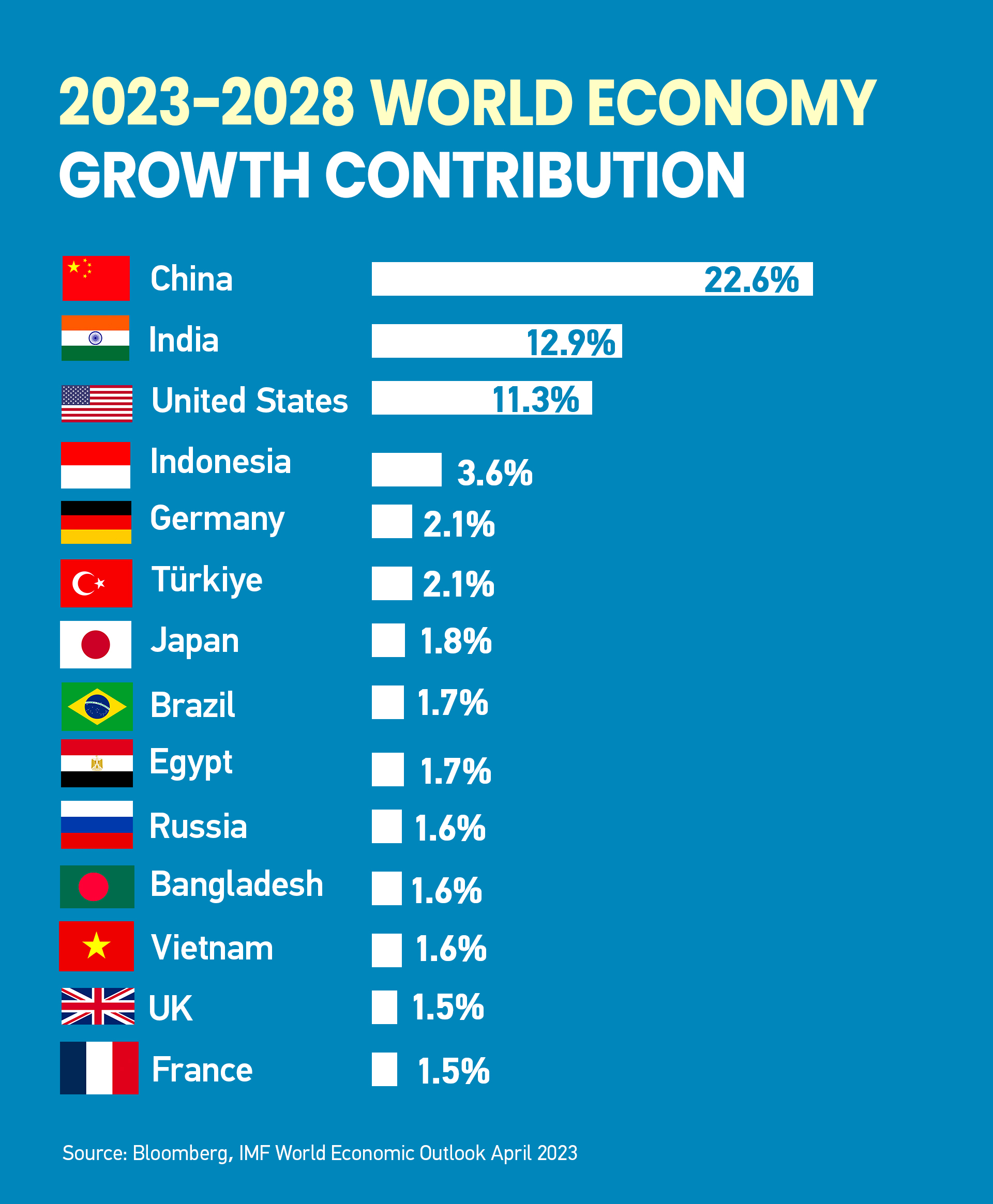

The IMF predicts that China will contribute 34.9 percent of global growth this year. A recent IMF staff analysis found that when China's growth rate increases by 1 percentage point, growth in other countries rises by around 0.3 percentage points. And Bloomberg's report shows that, from 2023 to 2028, China's contribution to the global economy will reach 22.6 percent. The U.S. will account for only half of that.

According to Australia's Lowy Institute, in 2001, over 80 percent of countries with data available engaged in a larger volume of trade with the U.S. than with China. That figure had fallen to just over 30 percent by 2018.

This growing desperation on America's part is leading it to use any tools at its disposal in an attempt to reverse this decline. However, these desperate attempts run the risk of destabilizing the global economy. International Monetary Fund (IMF) Managing Director, Kristalina Georgieva, warned this month that trade tensions could potentially escalate into a new Cold War, which would be detrimental to global growth.

China is generously sharing its economic successes with the world. This naturally raises the question: What does the U.S. have to offer beyond the hysteria and pointing fingers? Instead of pointing fingers and projecting its own faults onto other nations, the U.S. would do well to focus on getting its own house in order and thinking about its own development.

After all, what the world needs is a responsible leader who can truly contribute to the betterment of all countries' future.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com. Follow @thouse_opinions on Twitter to discover the latest commentaries in the CGTN Opinion Section.)