In March, Japan announced restrictions on the export of 23 types of semiconductor manufacturing equipment to approximately 160 destinations. Although China is not explicitly mentioned in the list, many perceive this move as a gesture of Japan's solidarity with the United States' chip curbs on China.

A result of geopolitical tensions

According to John Gong, a professor at the University of International Business and Economics, these restrictions align with the U.S. strategy of high-tech competition and its sanctions against China's semiconductor industry.

He said that the reasoning behind Japan's decision is purely political.

Wang Dan, chief economist at Hang Seng Bank (China), echoed this view and referred to the restrictions as a byproduct of current geopolitical tensions.

Wang said that it is not in Japan's economic interest to limit exports to China, considering China's position as Japan's major trading partner and the reliance of Japan's economy on exports.

In 2022, exports accounted for 18 percent of Japan's gross domestic product (GDP), with China accounting for 19.4 percent of Japan's total exports.

However, due to increasing tensions between China and the United States, China's share of Japan's total exports fell to 16.7 percent in the first quarter of 2023, while the U.S. became Japan's top trading partner with a 19 percent share in the same period.

A potential backfire

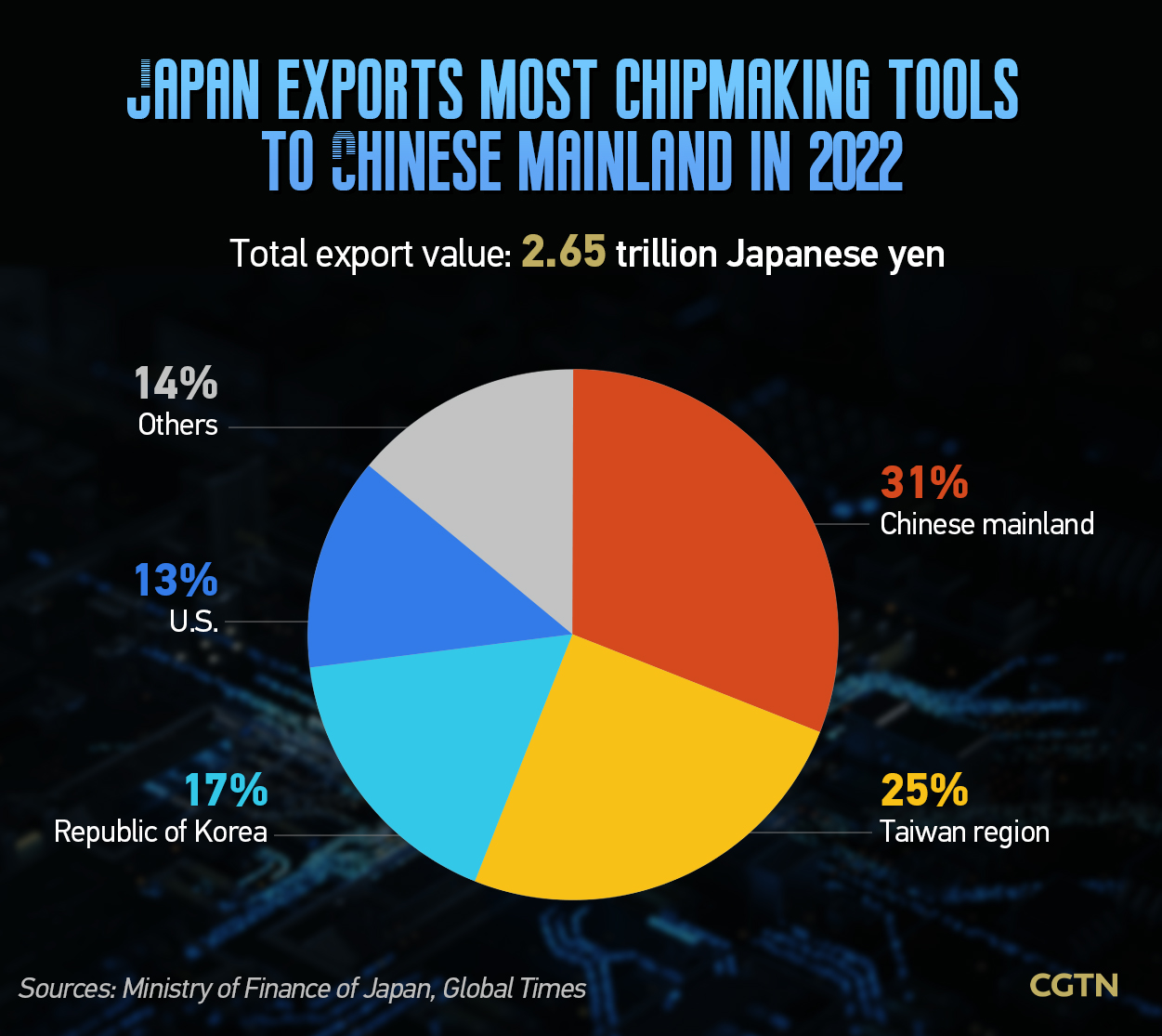

Despite Japan now accounting for only 9 percent of the global semiconductor production, far below over 50 percent that it took of global semiconductor production in the 1980s, the country still maintains a 35 percent global market share and international competitiveness in semiconductor manufacturing equipment.

