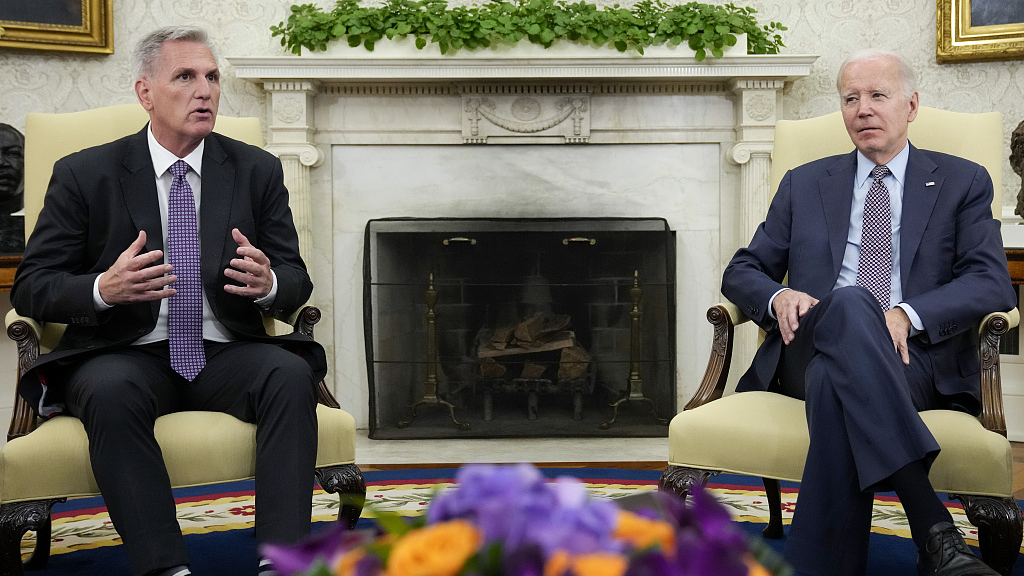

House Speaker Kevin McCarthy (L) speaks as he meets with President Joe Biden to discuss the debt limit in the Oval Office of the White House in Washington, D.C., U.S., May 22, 2023. /CFP

House Speaker Kevin McCarthy (L) speaks as he meets with President Joe Biden to discuss the debt limit in the Oval Office of the White House in Washington, D.C., U.S., May 22, 2023. /CFP

Negotiators for Democratic President Joe Biden and top congressional Republican Kevin McCarthy held what both sides called productive talks on Wednesday to try to reach a deal to raise the United States' $31.4 trillion debt ceiling and avoid a catastrophic default.

After a four-hour White House meeting, U.S. House Speaker McCarthy said negotiations had improved and would continue in the evening. He predicted the two sides would reach an agreement, though several issues remain unresolved.

"We've made some progress working down there. So that's very positive," said McCarthy. "I want to make sure we get the right agreement. I can see that we're working towards that."

White House spokesperson Karine Jean-Pierre said talks remain fruitful. "If it keeps going in good faith, we can get to an agreement here."

But the White House and congressional Democrats also accused Republicans of taking the economy hostage to advance an agenda they could otherwise not pass. They said Republicans need to make more concessions as they will need Democratic votes to pass any deal.

"Just listen to members of The House Freedom Caucus, now openly referring to the full faith and credit of the United States as a hostage," Jean-Pierre said.

Ratings agencies have taken note of the impasse with McCarthy insisting on spending cuts while Biden wants to hold spending steady.

Fitch put the United States' "AAA" ratings on negative watch on Wednesday. The agency said it believes "risks have risen" that the debt ceiling will not be raised before the so-called X-date, when the Treasury runs out of money, adding that "increased political partisanship is hindering reaching a resolution."

A view of the New York Stock Exchange during the opening bell in New York, U.S., May 23, 2023. /CFP

A view of the New York Stock Exchange during the opening bell in New York, U.S., May 23, 2023. /CFP

Moody's, another rating agency, might change its assessment of U.S. debt if lawmakers indicate a default is expected. Moody's currently has a top-notch "AAA" rating for U.S. debt. A lower rating could push up borrowing costs.

Time is running short, as the Treasury Department has warned the federal government could be unable to pay all its bills by as soon as June 1 and it will take several days to pass legislation through the narrowly divided Congress.

House Republican leaders said they would adjourn on Thursday for a week-long Memorial Day holiday recess scheduled but would call lawmakers back if needed for any votes, Punchbowl News reported.

McCarthy has insisted that any deal must not raise taxes and must cut discretionary spending, not hold it steady as Biden has proposed.

Any deal that Biden and McCarthy reach will have a narrow path for passage through the divided Congress, where McCarthy's Republicans hold a 222-213 House majority and Biden's Democrats control the Senate by a 51-49 margin.

The lack of progress has heightened concerns that Congress could inadvertently trigger a crisis by failing to act in time.

"We're certainly getting to a place that's too close for comfort," said Shai Akabas of the Bipartisan Policy Center, a think tank. The months-long standoff has spooked Wall Street, weighing on U.S. stocks and pushing the nation's cost of borrowing higher.

U.S. stock indexes fell on Wednesday on debt-ceiling concerns.

"Up until yesterday, investors have been very optimistic," said Angelo Kourkafas, senior investment strategist at Edward Jones. "But now as we get closer, we are seeing some caution again."

(With input from Reuters)