01:18

The central financial work conference was held in Beijing from Monday to Tuesday, at which Xi Jinping, general secretary of the Communist Party of China (CPC) Central Committee, delivered an important speech.

Xi, also Chinese president and chairman of the Central Military Commission, analyzed the situations facing high-quality development of the financial sector and arranged relevant work for the current and future periods.

Noting that finance is the lifeblood of the national economy and an important part of the country's core competitiveness, the meeting urged greater efforts to comprehensively step up financial supervision, optimize financial services, prevent and resolve risks to promote high-quality development of China's financial sector.

Financial system supports overall economic and social development

Since the 18th CPC National Congress, the financial system has strongly supported the overall economic and social development, the meeting pointed out.

Under the leadership of the CPC Central Committee, financial innovation has been advanced based on marketization and the rule of law, it said, adding that efforts have been made to deepen the supply-side structural reform, and coordinate financial openness and security, sticking to the basic tone of seeking progress while maintaining stability.

From 2014 to September 2023, China saw its outstanding yuan-denominated loans issued to the real economy shoot up to over 230 trillion yuan (about $32.04 trillion) from 81.43 trillion yuan, with an average annual growth of 10 percent, generally in line with the nominal GDP growth, data from the People's Bank of China (PBOC) reveals.

However, with the various problems intertwined in the financial sector, the meeting said that there are still hidden economic and financial risks, such as the occurrence of financial corruption, and low efficiency of the financial sector serving the real economy.

Stressing the need for the financial sector to better provide high-quality services for the country's economic and social development, the meeting called for efforts to create a good monetary and financial environment, maintain the stability of monetary policy, and develop modern financial institutions and market systems, it said.

It is necessary to optimize the capital supply structure to use more financial resources to promote technological innovation, advanced manufacturing, green development, and micro-, small-, and medium-sized enterprises, said the meeting.

It also called for strengthening market rules and creating a financial market with unified rules and coordinated supervision to promote the formation of long-term capital.

Efforts must be made to promote high-level financial opening-up to ensure national financial and economic security, it said, adding that it is necessary to steadily expand institutional opening-up in the sector, improve cross-border investment and financing facilitation, aiming to attract more foreign financial institutions and long-term capital to develop businesses in China.

By the end of September, 202 banks from 52 countries and regions had set up institutions in China.

Data also shows that 1,110 overseas institutions had gained access to China's bond market, with holdings topping 3.3 trillion yuan by the end of September.