China's Customs Statistics revealed that in 2022, China purchased $6.4 billion worth of semiconductor manufacturing equipment from Japan. While this figure represents less than 1 percent of Japan's overall exports, it accounts for 21 percent of Japan's semiconductor equipment exports.

Both Gong and Wang anticipated limited impacts of the restrictions on Japan's overall trade and economy. However, they expected Japanese semiconductor equipment manufacturers to experience revenue losses.

Wang emphasized that since chipmaking heavily relies on innovation, reduced income would undermine the market development and competitiveness of Japanese equipment manufacturers. It should be noted that the restricted machines are those with the most advanced technology and highest added value.

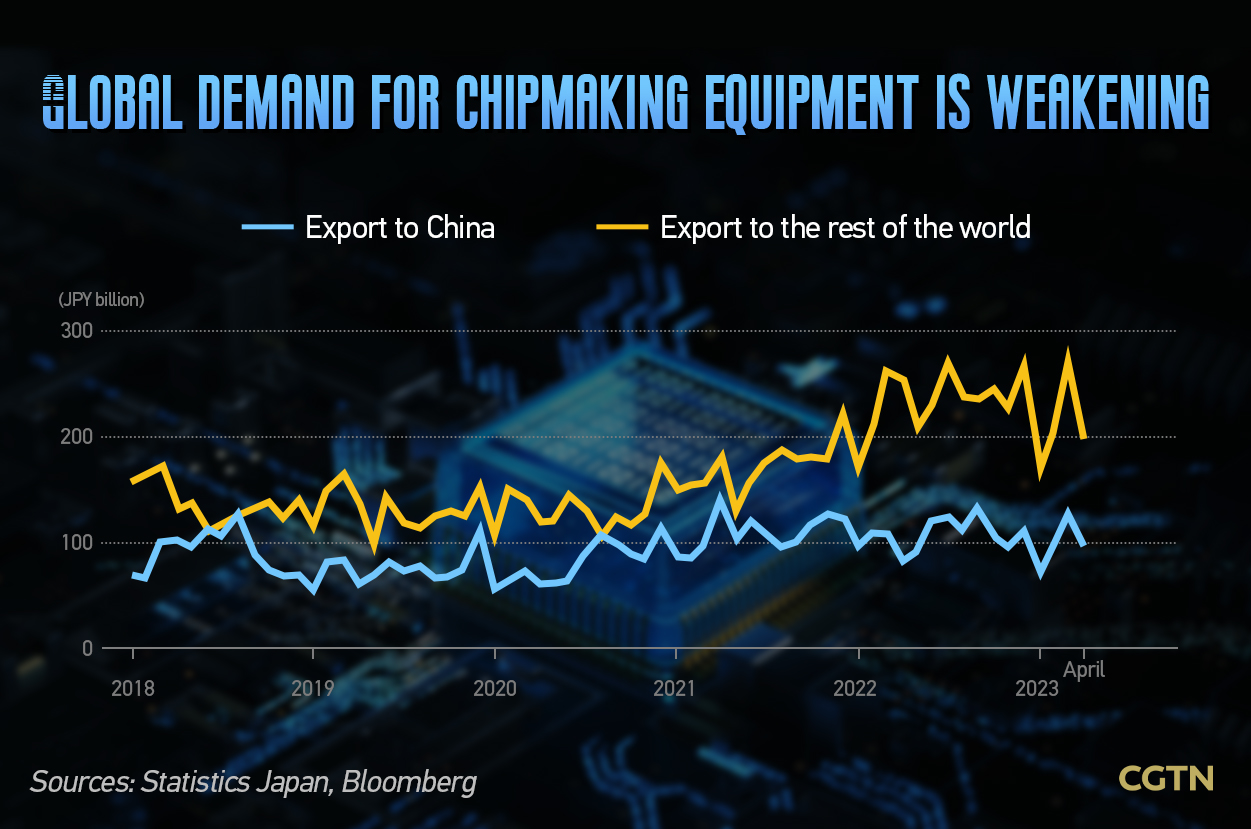

Japan's export of semiconductor manufacturing equipment to China saw a 1 percent decline year on year in the first four months of 2023. Wang expects this trend to continue with the restrictions in place.

She suggested that any decline in semiconductor equipment exports to China could potentially be partially offset by increased demand from other regions. However, data from Bloomberg indicates a weakening global demand for chipmaking equipment.

A sign of decoupling

To some extent, trade decoupling between China and Japan is becoming apparent, Gong said.

Previously, China-Japan relations were described as "hot economics, cold politics," but now the economic aspect also appears to be cooling. Gong attributed this partly to the ruling party's China policy and said that there are no signs of improvement for the outlook.

According to Wang, these recent measures indicate a long-term trend of decoupling in the high-tech sector, where geopolitical risks are playing a more significant role in the decision-making of international companies regarding new investments.

Cover via CFP

Graphic designer: Liu Shaozhen