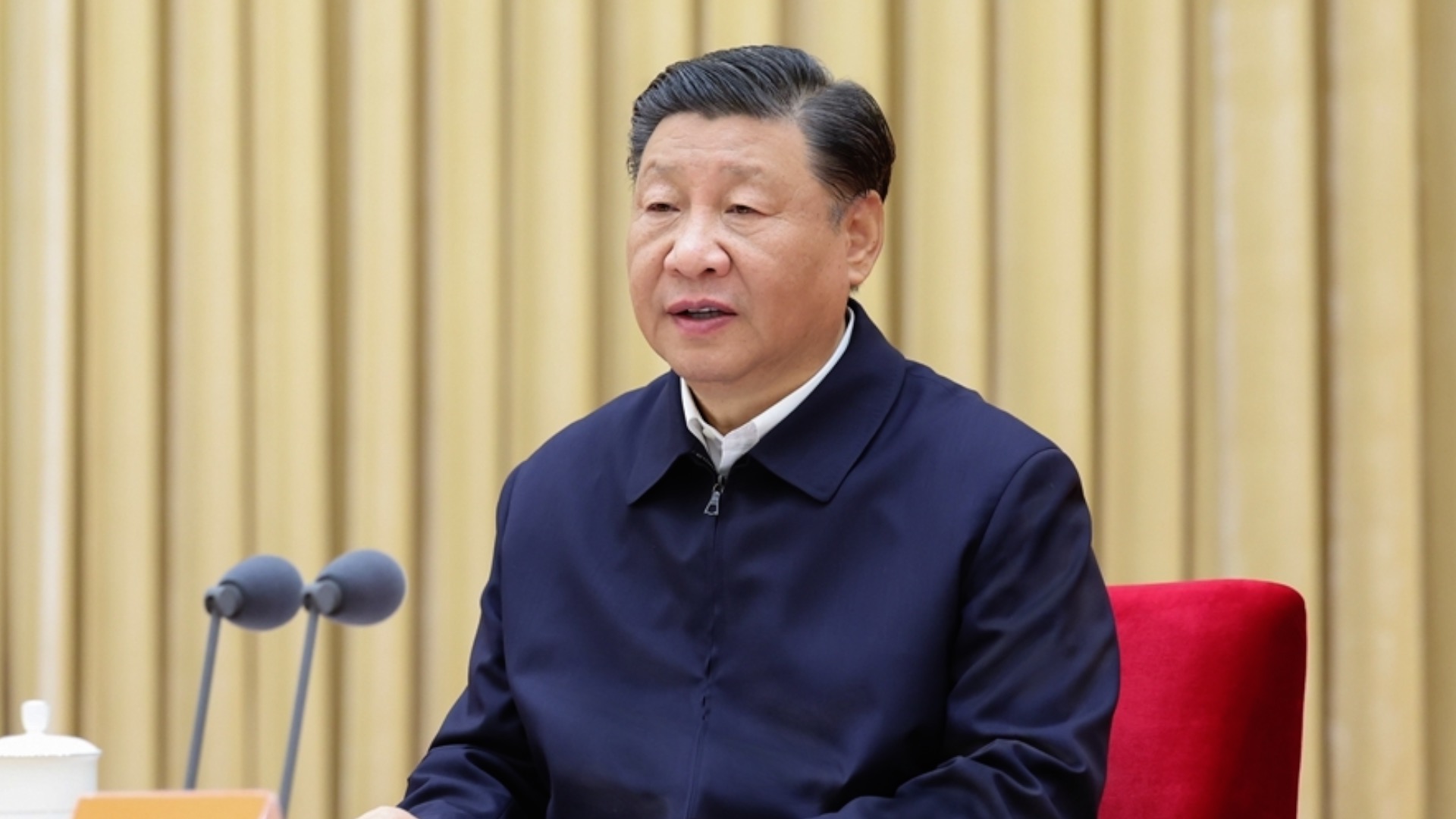

Xi Jinping, general secretary of the Communist Party of China Central Committee, also Chinese president and chairman of the Central Military Commission, delivers an important speech at the central financial work conference held in Beijing, China, October 31, 2023. /Xinhua

Xi Jinping, general secretary of the Communist Party of China Central Committee, also Chinese president and chairman of the Central Military Commission, delivers an important speech at the central financial work conference held in Beijing, China, October 31, 2023. /Xinhua

Stepping up financial supervision to prevent and resolve financial risks

The meeting stressed the importance of stepping up financial supervision to prevent and resolve financial risks.

The effectiveness of financial supervision should be improved, it said, urging efforts to deal with the risks of small- and medium-sized financial institutions in a timely manner, and set up long-term mechanism to prevent and resolve local debt risks.

In a bid to meet the reasonable financing demand for all types of real estate enterprises, it is necessary to improve the supervision system and capital supervision of real estate enterprises, and improve the macro-prudential management.

The management of foreign exchange market should be strengthened to maintain the basic stability of the renminbi (RMB) exchange rate at a reasonable and balanced level, it said, urging to resolutely punish illegal crimes and corruption.

The meeting also stressed efforts to strengthen high-quality financial services, expand high-level financial opening-up, better serve the construction of the Belt and Road Initiative, as well as steadily and prudently advance the internationalization of the RMB.

(With input from Xinhua)

(Cover: A view of the Central Business District in Beijing, capital of China. /CFP)